Research Brief

Canada Industrial

January 2026

Industrial Sector Resilient Entering 2026 Despite Near-Term Hurdles

Global factors pose a short-term challenge. As expected, the manufacturing sector continued to face external headwinds toward the end of 2025. In November, total sales declined by 1.2 per cent monthly, driven by a sharp 15.9 per cent drop in motor vehicle shipments and a 6.3 per cent decrease in motor vehicle parts sales. The automotive sector was significantly disrupted by global semiconductor shortages, affecting several assembly and manufacturing plants in Ontario. In addition, new U.S. tariffs — 25 per cent on medium and heavy-duty trucks and 10 per cent on buses — that came into effect in November may have contributed to the production cuts. Other industries subject to ongoing U.S. tariffs, including primary metals and lumber, also recorded sales declines.

Auto sector weakness constrained wholesale activity. The factors weighing on manufacturing sales also drove similar declines in the wholesale sector. In November, total wholesale sales fell by 1.8 per cent, marking the second-largest monthly decline in the past two years. The contraction was again most pronounced in the auto sector, with sales of motor vehicles and parts dropping by 11.5 per cent. This decline was more concerning than the decline in manufacturing sales, as it was sufficient to subtract approximately 0.1 per cent from November’s GDP. Looking ahead, these headwinds are likely to persist in the near term, weighing on both manufacturing and wholesale activity. As a result, the fourth quarter may end on a soft note, with GDP growth coming in below initial expectations.

Pro-growth environment could spur investor comeback. The persistence of short-term headwinds in the manufacturing sector, alongside a rise in the unemployment rate in December, effectively dashed speculations that the Bank of Canada could raise interest rates in 2026. Instead, this backdrop is likely to prolong the current accommodative monetary environment, reinforcing the growth impulse from newly introduced fiscal measures to support Canada’s economic recovery. This coordinated monetary and fiscal stance will help offset lingering trade and geopolitical risks, encouraging investors to reenter the market.

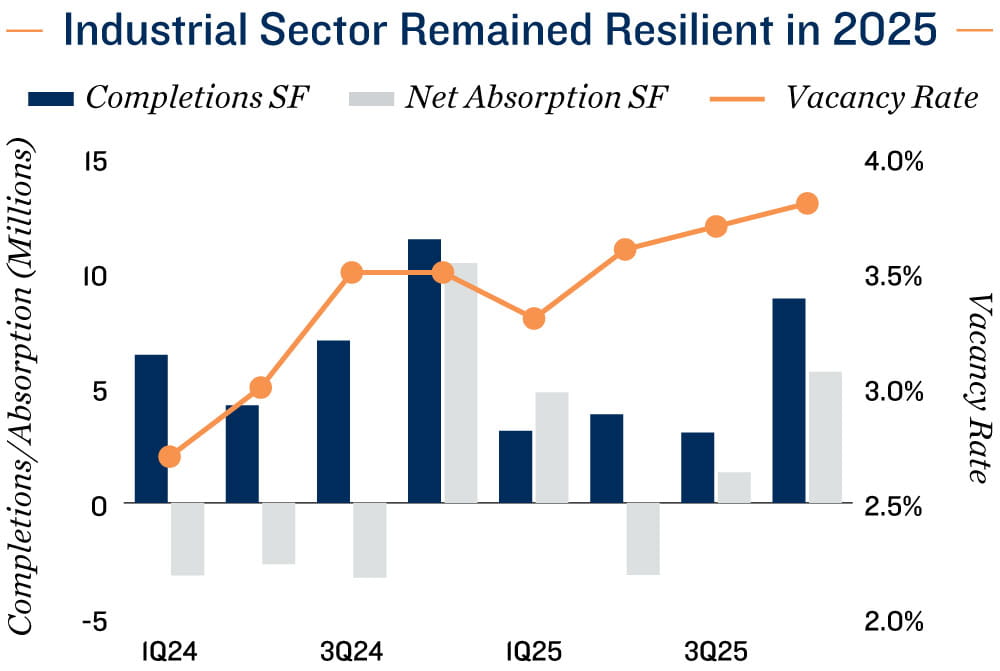

Industrial sector remained resilient last year. Despite soft manufacturing activity in October and November, industrial space demand ended 2025 on a strong note. Net absorption has rebounded swiftly since the second quarter, rising to 5.7 million square feet in the final three months. For the year as a whole, total absorption reached 8.7 million square feet, a significant increase from just 1.0 million square feet in the prior year. The vacancy rate rose by only 30 basis points, reflecting slightly higher completions, rather than weakening demand. This performance underscores the sector’s resilience to external shocks and highlights the role of lower interest rates in bolstering tenant confidence. Over the longer term, pro growth government policies and new legislation, including the One Canadian Economy Act and the Building Canada Act, could serve as the next catalyst for improving the industrial sector outlook.

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Statistics Canada

TO READ THE FULL ARTICLE