Research Brief

Canada Retail Sales

January 2026

Retail Sales Rebound While CRE Markets

Position for a Measured Recovery in 2026

Deals drive recovery in consumer spending on the month. Retail activity posted a solid rebound in November, with sales up 1.3 per cent month-over-month and gains recorded across eight of nine subsectors. Food and beverage retailers were the main drivers, boosted by the resolution of B.C.’s liquor-distribution disruptions. Renewed strength in clothing, building materials, and health care also contributed. Core retail sales climbed an even stronger 1.6 per cent, and inflation-adjusted numbers were up 1.1 per cent on the month. While November’s uptick reflects healthy participation across categories, early estimates point to a 0.5 per cent pullback in December, suggesting the surge was fuelled more by Black Friday promotions than a sustained improvement in underlying consumer demand.

Solid gains point to modest fourth-quarter growth. November’s rebound will likely provide a modest lift to fourth-quarter GDP, with broad-based gains in core retail categories helping to counter earlier weakness. Although preliminary estimates point to a December decline, much of that likely reflects sharply lower gasoline prices, meaning sales volumes may still edge higher, keeping household consumption and fourth-quarter GDP growth in positive territory. This aligns with consumers remaining price-sensitive and cautious amid higher mortgage renewals and ongoing trade frictions. Overall, the data indicates spending is stabilizing rather than accelerating, reinforcing expectations that the Bank of Canada will hold interest rates steady through 2026 as core inflation continues to cool and the economic recovery progresses gradually.

Commercial Real Estate Outlook

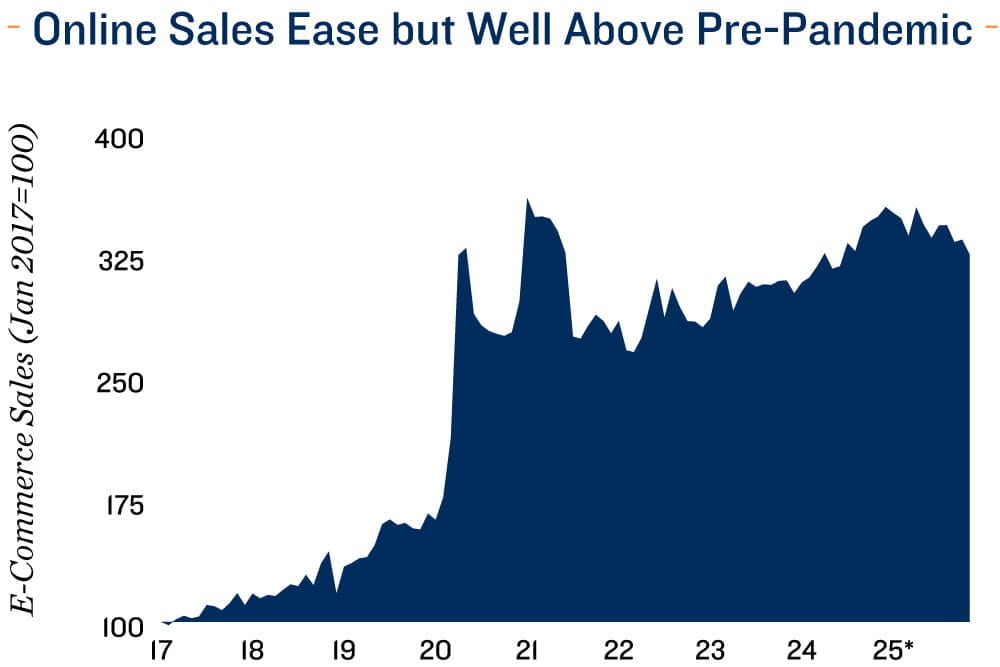

Online softness converges with a stabilizing industrial sector. E-commerce activity continued to soften in November, with online sales down 2.8 per cent monthly and accounting for just 5.7 per cent of total retail trade — the lowest since late 2023. The cooling online demand parallels evolving conditions in Canada’s industrial sector, which opened 2025 with nearly five million square feet of positive net absorption before tariffs halted momentum, pushing absorption negative in the second quarter and keeping it subdued in the third. As interest rate visibility improved and trade headwinds eased, leasing strengthened notably in the fourth quarter. Vacancy followed the same trajectory — tightening early in the year before drifting up and stabilizing around 3.8 per cent by December. Looking ahead, interest rate visibility, a smaller build pipeline, firmer trade clarity, and infrastructure investment should support a gradual improvement, with national vacancy poised to trend down to around 3.5 per cent.

Retail properties well positioned. Canada’s retail property sector softened in 2025, with vacancy rising 90 basis points to 2.6 per cent amid the Hudson’s Bay closures, muted population growth, and broader economic uncertainty. Household consumption even contracted slightly in the third quarter, underscoring the pressure on discretionary categories. Vacancy is expected to edge higher in 2026 to just under 3.0 per cent as demand remains tempered and modest new supply comes online. Even so, underlying fundamentals remain solid, with grocery-anchored centres continuing to attract steady leasing demand and standing out as the preferred investment segment.

* Through November; ** Forecast provided by Capital Economics

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Canada Mortgage and

Housing Corporation; Capital Economics; CoStar Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE