Research Brief

Canada Industrial

February 2026

New Opportunities Emerge While Near-Term Headwinds Persist

Near-term pressure persists as USMCA joint review approaches. For 2025 as a whole, the manufacturing sector remained subdued. The year began with the initial tariff shock in the first half, followed by a short-lived recovery that lost momentum toward year-end. In real terms, annual shipments declined in 16 of 21 sectors, led by a 12 per cent drop in textile products and an 11 per cent contraction in paper manufacturing. Petroleum and coal products — a key pillar of Canada’s economy — recorded a 5.2 per cent decline in sales amid higher U.S. tariffs. Looking ahead, tariff impacts are likely to persist until at least mid-2026, when the joint review of the USMCA is scheduled. This extended period of trade barrier is likely to keep the manufacturing sector on fragile footing in the near term.

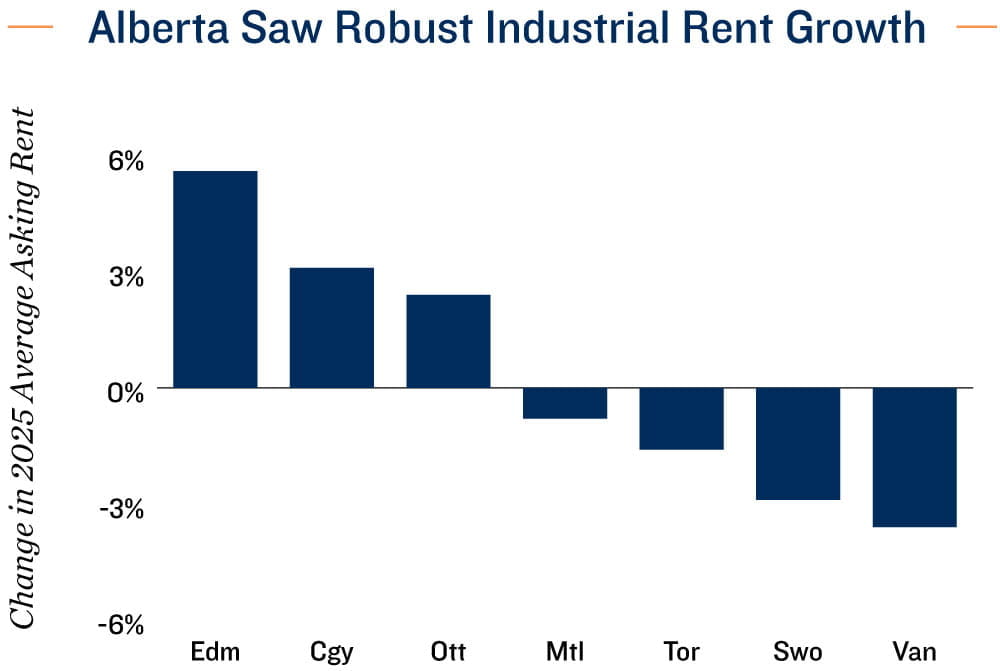

Economic reforms serve as next catalyst for industrial sector. While the manufacturing activity remained soft, the industrial properties at large proved resilient last year. The vacancy rate rose only modestly, by 20 basis points, supported by a rebound in net absorption alongside lower completions. This suggests that businesses largely viewed trade frictions as a temporary hurdle and resumed leasing activity after the initial tariff shock to secure space for longer-term positioning. The momentum was particularly evident in Calgary and Edmonton, where robust demand for space fueled another year of strong rent growth. Looking ahead, while trade relations with the U.S. remain uncertain, Canada’s recent pivot toward internal trade liberalization, export market diversification, and nation-building projects should help support business sentiment, boding well for the industrial sector’s long-term growth.

Investors may still need time to rebuild confidence. In the transaction market, capital deployment may remain selective in the near term, focused on core assets with durable tenant profiles amid persistent trade risks and geopolitical shifts. Over the longer run, however, Canada’s efforts to unlock its growth potential through economic reforms should help reinforce industrial demand fundamentals. As greater clarity emerges and structural tailwinds gain traction, investors are likely to reassess the sector’s prospects and gradually return to the market in greater force.

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Capital Economics; Costar;

Statistics Canada

TO READ THE FULL ARTICLE