Research Brief

Canada Retail Sales

December 2025

Retail Properties Offer Durable Performance

Despite Recent Sales Volatility

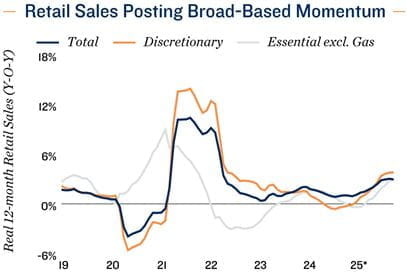

Retail sales soften as underlying momentum stabilizes. Canada’s retail sales edged down 0.2 per cent monthly in October, marking a modest pullback after recent volatility. The headline decline was driven by weakness across core retail categories, which fell 0.5 per cent for a second consecutive monthly decrease. Lower sales at food and beverage retailers were the primary drag, partly reflecting temporary labour disruptions in British Columbia, while clothing and health-related categories also softened. In volume terms, retail sales declined 0.6 per cent, underscoring continued pressure on discretionary spending amid elevated household costs and ongoing uncertainty. That said, retail sales were still up 2.0 per cent year-over-year, and early indications point to a 1.2 per cent rebound in November. As consumer confidence appears to be stabilizing, this may signal that the recent weakness was short-lived.

Economic growth to remain soft, not recessionary. October retail sales data reinforces the view that consumer spending is cooling in line with subdued confidence rather than collapsing outright. While the advance estimate points to a solid rebound in November, roughly half of that increase likely reflects temporary factors from a rebound in B.C. and higher gasoline prices. As a result, the near-term trajectory for consumption remains modest. That said, recent interest rate cuts are beginning to feed through the economy and are likely to support activity gradually over 2026. Overall, the retail backdrop remains consistent with a soft-growth environment that limits inflation risks but also caps near-term GDP acceleration.

Commercial Real Estate Outlook

Fundamentals anchored by necessity-based demand. The latest retail sales data points to continued normalization rather than a deterioration in underlying property performance. Consumer spending is again gravitating toward essential and value-oriented categories, a trend that supports grocery-anchored centres, service-oriented retail, and well-located neighbourhood plazas. While discretionary retailers remain cautious amid weak consumer confidence, spending in this segment has also gained some momentum this year. Spending resilience for motor vehicles and select durable goods also suggests pockets of pent-up demand that could reemerge more broadly as financing conditions ease. Meanwhile, e-commerce sales fell and accounted for just 6.0 per cent of total retail trade in October, reinforcing the continued relevance of physical retail locations.

Outlook favors well-positioned retail assets. Retail property performance is expected to remain steady over the coming year, supported by limited new supply, stable occupancy, and improving leasing conditions in select markets. While retailers are likely to remain cautious in the near term, gradual improvements in consumer spending power should translate into firmer sales productivity over the course of 2026. As a result, retail assets with strong tenant mixes, exposure to essential services, and locations aligned with population growth are well positioned to continue delivering stable cash flow. In an environment marked by broader macroeconomic uncertainty, retail real estate remains one of the more defensive segments of the commercial property landscape.

* Retail sales through October, confidence through December; ** Three-month moving average

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Capital Economics; CoStar

Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE