Research Brief

Retail Sales

October 2025

Sentiment, Foot Traffic and Vacancy Readings Hint at Potential Challenges

Alternative measures shed light on retail sales. Following two consecutive months of 0.4 percent real term spending gains, the outlook for September core retail sales was optimistic despite the weakening labor market and tariff-related price pressures. The government shutdown, however, has led to the suspension of official economic data, including the monthly retail sales report, raising questions regarding the direction of consumer spending prior to the holiday shopping season. Fortunately, foot traffic, consumer sentiment and online spending data is published by other sources, providing a window into the retail sales landscape.

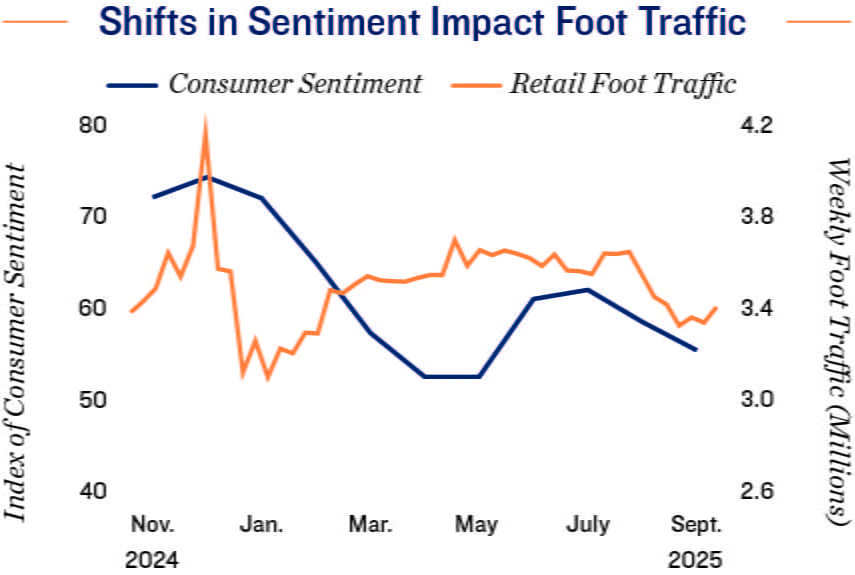

Link exists between sentiment and patronage. Driven by inflation and employment-related concerns, consumer sentiment fell for a second straight month in September, with the reading down more than 20 percent year over year. Concurrently, foot traffic across Placer.ai’s 14 retail categories collectively declined by nearly 6 percent in September when compared to August — while also down 2.5 percent year over year. Together these readings suggest some core retail categories recorded real-term declines in spending last month. Based on preliminary October data, and the tendency for sentiment to decline during an extended government shutdown, the index may remain on a downward trajectory. If this occurs, foot traffic could be further impacted, creating challenges for certain retailers.

Positive absorption still evident across retail categories. Demand for space has tapered in 2025; however, fundamentals as of October remained encouraging across many retail property types. Nationwide, tenants absorbed a combined 6.8 million square feet of restaurant, fast food, convenience store and supermarket space during the first nine months of 2025 — translating into modest vacancy movement across these single-tenant sectors. This favorable performance has the potential to steer more active investors to net-leased retail listings, specifically during a period of rising operating, maintenance and tenant improvement costs.

Positive absorption still evident across retail categories. Demand for space has tapered in 2025; however, fundamentals as of October remained encouraging across many retail property types. Nationwide, tenants absorbed a combined 6.8 million square feet of restaurant, fast food, convenience store and supermarket space during the first nine months of 2025 — translating into modest vacancy movement across these single-tenant sectors. This favorable performance has the potential to steer more active investors to net-leased retail listings, specifically during a period of rising operating, maintenance and tenant improvement costs.

Pockets of shopping center tightness exist. Tenants relinquished a net of 900,000 square feet of multi-tenant retail space in the third quarter based on preliminary estimates. Still, certain property types continue to outperform, with positive net absorption noted across power and strip centers during the three-month stretch. Each property type entered October with mid-4 percent vacancy — well below the low-6 percent overall multi-tenant rate.

2.5% |

5.9% |

|

Year-Over-Year Decrease in |

Monthly Drop in |

Note: Foot traffic based on weekly recordings across Placer.ai's 14 retail categories

Sources: Marcus & Millichap Research Services; CoStar Group, Inc.; Deloitte; Mastercard; National Retail Federation; Placer.ai; University of Michigan

TO READ THE FULL ARTICLE