Research Brief

2026 Hospitality Outlook

January 2026

Shifting Pressures May Narrow the Divide

Between Chain Scale Performance

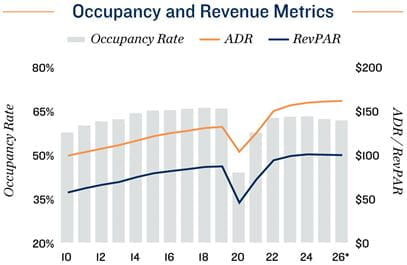

Demand uneven across service levels. After four years of rapid recovery and new growth, the U.S. hospitality market faced several hurdles in 2025, resulting in the nation’s first annual decline in RevPAR since 2021. Demand growth was subdued relative to pre-pandemic norms last year, and roughly half of all major U.S. markets reported year-over-year declines in bookings in late 2025. This deceleration was felt most in economy hotels, which saw demand decline nearly 3 percent year-over-year in 2025. Outside the economy segment, demand modestly increased in all other chain scales, with luxury properties recording an almost 3 percent year-over-year bump and posting the fastest pace of new supply additions among all chain scales over the past two years. These demand trends were reflected in RevPAR performance, with only luxury and upper-upscale properties achieving year-over-year gains.

Limited-service recalibrates. Persistent inflationary pressures and slower income growth among lower-income households have weighed on the more price-sensitive limited-service segment. However, lower-service-level performance could recalibrate in 2026. Gradually increasing savings rates among lower-income cohorts since 2023 suggest improving household balance sheets, which may support an uptick in discretionary travel. As well, recent federal tax legislation makes expanded standard deductions permanent, increases the Child Tax Credit, and reduces taxes on certain overtime and tip income. These shifts could result in larger tax refunds and higher after-tax income for lower- to middle-income households, further buoying value-oriented leisure travel demand.

Some pressures subside amid national tailwind. The broader hospitality market is also putting some 2025 headwinds in the rearview. A modest drop in international travel — stemming in part from volatile U.S. tariff policies — as well as the federal government shutdown and payroll cuts, disrupted overall booking activity and weighed on consumer confidence. Looking ahead, improved clarity around the effects of trade policy and the waning effects of the government shutdown may support a slight rebound in domestic travel. Additionally, the 2026 FIFA World Cup is expected to provide a temporary boost to lodging demand in host markets and nearby metros.

Developing Trends

New supply shifts away from the luxury segment. On the supply side, the total number of room nights expanded by approximately 8 percent over the past five years, roughly in line with the 2015-2019 pace. While luxury supply growth is expected to decelerate meaningfully in 2026, overall hotel supply growth is forecast to accelerate from 0.9 percent in 2025 to 2.6 percent, driven by development in the upscale, upper-midscale, and midscale segments. This acceleration may place near-term pressure on occupancy rates in chain scales experiencing the most pronounced inventory growth.

Value-add opportunities arise. An average cap rate in the upper 8 percent range, the highest among property types, is poised to continue supporting modestly rising transaction velocity. However, the limited-service segment may take longer to attract capital, given its recent underperformance and increasingly compressed margins due to elevated labor and operating costs. Investors with the resources to refresh properties may find added opportunities in this environment, particularly as refinancing pressures remain. Should geopolitical tensions and policy-related macroeconomic uncertainty continue to weigh on consumer confidence in 2026, investors will likely remain selective in acquisitions, prioritizing favorable capital structures, locational advantages, and brand strength

* Forecast

Sources: Marcus & Millichap Research Services; CoStar Group, Inc.; Federal Reserve;

Moody’s Analytics

TO READ THE FULL ARTICLE