Research Brief

Canada Employment

December 2025

Resilient Hiring Continues Amid Differing

Sector and Market Performances

Labour market delivers another above-consensus gain. Canada posted another solid employment reading in November, with 54,000 jobs added and the unemployment rate dropping 40 basis points to 6.5 per cent. This marked a third straight monthly increase, signaling that hiring momentum has firmed after earlier tariff disruptions. The headline result beat expectations once again, aligning with views that the labour market continues to surprise to the upside. That said, most of the growth came through part-time positions and youth hiring, which softens the quality of the increase but does not detract from the broader message that employers are still adding staff. Meanwhile, manufacturing — the sector most exposed to trade pressures — recorded job losses, suggesting some unevenness beneath the surface. Still, the report’s overall tone is optimistic.

Rate implications lean hawkish rather than supportive. A third consecutive upside surprise in hiring and a sharp 40-basis-pointdrop in unemployment suggest the labour market is tighter than many expected heading into year-end. Slower population growth and a dip in participation also helped reduce slack, narrowing the window for additional monetary easing. With policy already near neutral, this type of employment strength gives the Bank of Canada little urgency to cut. Markets are already adjusting, now entertaining the possibility that the next move could be up rather than down. For now, the most realistic outcome is extended rate stability through the first part of 2026, particularly as policymakers wait for more clarity on trade conditions tied to USMCA.

Commercial Real Estate Outlook

Prairie province shows continued strength. Alberta once again outperformed, adding 29,000 jobs in November. This was the second major gain in three months, pushing annual employment growth above 4.0 per cent. The unemployment rate also fell to 6.5 per cent — the lowest since March 2024 — with declines in both Calgary and Edmonton, supporting the view that the province is positioned to lead Canada in economic growth through 2026. Strong job creation, energy-linked investment and continued in-migration are contributing to this confidence in Alberta’s outlook. For commercial real estate, this momentum points to healthier tenant demand across industrial and retail sectors, sustained interest from renters for apartments, and continued investor attention relative to metros where labour and consumer conditions are under greater pressure.

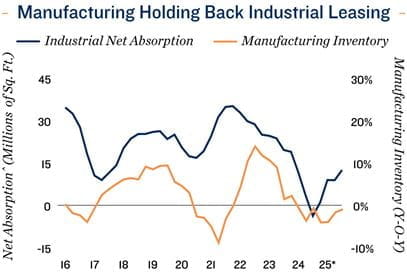

Industrial bifurcation expected. Further job losses in the manufacturing sector highlight rising caution among export-oriented firms navigating tariff exposure. While national industrial fundamentals remain solid — with net absorption improving this year and vacancy hovering around 4.0 per cent by year-end — a softer manufacturing backdrop could temper space expansion plans for heavy-industrial users. Growth is more likely to skew toward logistics, energy-related and transportation users, while Ontario and Quebec manufacturing markets may face slower deal velocity and more conservative footprint decisions. In contrast, energy and logistics-driven markets with more diverse trading partners are better positioned to carry momentum into 2026, even if uncertainty weighs on parts of the export economy.

* Through 3Q; ** Forecast from 4Q 2025 to 4Q 2027; ^ Trailing 12-month total

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Capital Economics; CoStar

Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE