Research Brief

Canada Monetary Policy

December 2025

CRE Investment Activity Accelerating as

Interest Rate Predictability Grows

Central bank holds as expected. The Bank of Canada kept its overnight rate at 2.25 per cent in December, a widely anticipated move. Policymakers cited continued global resilience — specifically strong U.S. consumption and AI-related investment — but emphasized that uncertainty remains high. For Canada, the country posted a surprisingly strong 2.6 per cent GDP gain in the third quarter despite a decline in domestic demand. An increase in net trade and government capital formation largely drove this growth. At the same time, Canada’s labour market has shown resilience in recent months. Domestic demand is forecast to improve in the fourth quarter, yet weaker net exports are likely to keep near-term growth soft. That said, the Bank anticipates a pickup in 2026 as the economy adjusts to the ongoing global trade reconfiguration.

Terminal rate likely reached barring major shifts. The Bank’s decision reinforces the market’s view that the policy rate is likely at or very near the terminal level for this cycle. Recent economic data — such as GDP and employment — have outperformed expectations. Meanwhile, inflation remains vulnerable to spillover effects from trade-related tariffs, reducing the urgency for further easing. The Central Bank is expected to remain data-dependent, but with the USMCA renegotiation still unfolding, policymakers will likely avoid further adjustments until the external environment becomes clearer. Markets should prepare for a steady-rate environment through the near term unless conditions significantly worsen.

Commercial Real Estate Outlook

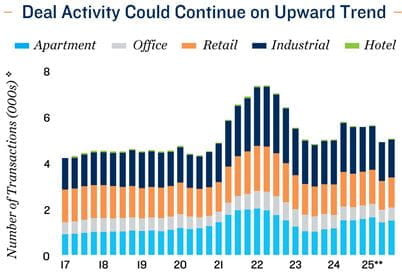

Visibility bodes well for confidence. While investors would welcome more rate relief, stability itself is benefiting commercial real estate. A more predictable lending landscape is improving visibility for borrowers and lenders, easing underwriting friction and gradually reopening deal pipelines. With financing spreads stabilizing, pricing gaps between buyers and sellers are narrowing, encouraging capital to reengage after a lengthy hesitation. As clarity around USMCA renegotiations emerges — along with the Carney administration’s pro-growth policies focused on infrastructure investment and trade diversification — confidence should firm further. Overall, stable borrowing costs and improved policy clarity set the stage for transaction activity to steadily increase through the second half of next year.

Select property types could benefit the most. If financing conditions continue to stabilize and trade clarity improve, retail and industrial properties are positioned to respond. Space demand from retailers closely depends on consumer strength, and lower borrowing costs, along with improve sentiment, could support tenant expansion and restore leasing and investment momentum. The industrial sector, meanwhile, stands to gain from infrastructure spending and trade diversification, with supply-chain investment and nearshoring activity likely to lift absorption over the longer term. Other sectors will benefit over time, but these two appear best positioned to capture early upside as confidence rebuilds.

* Forecast provided by Capital Economics; ** Through 3Q; v Trailing-12-month total

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Capital Economics; CoStar

Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE