Research Brief

2026 Interest Rates & Debt Capital Outlook

January 2026

Inflation Outlook Paving the Way for Improved

Commercial Real Estate Debt Liquidity

Stabilizing housing costs will shape the 2026 price landscape. Inflation will influence interest rates and the debt capital climate — driving commercial real estate investment this year

- In 2025, the Federal Reserve maintained elevated interest rates amid concerns over tariff-related inflation risks, despite inflation increasing only modestly relative to expectations.

- Looking further into 2026, most inflation forecasts are relatively tame, in the 3 percent range, which is above the 2 percent target rate, but still well below the 2022 breakout levels.

- Although inflation remains elevated across select CPI categories, including services and food, shelter-related costs will likely restrain overall price pressures in 2026.

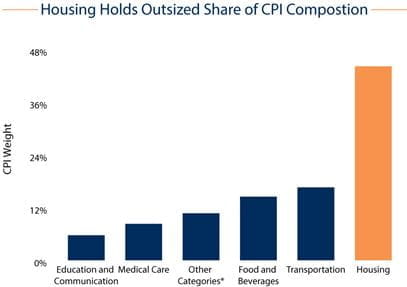

- Housing comprises 44 percent of CPI, carrying about the same weight as the next four largest subcomponents combined.

- With home price appreciation and rent growth subdued at 1.2 percent and 3.0 percent last year, the heavy weighting and backward-looking nature of the housing component are likely to anchor headline CPI near 3 percent.

Interest rates remain a key factor for the economic outlook. Evolving monetary policy and market reactions will play an important role in determining the cost of debt capital.

- Inflation stability near 3 percent would allow the Federal Reserve greater flexibility to adopt a more dovish stance, likely reinforced by the upcoming leadership transition.

- While a 25-basis-point cut is possible in early 2026, additional cuts later in the year are more likely and should bolster commercial real estate debt liquidity, putting downward pressure on lender spreads.

- This outcome is not guaranteed, however, as the 10-year Treasury does not automatically track the federal funds rate, and market perceptions of risk could push long-term yields higher.

- That said, since August 2025, the 10-year Treasury has largely remained range-bound between 4.00 and 4.25 percent.

Debt capital availability poised to improve. Expanding lender participation and supportive underwriting trends point to strengthening liquidity and improved deal flow.

- Since mid-2024, banks have been capturing a rising share of the lending market, a trend that should bolster debt liquidity.

- Fannie Mae and Freddie Mac have increased their lending caps for 2026 by more than 20 percent to $88 billion each, while the Mortgage Bankers Association forecasts a 24 percent increase in commercial real estate lending this year.

- At the same time, the loan-to-value ratio for multifamily debt has been rising, and the LTV on commercial properties is trending upward.

- Together, these dynamics imply that debt liquidity in 2026 will continue to strengthen, and commercial real estate borrowing rates will remain stable or potentially decline modestly.

- This favorable lending climate will strengthen commercial real estate transaction velocity this year.

- There are risks to this outlook, however, as federal policies and financial markets have been unpredictable.

- Barring a significant event, though, commercial real estate debt markets are looking increasingly accretive for investors.

* Other categories includes: Recreation, Other Goods and Services, and Apparel

Sources: Marcus & Millichap Research Services; CME Group; Federal Reserve; Mortgage Bankers

Association; National Association of Realtors; Real Capital Analytics RealPage, Inc.; U.S. Bureau of

Labor Statistics; U.S. Census Bureau

TO READ THE FULL ARTICLE