Research Brief

Canada Business Outlook

January 2026

Trade Diversification Progresses Gradually

Amid Soft Business Outlook

Weak sentiment persisted entering 2026. In the final quarter of 2025, business confidence remained subdued amid lingering trade risks and weak consumer demand over the past year. Despite rebounding from its May low, the monthly index tracking current business conditions has remained below its historical average since September 2023. Although most Canadian goods were exempt from U.S. tariffs, exporting firms continued to face headwinds. Those included soft U.S. demand, hesitation among U.S. customers to engage Canadian suppliers due to trade policy uncertainty, and firms’ own reluctance to enter the U.S. market. That said, expectations for future sales improved modestly, driven by more optimistic outlooks among firms less exposed to U.S. trade policies.

Trade diversification could lift confidence moving forward. One encouraging signal from the survey is that, despite sluggish sales to the United States, a small but growing share of businesses reported increased sales to non-U.S. markets. However, most exporters have

yet to diversify meaningfully, reflecting barriers such as the need to invest in specialized equipment, comply with foreign regulatory requirements, and absorb higher transportation costs associated with serving more distant markets. Looking ahead, as the government continues to promote trade diversification, a broader set of exporters is likely to expand into non-U.S. markets. In addition, recent improvements in Canada-China trade relations could further lift business sentiment, an effect that may become more evident in survey results later this year.

Commercial Real Estate Outlook

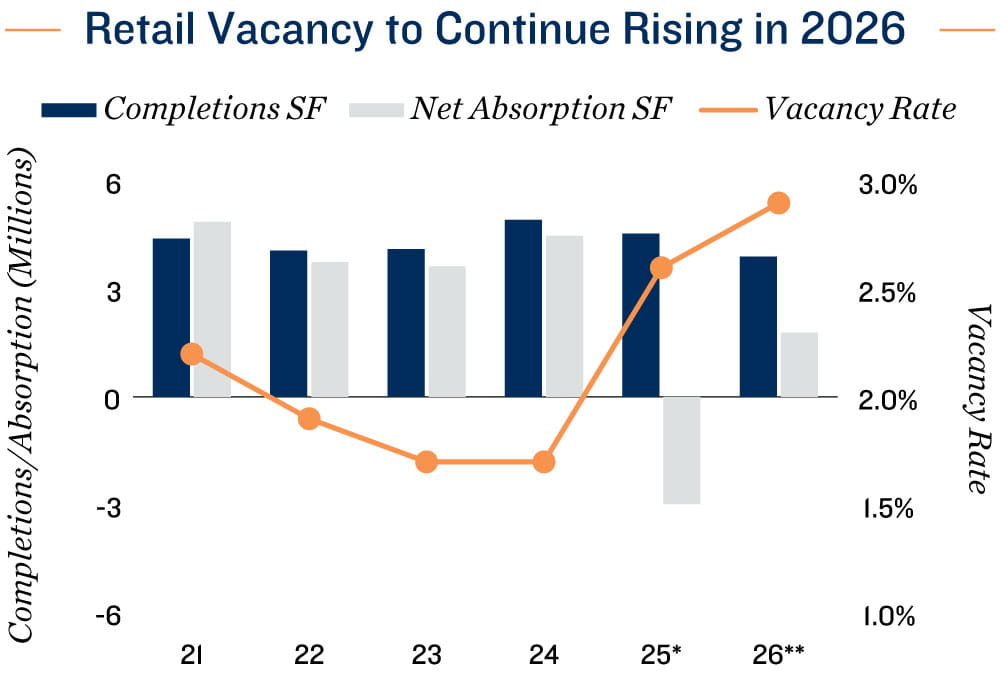

Soft labour market conditions weigh on retail sector recovery. One area of concern in the latest survey is the rising share of businesses planning to reduce their employee headcount over the next 12 months. This caution is echoed in the latest consumer expectations survey, which shows an increase in the share of consumers concerned about potential job losses and missing a debt payment. Together, these dynamics may exert downward pressure on consumer spending in the near term. Combined with persistent uncertainty surrounding U.S. trade policy and a slowing pace of population growth, retailers are likely to remain hesitant to expand their physical storefronts, resulting in a measured recovery in retail space demand. As a result, the retail vacancy rate is forecast to rise in 2026 as net absorption lags behind completions for another year.

Interest rate clarity to facilitate investor return. Trade policies remain the primary driver of elevated inflation expectations among businesses, keeping them above the Bank of Canada’s target. At the same time, firms remain reluctant to expand hiring or initiate new investment, signaling a soft near-term growth outlook. Together, these opposing forces are likely to reinforce the Bank of Canada’s current policy stance, with rates remaining on hold as policymakers wait for the effects of past rate cuts to filter through the economy. For commercial real estate investors, this environment supports greater rate stability and improved financing visibility, which could encourage a gradual investment recovery, particularly in sectors with resilient fundamentals and stable cash flows.

* Estimates; ** Forecasts

Sources: Marcus & Millichap Research Services; Bank of Canada

TO READ THE FULL ARTICLE