Research Brief

Canada Inflation

December 2025

Commercial Real Estate Clarity Improves

Alongside Contained Inflation Measures

Canada’s inflation backdrop remains stable. Headline CPI remained at 2.2 per cent year-over-year in November, coming in slightly below consensus expectations. While food and gasoline prices rose on the month, underlying inflation was notably subdued across most categories. Both CPI-trim and CPI-median fell to 2.8 per cent, marking the first time since May that Canada’s preferred core measures have simultaneously stayed below 3.0 per cent. At the same time, the average three-month annualized rate of these core readings was down to just 2.3 per cent. Although progress varies across categories, the overall trend suggests easing domestic inflation momentum rather than renewed acceleration, which is mainly positive for Canada’s interest rate outlook.

Inflation reading counters shifting rate expectations. With headline inflation stable and core measures posting their smallest monthly gains in nearly two years, the market’s view that the Bank of Canada’s next move could be a rate hike should now be largely dismissed. While cost risks persist amid tariff-related uncertainty, recent labour market strength, a stronger-than-expected rebound in third-quarter GDP growth, and cooling inflation support the case for policy stability rather than renewed tightening. At the same time, the data does little to reopen the door to near-term rate cuts. Policymakers are instead expected to remain on hold, as inflation remains sticky enough to justify caution, but no longer problematic enough to warrant renewed restraint. This reflects the consensus that the policy rate has likely reached its peak for this cycle.

Commercial Real Estate Outlook

Bond markets respond. As inflation risks fade and policy uncertainty diminishes, most forecasters expect some easing in longer-term Canadian bond yields during the first half of next year. While downward pressure may be limited due to tariff-related inflation spillover effects and larger government deficits, this will still provide incremental relief for commercial real estate investors who prefer fixed-rate mortgages. Meanwhile, this more stable lending environment also allows for clearer underwriting assumptions and improved future visibility, which will continue to support price recalibration and help narrow bid-ask spreads. Altogether, these factors are likely to aid transaction momentum as capital reenters the market to capitalize on more favourable pricing, improved operating fundamentals, and real estate’s defensive characteristics during uncertain times.

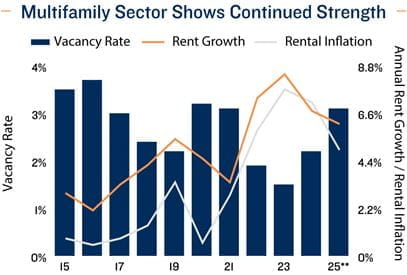

Shelter costs decrease as multifamily fundamentals shift. National rental inflation slowed to 4.7 per cent in November, down 300 basis points from a year earlier and aligning with recent trends in multifamily. Slower population growth due to tighter immigration policies, along with increased deliveries, has raised apartment vacancy 90 basis points to 3.1 per cent this year, leading to a 60-basis-point slowdown in annual rent growth to about 6.0 per cent. While rental conditions are expected to ease further through 2026 due to ongoing supply additions and slower demographic growth, the outlook remains positive. Multifamily assets continue to provide investors with reliable, long-term cash flow and relative stability amid an otherwise uncertain macroeconomic environment.

* Through November; ** Rental inflation as of November

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Canada Mortgage and

Housing Corporation; Capital Economics; CoStar Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE