Research Brief

Canada Retail Sales

November 2025

Commercial Property Investors Favour Retail

Sector’s Stability

Consumption remains bumpy. Canada’s retail sector lost some ground in September, with sales edging down 0.7 per cent and inflation-adjusted sales slipping 0.8 per cent, marking another month of choppy performance. Despite this soft patch, consumer activity remains as one of the few reliable supports for Canada’s economy. Strength in categories such as food and sporting goods partially offset weakness in autos and building materials, reinforcing that underlying demand — while uneven — remains intact. Taken together, the data suggest that retail spending is no longer running at the pace seen earlier this year, yet it remains a relatively bright spot at a time when other pillars of growth are showing clearer signs of strain.

Spending trends could feed into policy outlook. Following September’s retail sales numbers, household consumption is now estimated to have slowed sharply to roughly 1.0 per cent annualized in the third quarter, down from 4.5 per cent in the prior three months. This deceleration is emerging alongside softer business sentiment and persistent trade uncertainty. While many forecasters argue the Bank of Canada has reached its terminal rate of 2.25 per cent, the combination of weaker consumption and an ongoing drag on GDP growth from tariff-related risks strengthens the case for additional easing next year. If these trends persist into early 2026, the Bank may ultimately be pushed toward one or two further cuts during the first half of the year to stabilize demand and safeguard the recovery. This could further bolster commercial real estate investor confidence, unlocking liquidity and fueling greater transaction activity.

Commercial Real Estate Outlook

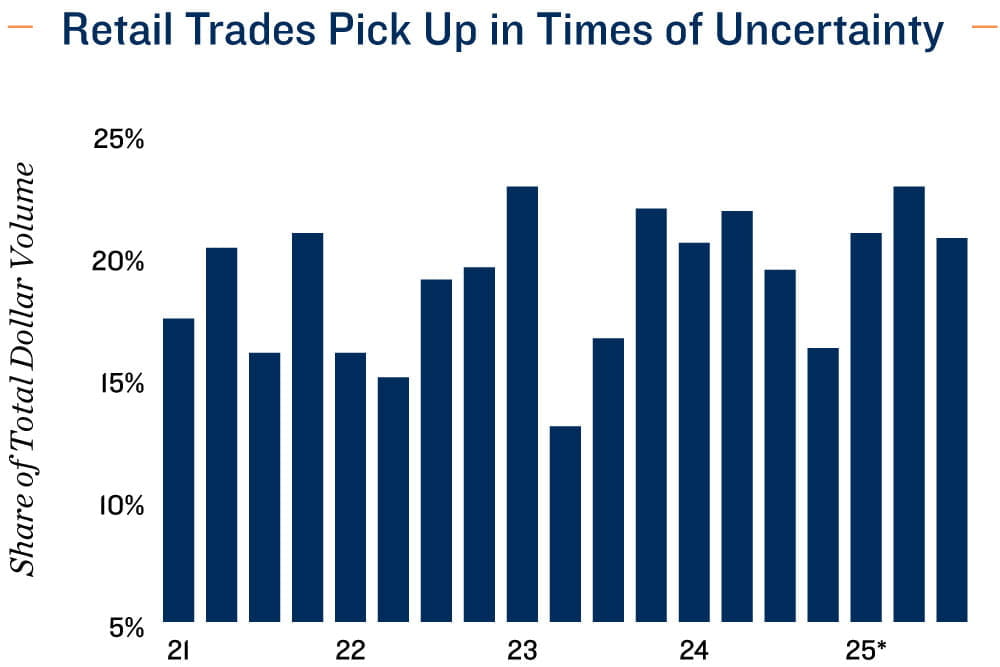

Retail real estate shows strong performance across the spectrum. In the investment market, retail real estate continues to stand out as a preferred option. Grocery-anchored and essential-based centers remain highly sought-after for their defensive characteristics, but 2025’s pickup in discretionary spending has broadened investor interest across the asset class. Retail transaction activity and dollar volumes have both trended higher over the past year, reinforcing the sector’s reputation as a stable, income-driven investment at a time when many other property types are still finding their footing.

Industrial properties show mixed indicators. September’s decline in retail sales also underscored some of the pressures facing Canada’s industrial sector. E-commerce sales fell 3.5 per cent monthly, reflecting the broader volatility in consumer spending that has weighed on distribution and logistics demand over the past year. Additionally, the drop in retail sales was driven by a 2.9 per cent decline in motor vehicles, highlighting ongoing challenges in Canada’s manufacturing base. Even so, the sector showed signs of stabilization, with overall manufacturing sales rising 3.3 per cent in September, suggesting the most acute tariff-related headwinds may be easing. In commercial real estate, the industrial market is improving. Net absorption was positive through the first three quarters of 2025, a marked improvement from last year’s contraction. With interest rates now lower, the renegotiation of the USMCA and large-scale infrastructure spending ramping up next year, conditions appear to be aligning for a more stable industrial outlook in 2026.

* Through 3Q

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Capital Economics; CoStar

Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE