Research Brief

Canada Employment

January 2026

Labour Force Signals Reinforce a Turning Point

for Commercial Real Estate

Job market closed 2025 on firmer footing. Employment edged up by 8,200 positions in December, leaving job growth effectively flat on the month. The unemployment rate also rose 30 basis points, to 6.8 per cent, as more residents entered the labour force. However, the soft finish should not overshadow the broader late-year rebound. After hiring largely stalled through August amid tariff-related uncertainty, clearer policy signals helped restore momentum in the fall. From September through December, employment increased by nearly190,000 positions, driving total job growth in 2025 to 226,300 roles, or a 1.1 per cent year-over-year gain. Rather than signaling a setback that economists generally expected, December’s modest employment gain and a 30-basis-point drop in unemployment from the September peak reinforce the view that Canada’s labour market is stabilizing and beginning to recover, albeit in a choppy manner.

Jobs report weakens case for higher interest rates in 2026. December’s muted employment growth and higher unemployment rate point to lingering slack in the labour market, while cooling wage growth — easing 30 basis points to 3.7 per cent year-over-year for permanent employees — signals moderating labour-driven inflation pressures. Together, these trends should effectively quash lingering speculation that the Bank of Canada could pivot back toward rate hikes sometime this year. Instead, the data aligns with a policy environment where officials can remain on hold, allowing prior rate cuts to continue working through the economy while monitoring whether the late-year improvement in hiring proves durable.

Commercial Real Estate Outlook

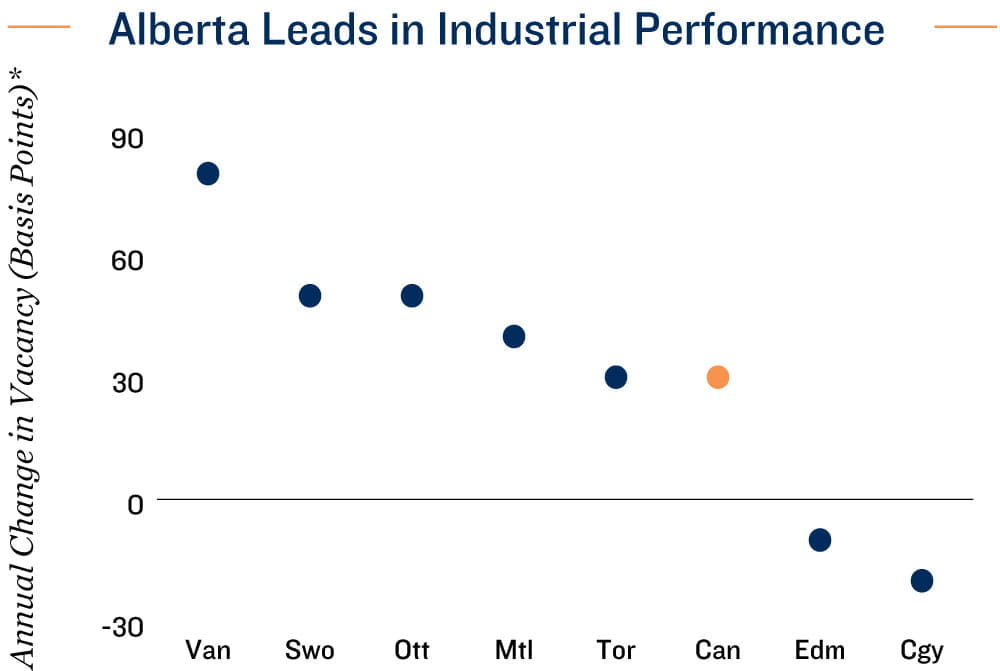

Alberta metros outperform. Edmonton and Calgary led the nation in job gains last year. Vancouver also outpaced the national average, supported by economies less exposed to protectionist U.S. trade. Energy production, natural resources, and infrastructure investment provided a more stable base, while greater access to Asian markets via the Pacific supported greater economic activity and employment< prospects. This relative labour market strength translated into more resilient commercial real estate fundamentals, particularly in Alberta for industrial and multifamily assets. Stronger job creation and sustained population inflows have underpinned tenant demand, limited vacancy expansion, and supported rent growth. This reinforces Western Canada’s position as one of the more defensive and growth-oriented regions for CRE investment heading into 2026.

Industrial properties weather tariff risks. Canada’s industrial sector entered 2025 as one of the most exposed segments, given its ties to manufacturing and cross-border trade, amid tariff uncertainty. Despite these headwinds, industrial-related employment proved resilient, with manufacturing headcounts rising 0.4 per cent annually and transportation and warehousing up 1.4 per cent. Industrial property fundamentals also stabilized, as vacancy increased by just 30 basis points in 2025 and largely held firm at just below 4.0 percent through the second half of the year. Looking ahead, easing supply pressures, greater trade clarity, infrastructure initiatives, and a gradually improving economy should drive further positive momentum in industrial leasing conditions and investment performance.

* Annual change in 2025

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Canada Mortgage and

Housing Corporation; Capital Economics; CoStar Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE