Research Brief

Canada Inflation

November 2025

Inflation Progress Strengthens the Case

for Stabilization Across Canadian CRE

Pricing report delivered mixed but reassuring signal. The change in headline CPI eased 20 basis points to 2.2 per cent in October, driven by sharp declines in energy prices, alongside continued softness in clothing and footwear. Shelter costs were the outlier, with property tax updates and another firm monthly rent increase pushing the category higher. Still, the broader inflation pulse cooled. CPI-trim and CPI-median rose by an average of just 0.18 per cent, the closest they have been to the Bank’s target-consistent pace in more than a year. The three-month annualized rate also edged down 10 basis points to 2.7 per cent. These trends suggest underlying price pressures continue to moderate despite some lingering stickiness, potentially setting the stage for additional rate cuts next year.

Interest rate implications are mixed. While some forecasters still expect two additional cuts in the first half of 2026 — bringing the overnight rate to a 1.75 per cent terminal level — others argue the Bank of Canada is effectively done, with the policy rate likely to hold at the current 2.25 per cent. The case for further easing is complicated by lingering tariff-related inflation pressures, surprisingly resilient household consumption, and fresh fiscal stimulus from the recent federal budget that could bolster growth over the second half of next year. Even so, with underlying inflation pressures cooling and trade-related headwinds looming large over Canada’s economy, the Bank could retain an easing bias. While a rate pause is widely expected in December, these factors could prompt further easing from the monetary authority sometime next year if economic growth remains soft.

Commercial Real Estate Outlook

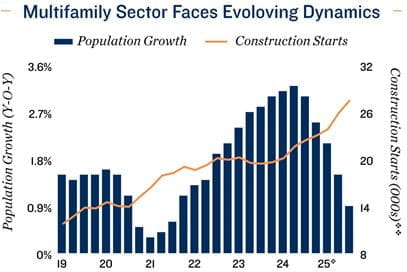

Rental inflation gains momentum. After a period of exceptional strength, Canada’s purpose-built rental sector softened in 2025, with vacancy drifting higher and likely ending the year above 4.0 per cent. Annual rent growth has slowed sharply from the 2023 high — and asking rates may even contract modestly by year-end — as a record wave of new supply provides more choice and tighter federal immigration policies continue to curb population growth. Meanwhile, trade-related headwinds have kept labour market conditions soft and weighed on consumer confidence, tempering leasing activity. Yet October’s inflation data signals a potential shift. Rental inflation has accelerated for three consecutive months and reached 5.2 per - cent, suggesting underlying demand remains firm. If sustained, this dynamic could help stabilize both vacancy and rent levels throughout 2026.

Trends highlight experiential retail. October’s pickup in recreation-related prices, boosted in part by the Blue Jays’ postseason run, underscores a broader shift in consumer behaviour toward live events, dining, fitness and other experience-based spending. This trend has been a tailwind for well-located retail assets, where supply remains exceptionally tight. Consumption has also held up, rising 4.5 per cent annualized in the first quarter. This helped sustain foot traffic and spending. Still, tariff headwinds have weighed on confidence and pushed up input costs for small businesses, contributing to a slight uptick in retail vacancy this year. Even so, the national rate remains low at roughly 2.5 per cent and is expected to stay tight, reinforcing the sector’s continued resilience heading into 2026.

* Through October; ** Forecast by Capital Economics; v Through 3Q; vv Trailing-12-month average

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Canada Mortgage and

Housing Corporation; Capital Economics; CoStar Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE