Research Brief

Financial Markets

October 2025

Fed Cuts Rate For Second Time in 2025;

Investment Activity Picks Up in 3Q

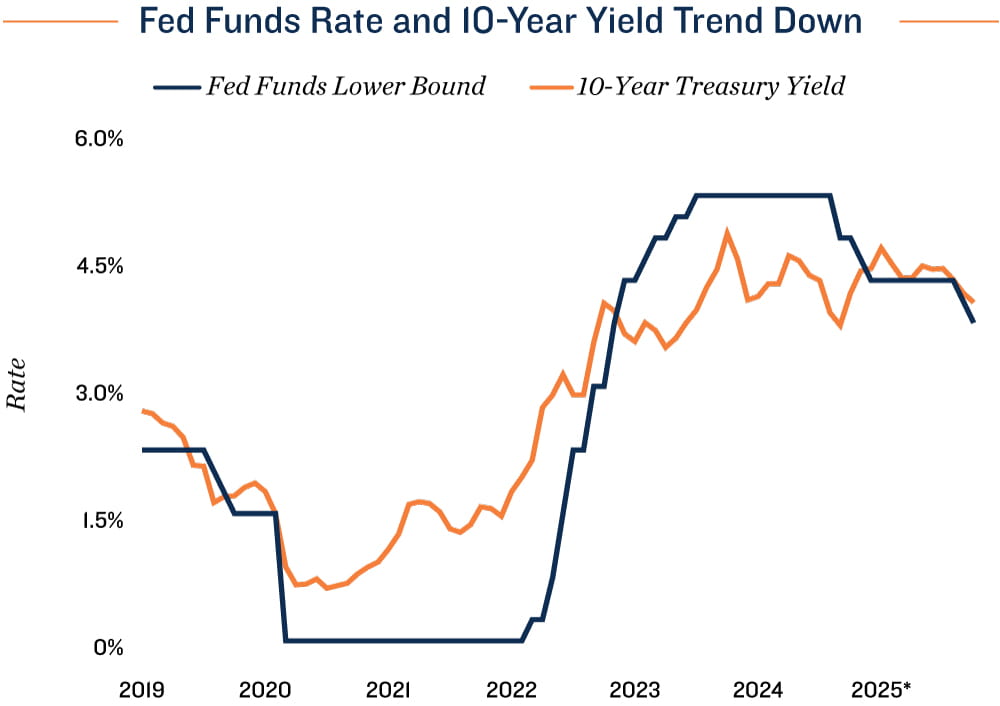

Monetary policy loosens modestly. The Federal Open Market Committee reduced the target range of the federal funds rate by another 25 basis points at its late October meeting. At 3.75 percent, the overnight rate’s lower bound is now the lowest since the end of 2022. The FOMC also indicated they will end quantitative tightening on Dec. 1. From there, proceeds from maturing holdings on mortgage-backed securities on the Federal Reserve’s balance sheet will be directed into Treasury securities. Most Wall Street participants expect the Fed to cut 25 basis points again in December. But that outcome is not certain since the committee’s October decision was not unanimous.

Rate cuts, lower treasury yields help borrowers. The combined 50-basis-point drop in the federal funds rate since August should translate into slightly lower short-term borrowing costs, but the impact on longer-term debt is less clear. While the yield on the commonly benchmarked 10-year Treasury has trended lower this year, around 4.0 percent in late October, further decrease is not guaranteed. If inflation picks up or U.S. debt issuance increases, it could apply upward pressure to the yield. For the near future, however, the modestly lower 10-year Treasury could translate into slightly tempered borrowing costs for investors seeking financing.

Rate shifts may augment recent uptick in transaction activity. Lending on commercial real estate continues to evolve, with banks of all scales taking on a larger share of financing in the first half of 2025 than they did in 2024. Investor-driven capital sources have also become more prevalent, representing 15 percent of lending in the first six months of this year for commercial property deals priced $2.5 million or higher. An active financing landscape and lower interest rates should allow more transactions to pencil. Trading of multifamily, office, retail and industrial properties picked up over 30 percent from the second to third quarter, with the trailing 12-month total up roughly 15 percent from the prior span. Lower borrowing costs could further facilitate this trend, with the Mortgage Bankers Association expecting 24 percent more commercial lending in 2026 over 2025.

Rate shifts may augment recent uptick in transaction activity. Lending on commercial real estate continues to evolve, with banks of all scales taking on a larger share of financing in the first half of 2025 than they did in 2024. Investor-driven capital sources have also become more prevalent, representing 15 percent of lending in the first six months of this year for commercial property deals priced $2.5 million or higher. An active financing landscape and lower interest rates should allow more transactions to pencil. Trading of multifamily, office, retail and industrial properties picked up over 30 percent from the second to third quarter, with the trailing 12-month total up roughly 15 percent from the prior span. Lower borrowing costs could further facilitate this trend, with the Mortgage Bankers Association expecting 24 percent more commercial lending in 2026 over 2025.

Property Type Trends

Long-term trends benefit multifamily properties. Less upward pressure on borrowing costs aligns well with property performance trends, supporting a favorable investment outlook. The completion wave that hit the multifamily sector last year appears to be easing. Deliveries will fall roughly 30 percent in 2025 and perhaps as much again in 2026. While the net absorption of apartments slowed in the third quarter after a record first half, elevated homeownership barriers provide a structural backstop to demand. This will likely keep overall vacancy in the high-4 percent to low-5 percent zone for the year ahead.

Retail outlook favorable despite soft start to the year. In contrast to the multifamily sector, retail net absorption picked up in the third quarter, partially offsetting net relinquishments from the first half of the year. While the potential to backfill closed stores in strong locations is high, national vacancy will likely end the year up slightly at 5.0 percent. This would still mark 2025 as one of the five least vacant years of the past 25, reflecting the retail sector’s generally tight conditions.

3.75% |

4.06% |

|

Federal Funds Rate Lower Bound |

10-Year Treasury Yield on Oct. 29 2025 |

* Through Oct. 29

Sources: Marcus & Millichap Research Services; CME Group; CoStar Group, Inc.; Federal Reserve;

Mortgage Bankers Association; RealPage, Inc.

TO READ THE FULL ARTICLE