Research Brief

Interest Rates

November 2025

Greater Bonus Depreciation Bodes Well for STNL;

Quality of Tenant Credit Key Influence on Cap Rates

Bonus depreciation highlights STNL. Single-tenant net lease retail properties are a popular asset class for investors seeking to own commercial real estate without incurring substantial management responsibilities.

- In a triple net lease, the tenant pays the taxes and insurance on the property as well as most maintenance fees, while the owner generally covers structure-related costs, like the roof.

- STNL properties such as car washes, convenience stores, quick-service restaurants and auto service centers became more popular after the adoption of 100 percent bonus depreciation. These assets generally have a higher proportion of equipment and site improvements that qualify.

- While bonus depreciation stepped down to 60 percent in 2024, tax reform earlier this year made 100 percent bonus depreciation permanent.

- Investors may be able to pair the return of this benefit with tax-deferred gains via a 1031 exchange.

Tenant quality a major consideration. Because there is only one tenant at an STNL property, their creditworthiness becomes paramount for investors.

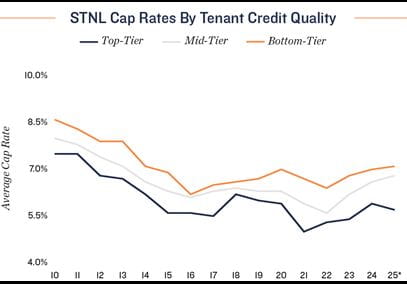

- Cap rates on STNL properties often vary depending on the tenant's credit standing and lease term remaining. These factors have become increasingly important over the past year.

- The average cap rate on tenants with higher credit has trended lower in that span, to the mid-5 percent range.

- The mean cap rate on the tenants with mid-tier credit has risen modestly to the high-6 percent zone.

- For tenants with lower credit standings, the average cap rate has been in the 7 percent band.

- Properties with less than five years on the lease have been changing hands with an average cap rate of 7.7 percent.

- This mean yield dips to 6.8 percent for properties with five to 15 years on the lease. For terms longer than 15 years, the average cap rate was 6.1 percent.

Investment hits notable level. Transaction activity for STNL properties has increased over the past year ended September. The transaction count was the third-largest on record, behind the broad CRE-wide sales surge in 2021 and 2022.

- Trades were up 18 percent compared to 2024 and 43 percent above the 2014-2019 average.

- Private investors have historically dominated STNL acquisitions. In the last year, they drove 64 percent of purchases.

- The single-tenancy status and triple net lease structure greatly simplify the expense management and rent collection processes into essentially a monthly payment from one party.

- This simplicity, paired with lease terms that can extend for a decade or more, can make these assets appealing for retirement and estate planning purposes.

- As such, a longer lease term for a tenant with a higher credit grade can provide substantial benefits to cash flow security. Recent cap rate trends reflect this.

- Some institutions and REITs are active in the space, but, overall, they have become less so in recent years.

* Trailing 12-months through 3Q; Consult a tax professional for tax advice

Sources: Marcus & Millichap Research Services; CoStar Group, Inc.; Real Capital Analytics;

Retailstat

TO READ THE FULL ARTICLE