Research Brief

Canada Monetary Policy

January 2026

Steadying Rates and Shifting Trade Reposition

Canada’s CRE Market in 2026

Monetary authority pauses as inflation eases and growth softens. The Bank of Canada held the overnight rate at 2.25 per cent in January, marking a second consecutive pause as inflation continues to cool and the economy works through the drag from U.S. trade restrictions. Fourth-quarter GDP likely slowed following a stronger-than-expected third quarter, reflecting weaker exports and a slower population backdrop, even as domestic demand showed early signs of stabilizing. Labour markets remain soft but steady, with the unemployment rate at 6.8 per cent and hiring intentions subdued across most sectors. Core inflation has also eased into the mid-2.0 per cent range. Against this backdrop, the current pause stance appears appropriate while trade uncertainties and geopolitical risks continue to shape the outlook.

Outlook points to a prolonged pause through 2026. Forward guidance reinforces the view that interest rates will remain unchanged this year as the economy absorbs slower population inflows, tariff-related costs, and modest growth. The Bank projects real GDP rising 1.1 per cent in 2026 and 1.5 per cent in 2027 — broadly unchanged from October’s prediction — while inflation is expected to hover near the 2.0 per cent target. This supports the base-case scenario of a full-year pause in 2026, although the path remains sensitive to USMCA renegotiations and further U.S. policy shifts. The private sector also echoes this view, suggesting that with core inflation trending lower and growth subdued, there is little justification for a near-term rate move. As a result, the next adjustment is likely to occur in 2027, contingent on the resolution of trade uncertainty and clearer economic visibility.

Commercial Real Estate Outlook

Rate visibility improving investor confidence. Commercial real estate investment ended 2025 on firmer footing as borrowing costs stabilized and underwriting assumptions began to normalize. Lower volatility early in the year supported a steadier pace of deal flow, although momentum softened in the second and third quarters as tariff uncertainty weighed on investor confidence. By late 2025, however, the combination of clearer trade signals and a firmer interest rate outlook helped revive activity, lifting fourth-quarter transaction volumes by narrowing bid-ask spreads in several major metros. Preliminary figures suggest that nationwide investment volumes were broadly in line with 2024 levels, indicating that the cycle has largely bottomed out. This improved footing positions the market for a measured recovery in capital deployment as macro conditions continue to stabilize.

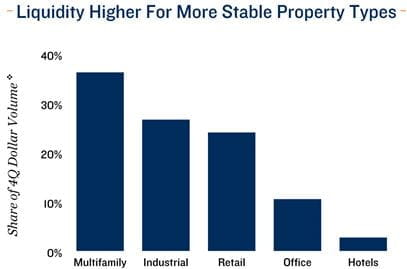

Rate stability and trade clarity set stage for a 2026 recovery. The outlook for CRE is cautiously optimistic as borrowing conditions steady and visibility around trade and economic policy improves. Investors continue to allocate capital to sectors with reliable cash flow and tight fundamentals — industrial, grocery-anchored retail, and rental housing — while maintaining a defensive posture in segments facing structural headwinds, including some office and trade-exposed industrial users. As lenders also begin to ease credit terms and developers adjust their pipelines, the investment environment is becoming more conducive. As modest economic momentum builds in the second half of the year, a clearer USMCA outlook and a more predictable rate path should support a gradual pickup in deal flow.

* GDP estimate for 4Q; ** Forecast provided by Capital Economics; v Preliminary estimate

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Capital Economics; CoStar

Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE