Electronics

T-Mobile - Indianapolis IN

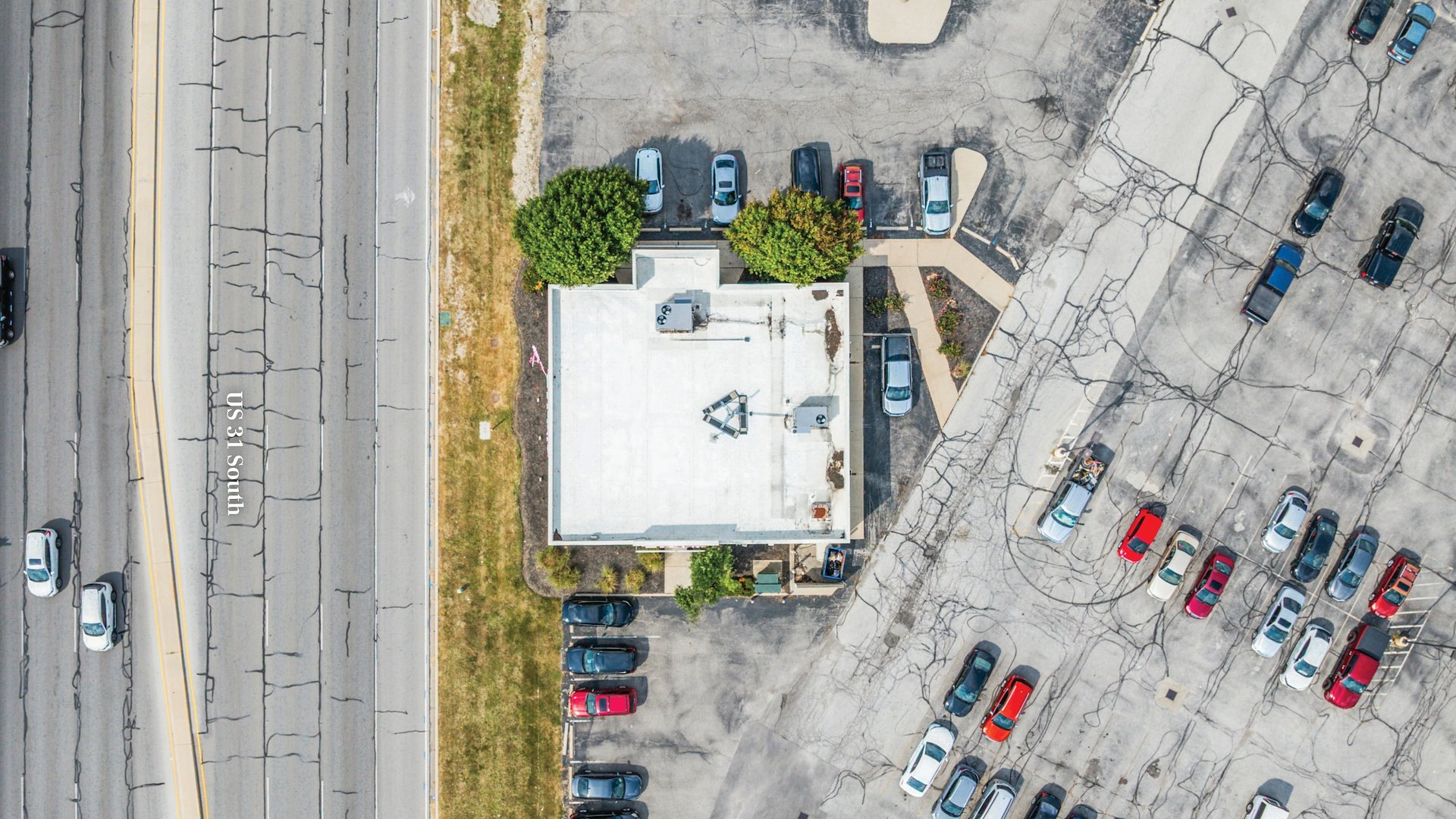

8241 US 31 S, Indianapolis, IN 46227

Listing Price: $1,443,312

Investment Overview

Marcus & Millichap is pleased to present qualified investors with a rare opportunity to acquire a corporate-backed, double-net leased asset in one of Indianapolis’ most active commercial corridors. Strategically located along US Highway 31 South, the property benefits from exceptional visibility and exposure to over 37,000 vehicles per day, while sitting between two major retail destinations that attract more than 31 million annual visitors within a 1.5-mile radius.

The site is surrounded by a dense concentration of national retailers including Target, Walmart, Home Depot, Lowe’s, Kohl’s, Dick’s Sporting Goods, TJ Maxx, Marshalls, Ross, JC Penney, and Floor & Decor. Additionally, the property is directly across from and adjacent to major automotive dealerships such as Toyota, Chevrolet, Kia, and Honda, contributing to a robust and consistent customer base.

The lease is backed by T-Mobile USA, Inc. (NASDAQ: TMUS), the second-largest wireless carrier in the United States with over 130 million subscribers. Originally operated as a Sprint store, the site was fully remodeled following T-Mobile’s acquisition of Sprint in April 2020, with all improvements completed at the tenant’s sole expense. The tenant has continued to invest in the property, including a recent HVAC upgrade, and recently extended the lease by one year with an additional two-year option that includes scheduled rent increases — a strong signal of their long-term commitment to the location.

The lease structure is double-net, with the landlord responsible only for the roof and structure. The roof carries a 10 year Roof Warrant with five years remaining minimizing future capital exposure and enhancing the property’s passive investment profile.

Demographically, the property is located in a thriving trade area. Within a five-mile radius, the population exceeds 208,000 residents across more than 84,000 households and with an average household income of $96,888 .The area features a balanced mix of age groups and educational attainment, with a significant portion of residents holding college degrees or higher. Consumer spending in the area is strong, particularly in categories such as housing, transportation, food, and personal insurance — all indicators of a stable and economically active community.

This asset combines strong real estate fundamentals, corporate credit, minimal management, and a prime location in a high-traffic, retail-dense corridor — making it a compelling opportunity for investors seeking durable cash flow and long-term value.

Investment Highlights

- Corporate T-Mobile with Proven Operating History & Recent Capital Investments

- Corporate Lease With T-Mobile USA, Inc. (NASDAQ: TMUS) – the Second-Largest Wireless Carrier in the United States With Over 130 Million Subscribers

- Attractive Double-Net Lease with Minimal Landlord Responsibilities

- Fee Simple Ownership – Landlord Owns Both Land and Building.

- Prime Indianapolis Location Surrounded by Major Retail & Automotive Anchors

- Strategic Positioning Between Two Major Retail Nodes – Benefits From Over 31 Million Annual Visitors Within a 1.5-Mile Radius, Driving Consistent Foot and Vehicle Traffic.

- Strong Demographics Within 5-Mile Radius

- Population: Over 208,000 Residents and 84,000+ Households. | Income: Average Household Income of $96,888.

Exclusively Listed By

Broker of Record

Financing By

Listing Price: $1,443,312

Investment Highlights

- Corporate T-Mobile with Proven Operating History & Recent Capital Investments

- Corporate Lease With T-Mobile USA, Inc. (NASDAQ: TMUS) – the Second-Largest Wireless Carrier in the United States With Over 130 Million Subscribers

- Attractive Double-Net Lease with Minimal Landlord Responsibilities

- Fee Simple Ownership – Landlord Owns Both Land and Building.

- Prime Indianapolis Location Surrounded by Major Retail & Automotive Anchors

- Strategic Positioning Between Two Major Retail Nodes – Benefits From Over 31 Million Annual Visitors Within a 1.5-Mile Radius, Driving Consistent Foot and Vehicle Traffic.

- Strong Demographics Within 5-Mile Radius

- Population: Over 208,000 Residents and 84,000+ Households. | Income: Average Household Income of $96,888.

Investment Overview

Marcus & Millichap is pleased to present qualified investors with a rare opportunity to acquire a corporate-backed, double-net leased asset in one of Indianapolis’ most active commercial corridors. Strategically located along US Highway 31 South, the property benefits from exceptional visibility and exposure to over 37,000 vehicles per day, while sitting between two major retail destinations that attract more than 31 million annual visitors within a 1.5-mile radius. The site is surrounded by a dense concentration of national retailers including Target, Walmart, Home Depot, Lowe’s, Kohl’s, Dick’s Sporting Goods, TJ Maxx, Marshalls, Ross, JC Penney, and Floor & Decor. Additionally, the property is directly across from and adjacent to major automotive dealerships such as Toyota, Chevrolet, Kia, and Honda, contributing to a robust and consistent customer base. The lease is backed by T-Mobile USA, Inc. (NASDAQ: TMUS), the second-largest wireless carrier in the United States with over 130 million subscribers. Originally operated as a Sprint store, the site was fully remodeled following T-Mobile’s acquisition of Sprint in April 2020, with all improvements completed at the tenant’s sole expense. The tenant has continued to invest in the property, including a recent HVAC upgrade, and recently extended the lease by one year with an additional two-year option that includes scheduled rent increases — a strong signal of their long-term commitment to the location. The lease structure is double-net, with the landlord responsible only for the roof and structure. The roof carries a 10 year Roof Warrant with five years remaining minimizing future capital exposure and enhancing the property’s passive investment profile. Demographically, the property is located in a thriving trade area. Within a five-mile radius, the population exceeds 208,000 residents across more than 84,000 households and with an average household income of $96,888 .The area features a balanced mix of age groups and educational attainment, with a significant portion of residents holding college degrees or higher. Consumer spending in the area is strong, particularly in categories such as housing, transportation, food, and personal insurance — all indicators of a stable and economically active community. This asset combines strong real estate fundamentals, corporate credit, minimal management, and a prime location in a high-traffic, retail-dense corridor — making it a compelling opportunity for investors seeking durable cash flow and long-term value.

Exclusively Listed By

Broker of Record

Financing By