Research Brief

Canada Retail Sales

October 2025

Retail Real Estate Foundations are Steady

Despite Bumpy Consumer Spending

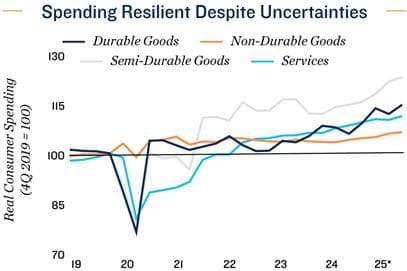

Store receipts rebound but volatility persists. Canadian retail sales rose 1.0 per cent monthly in August, fully offsetting July’s decline and extending the pattern of volatility amid ongoing tariff uncertainty. Despite these trade-related headwinds, auto sales – one of Canada’s most exposed sectors – advanced 1.8 per cent, joined by solid gains in electronics and clothing. Furniture sales, however, fell 2.9 per cent, likely reflecting still in-place retaliatory tariffs. Importantly, inflation-adjusted sales also rose 1.0 per cent, underscoring genuine strength rather than price effects. Even so, the advance estimate for September points to a 0.7 per cent pullback, reaffirming that demand remains uneven amid renewed residential mortgages at higher rates and persistent trade friction. August’s rebound looks more like a brief recovery than the start of a sustained upturn in consumer spending.

Bank of Canada likely to press ahead with rate cut. August’s stronger retail data is unlikely to alter the Bank of Canada’s easing path. September sales are expected to retreat, and consumption growth has slowed sharply to roughly 1.0 per cent to 1.5 per cent annualized in the third quarter, down from 4.5 per cent in the second quarter – signalling that consumer momentum is weakening. Inflation is also within the target range, while business surveys continue to cite insufficient demand as the primary constraint on growth. Combined, these indicators support expectations for another rate cut at the end of October, as policymakers look to cushion the broader economic slowdown rather than respond to a single month of firmer retail spending and a modest uptick in inflation.

Commercial Real Estate Outlook

Suburban strength offsets urban softness. Canada’s retail property sector remains resilient but is showing divergence. Suburban and necessity-based centers continue to outperform, with grocery-anchored plazas benefiting from current consumer spending patterns, steady foot traffic and vacancy near historic lows. By contrast, urban high-street and enclosed malls are facing slower leasing, pressured by softer discretionary spending. Retailers remain selective, prioritizing proven trade areas over downtown exposure. With limited new supply and stable fundamentals, suburban grocery-anchored assets remain the clear outperformers, offering investors redevelopment potential, defensive yield and insulation from broader economic volatility.

E-commerce uptick masks soft industrial momentum. Online retail sales in Canada remain modest, with e-commerce sales accounting for just over 6.0 per cent of total trade. While this share is still roughly double the pre-pandemic level, growth has been negligible recently amid a prolonged period of elevated interest rates and, more recently, tariff-related uncertainties. Consequently, demand from larger third-party logistics firms and retailers has been tepid over the past few years, leaving the amount of sublet space elevated and a large

portion of new supply still available. That said, a dwindling construction pipeline, infrastructure investment, lower borrowing costs aiding business expansion and the potential for greater trade clarity could help stabilize the nation’s vacancy rate around 4.0 per cent next year. For investors, this means value is in selective, quality assets, with smaller-bay product outperforming in the current market.

* Through 2Q

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Capital Economics; CoStar

Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE