Research Brief

Canada GDP

December 2025

BoC to Look Through Temporary Upside as

Strong Growth Masks Underlying Weakness

Growth rebounded on trade swings. Canada’s GDP expanded at a 2.6 per cent annualized pace in the third quarter, far surpassing market expectations for a 0.5 per cent increase. The upside surprise was driven largely by an 8.6 per cent pullback in imports and a 12.2 per cent jump in government investment. However, private sector demand remained subdued. Business investment in nonresidential structures, equipment and machinery fell 4.5 per cent, reflecting businesses’ limited appetite to expand operations amid trade uncertainty. Intellectual property investment also declined 2.4 per cent, indicating that the economy has yet to experience a meaningful boost from AI-related investment. Household spending also slipped 0.4 per cent, as a 2.0 per cent drop in goods consumption outweighed a modest 0.7 per cent increase in services.

Bank of Canada expected to stay put. While headline growth overshot the BoC’s projection by a wide margin, policymakers will likely look past this strength, as it stems largely from external trade shocks. The broader macro backdrop remains little changed: subdued household consumption, weak business investment, continued labour market slack and easing near-term inflation pressures. Moreover, the advance estimate of a 0.3 per cent contraction in October GDP suggests fourth-quarter growth could fall short of the Bank’s projection unless activity rebounds significantly in the final two months. Taken together, these conditions argue for a pause in December, giving the monetary authority space to assess the impact of its earlier easing moves.

Commercial Real Estate Outlook

Trade push to fuel future industrial growth. GDP data by industry shows that output declines in the manufacturing sector narrowed in September, confirming the upward momentum seen in manufacturing sales. The wholesale sector has also held firm, recording four consecutive months of year-over-year growth since May. These trends align with the recent increase in net absorption in the industrial sector, which is expected to broaden over the near term as lower borrowing costs aid manufacturing activity and firms adjust to the evolving trade environment. Over the long term, the industrial sector is positioned to benefit from Canada’s trade diversification push. Budget 2025 introduced a new trade strategy to double non-U.S. exports over the next decade. It will be supported by major infrastructure investments in the Great Lakes-St. Lawrence corridor and key rail networks in Alberta and the West Coast. Taken together, these initiatives will strengthen demand for industrial space as production, logistics and supply-chain activity expand.

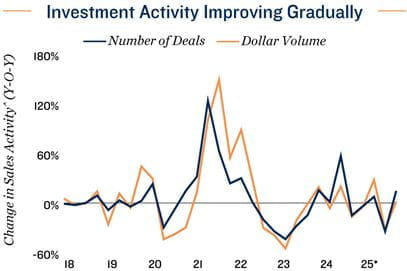

Investment recovery on the horizon. Commercial property sales in Canada improved in the third quarter, with year-over-year gains in transaction count across all sectors. This aligned with expectations that investment activity would rebound amid lower interest rates following the initial trade policy impact. Looking ahead, investor sentiment is expected to continue recovering as financial conditions are likely to remain accommodative through 2026. Moreover, a gradually improving economy — supported in part by measures from the latest federal budget — may further bolster buyer confidence.

* Through 3Q; ^ Property sales $1 million and greater of apartment, office, retail, industrial and

hospitality property types

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Statistics Canada

TO READ THE FULL ARTICLE