Research Brief

2026 Retail Outlook

December 2025

Disciplined Development Helps

Sustain Retail Sector's Momentum

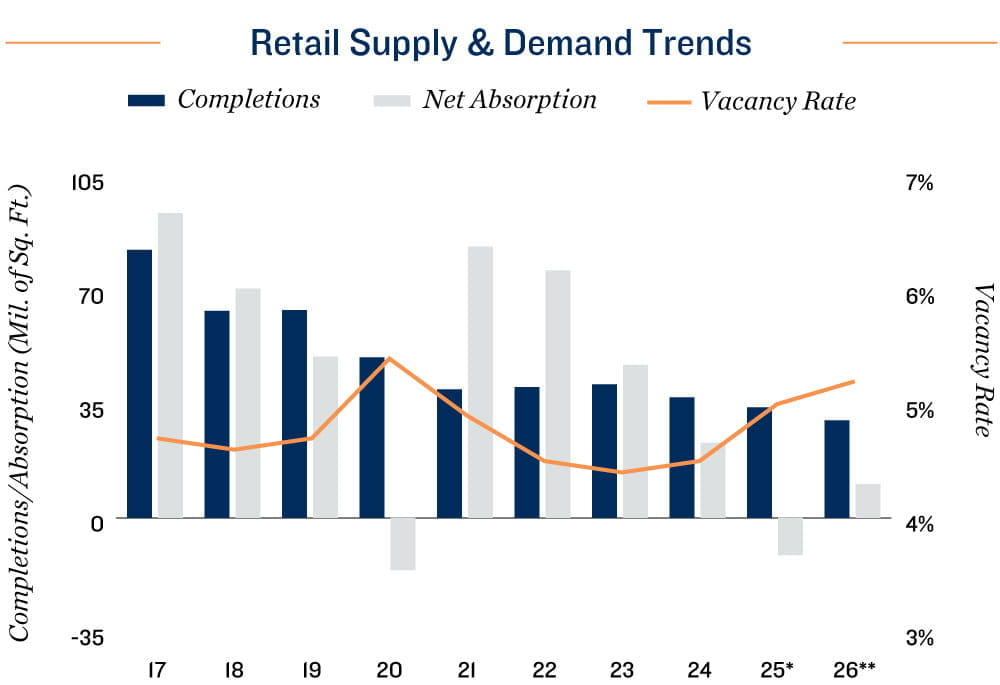

Limited construction supports vacancy stability. New demand for retail space slackened in 2025, mainly due to economic uncertainty stemming from tariffs. Yet, minimal development means that vacancy should remain relatively stable this year.

- Overall retail vacancy stayed range-bound near 5.0 percent in 2025 despite negative net absorption in the year's first half.

- Still, numerous metros are set to close out 2025 with vacancy rates below 4.0 percent.

- Vacancy rates at open-air centers range from 4.5 percent to 4.7 percent, while shopping malls — the outlier driving overall retail vacancy higher — are north of 9.0 percent.

- Historically, unanchored centers have higher vacancy than anchored properties, but since 2020, rates have converged, likely reflecting limited retail construction over the past 17 years

- In the trailing 12 months through the third quarter of 2025, less than 10 million square feet of multi-tenant retail space was constructed — the lowest completion pace since 2012.

- Retail construction is expected to total a record-low 30 million square feet in 2026, with over 70 percent single-tenant, keeping vacancy low even amid tepid demand.

Consumer debt has risen, but so have incomes. Healthy wage growth may offset concerns that record consumer debt could weigh on retail sales and restrain retailer expansion.

- Auto debt has reached a record $1.7 trillion, credit card debt has moved up to a record $1.2 trillion, and total household debt has risen to a record $18.5 trillion

- When measured as a percentage of income, auto debt is 5.5 percent, credit card debt is 4.1 percent, and total household debt is 61.3 percent — all near or below long-term averages.

- While total debt in absolute terms is high, when rising income levels are factored in, the debt load is not as severe as it seems.

- Worker shortages have restrained return-to-office efforts.

- Moreover, total savings, including money market funds, reached a record $25.4 trillion in the third quarter of 2025. That's up 4 percent from last year, suggesting consumers are not broadly under duress, which is aiding retail as it enters 2026.

Investment trajectory bullish. Retail investment sentiment, though tempered by policy uncertainty, remains positive entering 2026, as stabilized cap rates and elevated transaction activity outweigh modest vacancy increases.

- Although aggregate vacancy rates may tick up nominally in 2026 and rent growth may be modest, retail property investors remain optimistic.

- In aggregate, cap rates have stabilized around 6.8 percent.

- Single-tenant retail cap rates remained in the mid-6 percent band on average, while the mean multi-tenant retail cap rate stayed closer to the mid-7 percent range.

- Total retail investment activity reiterates investor optimism, with last year's transactions running 12 percent higher than the average for 2014 to 2019. Momentum may carry into 2026

- While tariff-driven uncertainty could weigh on retailers' expansion plans and some consumers face financial pressure, the retail commercial real estate sector remains well positioned for growth in 2026.

- With federal policies remaining unpredictable, however, new headwinds could emerge.

* Estimate ** Forecast

Sources: Marcus & Millichap Research Services; CoStar Group, Inc.; Real Capital Analytics

TO READ THE FULL ARTICLE