Research Brief

Canada Inflation

January 2026

Cooling Inflation Helps Clear Headwinds Facing

Canada’s CRE Market in 2026

Uptick in headline rate largely reflected temporary tax distortions. The consumer price index rose 2.4 per cent year-over-year, up from 2.2 per cent in November. It was driven primarily by adverse base effects tied to the expiry of the GST/HST holiday in December 2024. That distortion pushed food and restaurant prices sharply higher year-over-year, while energy prices continued to provide a meaningful offset amid falling gasoline prices. Beneath the surface, inflation momentum continued to cool. The Bank of Canada’s preferred core measures — CPI-trim and CPI-median — rose at an average pace of just 0.1 per cent month-over-month, marking a second consecutive below-target reading. The three-month annualized pace slowed to 1.7 per cent, reinforcing evidence that broad-based inflation pressures are easing even as headline CPI remains temporarily elevated.

The December data eliminates any remaining case for rate hikes. With core inflation running well below consensus in December and the three-month annualized pace at just 1.7 per cent, inflation is no longer constraining policy. At the same time, it appears fourth-quarter GDP growth will come in softer than expected, pointing to a cooling economy and raising the possibility that the Bank of Canada may loosen policy further. Even so, markets have yet to fully price in additional cuts, reflecting ongoing caution as headline inflation remains above target and labour market conditions show early signs of stabilizing. For now, while some indicators suggest further easing could occur, the base-case scenario continues to call for the central bank to remain on the sidelines for the remainder of the year.

Commercial Real Estate Outlook

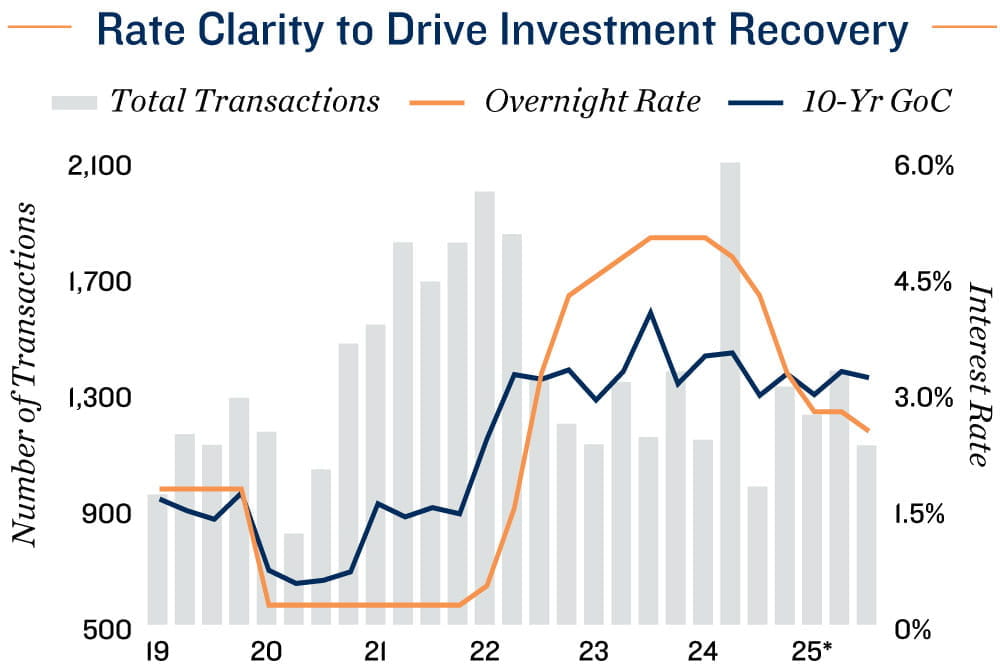

Cooling inflation is restoring rate clarity and CRE liquidity. As borrowing costs have stabilized and the path of future policy has become more predictable, deal flow has started to firm up. After showing encouraging momentum early last year, investment activity stalled through the second and third quarters as tariff uncertainty weighed on underwriting and temporarily widened bid-ask spreads. However, with financing costs stabilizing and macro risks becoming more transparent, preliminary fourth-quarter estimates suggest activity will pick up once again. This suggests the market is transitioning out of its pause phase, with a gradual recovery in transaction volume likely to take shape through 2026. This is being led by enhanced investor sentiment amid improving operating fundamentals, along with greater confidence in the rate outlook and broader economic backdrop.

Supportive environment for commercial real estate is forming. Continued moderation in core inflation, alongside headline noise, points to easing operating costs across most property types. Lower energy prices are providing relief for select tenants, while steadier travel- and service-related costs help moderate expense growth across most assets. Meanwhile, because the sharp increases in food and restaurant prices stem primarily from base-year tax distortions, they carry little implication for long-term CRE fundamentals. With the risk of further rate tightening effectively removed and broader macro visibility improving, discount-rate volatility is easing, strengthening underwriting confidence and supporting the gradual firming in transaction activity now beginning to reemerge.

* Through 3Q

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Capital Economics; CoStar

Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE