Research Brief

Insights From The 2026 NHMC Conference

February 2026

Three Key Trends Emerged During the

National Multifamily Housing Council Conference

Investment activity is gathering momentum. Investor sentiment suggests an expansion in acquisition targets, reflecting improving confidence in 2026 market conditions

- Capital availability among investors in attendance appeared elevated compared with recent years.

- Numerous investors indicated plans to complete more transactions in 2026 than in 2025, with upwards of 15 trades in some cases.

- Institutional investors and major investment funds, particularly those with dedicated capital sources, expressed heightened optimism about near-term market opportunities.

- Syndicator attendance was lower than in previous years, though those present represented larger and more established operators with strong performance histories.

- However, excess supply in the Sun Belt markets was identified as a continued headwind.

- The slowing pace of job creation may also weigh on demand for commercial real estate space this year.

- Nonetheless, there was a broad-based positive sentiment about the 2026 investment climate.

- Many investors anticipate that once elevated supply levels are absorbed, market performance will accelerate, following what is expected to be a choppy 2026.

Debt capital availability is improving. Market participants indicated that lending channels are more active, suggesting stronger liquidity despite persistent rate uncertainty.

- Investors noted an increase in debt capital availability, driven by both agency lenders and private lending sources.

- The 20 percent rise in lending allocations from Fannie Mae and Freddie Mac was viewed as a contributing factor to improving financing conditions.

- Many investors expect interest rates to trend modestly lower in 2026, though they acknowledged substantial uncertainty around the outlook.

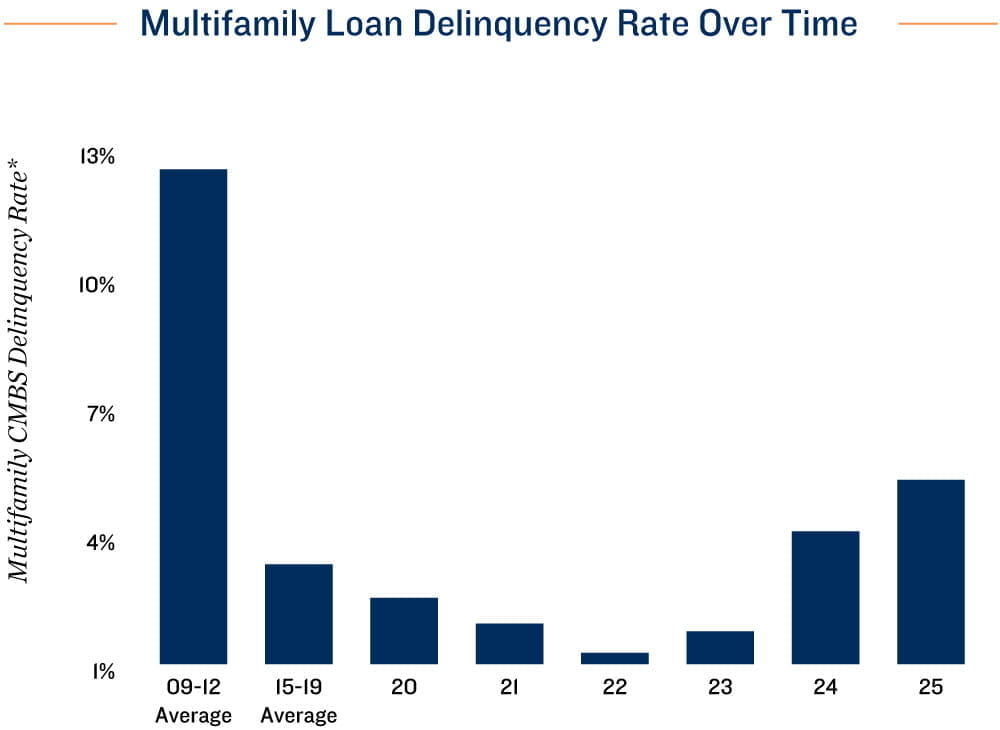

- Lenders are accelerating the resolution of distressed assets. Many financial institutions have begun acting on overdue loans rather than extending loan terms and allowing investors to retain assets facing headwinds.

- The recent shift away from "extend and pretend" practices marks a notable change in lender behavior compared with the past several years.

- Lenders will move distressed assets to market to resolve underwater loans and reduce balance sheet uncertainty, as many banks are now positioned to absorb losses

- In some cases, equity holders may be substantially impacted by lenders' pursuit of forced resolutions.

- Some debt providers are collaborating with current operators to facilitate an orderly transition to stronger investors.

- Other creditors are choosing to foreclose on struggling assets and appoint a receiver to stabilize the assets before sale.

- Investors generally viewed this shift as positive, as it is expected to bring a wave of troubled assets to market at discounted prices and lower cost bases.

- Investor sentiment at the National Multifamily Housing Council Annual Conference was positive, with participants signaling increased activity and the early stages of a healthier cycle.

*All data points are as of year-end.

Sources: Marcus & Millichap Research Services; Moody's Analytics

TO READ THE FULL ARTICLE