Research Brief

2026 Industrial Outlook

December 2025

Construction Pressures Abating

As Smaller Properties Outperform

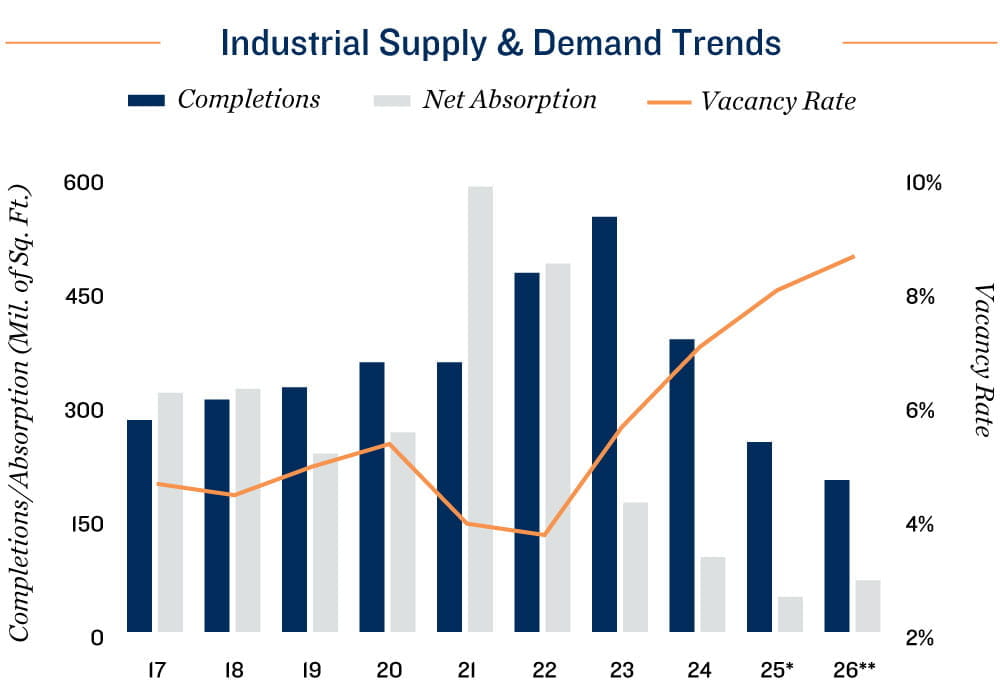

Demand and supply both change. Industrial real estate has achieved some significant milestones during the last five years.

- The national industrial vacancy rate reached a record low of 3.6 percent in the second quarter of 2022.

- That was followed by a construction wave — 1.4 billion square feet between 2022 and 2024 — pushing vacancy up to 7.8 percent as of September 2025.

- Though development is tapering, with an eight-year low of just 200 million square feet expected to deliver in 2026, vacancy is still expected to reach 8.6 percent by year's end.

Vacancy pressures fairly concentrated. While the industrial sector appears to have elevated vacancy driven by significant new supply, there is more happening beneath the surface

- Nearly half of the space completed over the past half-decade has been concentrated in just 10 major metros.

- About half of the additional space also came from industrial buildings, each of which was 500,000 square feet or larger.

- Therefore, the vast majority of available space is concentrated in large industrial properties in select markets with outsize inventory growth over the past five years.

- Industrial space in Austin grew by nearly 60 percent, Phoenix by roughly 40 percent. Charleston, Las Vegas, and San Antonio followed at rates ranging from 36 percent to 21 percent.

- The vacancy rate for large buildings reached 11.5 percent in the third quarter of this year.

- Meanwhile, smaller-format industrial properties and markets that have seen limited construction are observing much lower vacancy rates than the national mark.

- Vacancy in Cleveland and Minneapolis-St. Paul was below 4.0 percent earlier this year.

- The vacancy rate for industrial properties between 10,000 and 50,000 square feet was just 5.2 percent in the third quarter, scaling up to 7.0 percent for buildings between 50,000 and 200,000 square feet.

Investment dynamics positive. Small bay and infill industrial properties continue to outperform, especially in metros that have not added substantial inventory in recent years.

- Although industrial investment sales activity has dropped significantly from the 2021 peak, deal velocity in 2025 stayed 19 percent above the annual average from 2014 to 2019.

- The average industrial cap rate has remained steady in the upper 6 percent range over the past couple of years.

- Cap rates for larger industrial properties are generally lower than for smaller assets, likely due to a preference for newer vintages and tenants with stronger credit.

- Looking ahead, trade policy uncertainty might impact demand for industrial space, especially in U.S. regions reliant on trade with Asia.

- Nonetheless, investor interest in the sector remains strong, which should support transaction activity. If trade policy stabilizes, it could boost demand for space enough to slow the upward drift in vacancy, possibly putting upward pressure on industrial property values.

- For now, however, there is little clarity on when U.S. trade policy will stabilize.

* Estimate ** Forecast

Sources: Marcus & Millichap Research Services; CoStar Group, Inc.; Real Capital Analytics

TO READ THE FULL ARTICLE