Research Brief

2026 Employment Outlook

January 2026

Demand for Commercial Space Rising Despite

Tempering Force of Softening Labor Market

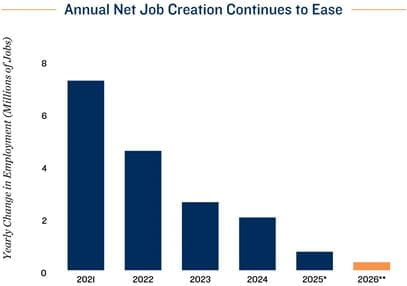

Three forces shape the commercial real estate climate. One of them, job growth, faces unique challenges that carry broad implications across property types.

- Entering 2026, the pace of job creation slowed significantly.

- In the first four months of 2025, before new tariffs were announced, the U.S. added a mean of 122,000 roles per month.

- Since May, average monthly job creation has fallen to just 17,000 positions, with most of the hiring in health care.

- This has put upward pressure on unemployment, which began 2025 at 4.0 percent and stood at 4.6 percent as of November.

- Tariffs are not the sole factor weakening the labor market. Other drivers include policy uncertainty, reduced immigration to the U.S. together with out-migration, and growth in AI, which is starting to boost worker productivity.

- As of the second quarter of 2025, output per worker was up about 5.4 percent, compared to the beginning of 2023.

Retail and office assets face similar dynamics. While the job creation tailwind aiding commercial space demand is ebbing, easing construction will support the office and retail sectors

- Office demand, which has slowly but steadily recovered over the last six quarters, is expected to grow more slowly this year.

- In 2024, net office space absorption totaled roughly 50 million square feet, while in 2025 it reached 85 million square feet.

- Looking ahead, new office demand will likely remain positive, but moderate to approximately 65 million square feet.

- Additionally, office space demand is projected to rise on net in almost every major market in 2026.

- Retail net absorption is anticipated to strengthen, potentially exceeding 10 million square feet, after soft demand in 2025 boosted the vacancy rate to roughly 5 percent.

- This will fall short of the expected 30 million square feet of development, mainly consisting of single-tenant projects.

- As a result, the overall retail vacancy rate is forecast to edge up by 20 basis points to 5.2 percent.

New supply tops new demand for industrial and multifamily. Despite the sluggish employment market, more industrial space and apartments will be needed this year on net.

- The net absorption of industrial space, expected to reach roughly 68 million square feet this year, will trail the roughly 200 million square feet delivering in 2026.

- The impact will be concentrated in large-format warehouses in high-construction markets, while smaller infill and logistics facilities, as well as smaller metros, should outperform.

- As a result, industrial vacancy is projected to rise 60 basis points, bringing the national rate to 8.6 percent.

- For multifamily properties, the softening labor market may weigh on demand growth, especially among young adults, given elevated unemployment among that age cohort.

- High home costs, however, could keep renters in place longer.

- The net effect will be the net absorption of about 240,000 units, falling short of the projected 270,000 completions.

- Together, these dynamics will push the vacancy rate up by 10 basis points to 4.7 percent.

- Still, in 2026, apartment vacancy is forecast to decline in 31 of 50 major markets.

* Estimate ** Forecast

Sources: Marcus & Millichap Research Services; CoStar Group, Inc.; Real Capital Analytics

RealPage, Inc.; U.S. Bureau of Labor Statistics; U.S. Census Bureau

TO READ THE FULL ARTICLE