Research Brief

2026 Equity Capital Outlook

January 2026

Multiple Factors Supportive of Institutional

Commercial Real Estate Investment in 2026

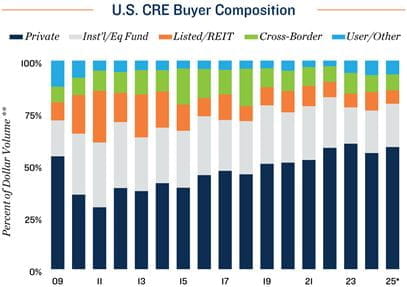

Private investors continue to outpace institutional buyers. The buyer composition of commercial real estate assets has consistently been dominated by privately sourced capital.

- Private investors drive the bulk of commercial real estate acquisitions.

- This group includes: high-net-worth individuals, family offices, and private investment firms that draw capital from private sources rather than public markets, including most syndicators and smaller equity funds

- When measured by dollar volume, private investors have accounted for an average of 47 percent of buy-side activity in deals over $2.5 million since 2010.

- Their share has risen to about 55 percent of deployed capital since 2019, reaching 59 percent through the first nine months of 2025.

- In contrast, institutional capital comprised roughly 26 percent of dollar volume since 2010, and just 21 percent of acquisition volume in the first three quarters of 2025.

Investors have faced headwinds. Fundraising conditions weakened in 2022, constraining capital availability

- Office demand, which has slowly but steadily recovered over the last six quarters, is expected to grow more slowly this year.

- In 2024, net office space absorption totaled roughly 50 million square feet, while in 2025 it reached 85 million square feet.

- Looking ahead, new office demand will likely remain positive, but moderate to approximately 65 million square feet.

- Additionally, office space demand is projected to rise on net in almost every major market in 2026.

- Retail net absorption is anticipated to strengthen, potentially exceeding 10 million square feet, after soft demand in 2025 boosted the vacancy rate to roughly 5 percent.

- This will fall short of the expected 30 million square feet of development, mainly consisting of single-tenant projects.

- As a result, the overall retail vacancy rate is forecast to edge up by 20 basis points to 5.2 percent.

New supply tops new demand for industrial and multifamily. Despite the sluggish employment market, more industrial space and apartments will be needed this year on net.

- During the low-interest-rate environment of 2021 and much of 2022, both private and institutional investors were aggressively buying commercial real estate.

- Over that time, the institutions raised more than $160 billion per year in capital.

- However, as interest rates began rising in 2022, capital fundraising declined to roughly $110 billion in 2023 and $91 billion in 2024.

- At the same time, the NCREIF total returns index fell into negative territory, only beginning to recover in 2024.

- As a result, institutional capital deployment slowed.

- Meanwhile, private investors — particularly syndicators and equity funds — also scaled back acquisition activity from the 2021 peak to the 2023 trough.

- Availability and deployment of equity capital set to improve. The opportunity to generate positive leverage on debt amid lower borrowing costs and higher yields suggests that investment in commercial real estate should continue to build.

- While deal flow fell 48 percent in 2023 compared to 2021, trading activity increased by a modest 3.3 percent in 2024.

- Transaction velocity for the first three quarters of 2025 was up 17 percent compared to the first three quarters of 2024 for properties above $2.5 million.

- In 2026, private investors will likely be active, though syndicators and equity funds still face capital-raising headwinds.

- However, a lower interest-rate climate together with higher cap rates should entice more activity, especially among high-net-worth private investors and family offices seeking to capitalize on positive leverage opportunities.

- On the institutional side, more than $121 billion in capital was raised last year, up about 33 percent from their 2024 total.

- Combined with the NCREIF total returns index back in positive territory, institutional investors may regain confidence to reengage the market.

* Year-to-date through 3Q ** Sales $2.5 million and above

Sources: Marcus & Millichap Research Services; NCREIF; Preqin; Real Capital Analytics

TO READ THE FULL ARTICLE