Cincinnati, Ohio

Commercial Real Estate in Cincinnati

Contact Our Office

312 Walnut St., Suite 2460

Cincinnati, OH 45202

Get Directions

Connect With Our Team

In 1971, Marcus & Millichap was founded on a unique set of principles to maximize value for real estate investors and, in the process, revolutionized the brokerage industry.

Michael L. Glass

The Cincinnati Office

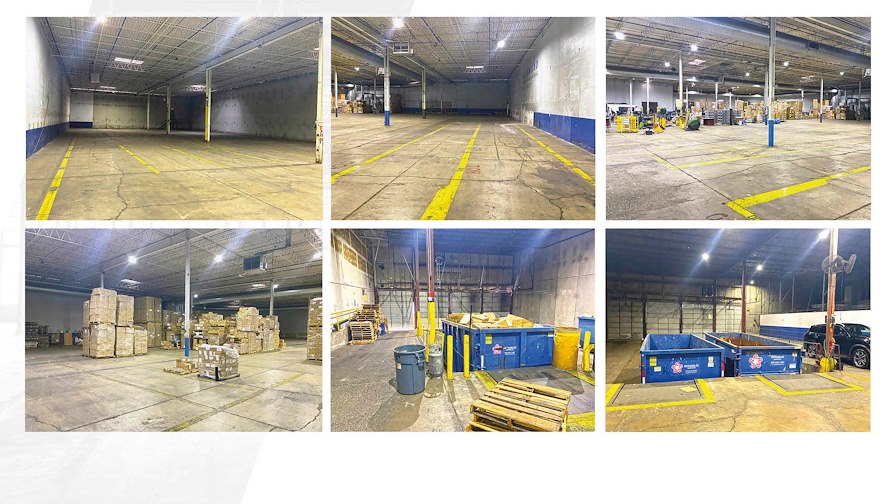

The Cincinnati office of Marcus & Millichap supports clients with commercial real estate investment brokerage and financing across Ohio and the central Midwest. Cincinnati commercial real estate agents assist in the sale of office, multifamily, industrial, retail, hospitality, and net-leased properties. The team leverages national research, a broad real estate properties for sale network, and financing expertise through a dedicated Marcus & Millichap Capital Corporation (MMCC) loan originator to deliver full-spectrum service.

Press Releases

Marcus & Millichap Arranges $2.7M Sale of Skilled Nursing Facility and Rehabilitation Center in Stevens Point, Wisconsin

Marcus & Millichap announced today the sale of Portage County Health Care Center, a skilled nursing and rehabilitation center located in Stevens Point, Wisconsin.

February 19, 2026

Press Releases

Marcus & Millichap Arranges $3.65M Sale of 15-Townhome Portfolio in New Richmond and Roberts, Wisconsin

Marcus & Millichap announced today the sale of a 15-townhome portfolio in New Richmond and Roberts, Wisconsin, for $3.65 million, to an all-cash, out-of-state buyer.