Research Brief

Canada Inflation

October 2025

Investors Face a Shifting Backdrop as Lower

Interest Rates Create Favourable Entry Point

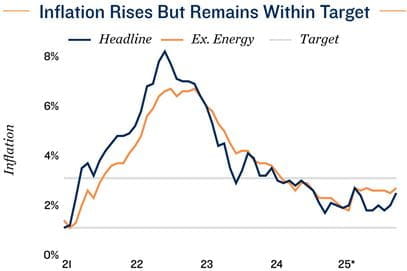

Inflation edges higher but remains contained. Canada’s annual inflation rate rose 50 basis points to 2.4 per cent in September, reflecting a modest upside surprise driven by specific categories rather than broad-based pressures. Higher food prices and a rebound in travel costs offset declines in clothing and household goods, while gasoline contributed modestly due to unfavourable base effects. The Bank of Canada’s core measures, CPI-trim and CPI-median, held steady at 3.1 per cent year over year, with the three-month annualized rate edging up 10 basis points to 2.7 per cent, indicating inflation is lingering and still above the 2.0 per cent target. While the data did surprise to the upside, it suggests price pressures remain contained but not resolved

Lingering price pressures lower chance for October rate cut. The September CPI report adds complexity to the Bank of Canada’s upcoming policy announcement. Soft economic growth, weak business and consumer sentiment, and the removal of retaliatory tariffs support the case for another 25-basis-point rate cut. That said, persistent underlying inflation and a stronger jobs report earlier this month argue for caution. The Bank will likely weigh the risks of easing too quickly against evidence that inflation momentum is slowing. On

balance, September’s release reduces – but does not eliminate – the odds for an October rate cut, with money markets still estimating the likelihood at roughly 75 per cent. As a result, terminal rate forecasts range from 1.75 per cent to 2.25 per cent.

Commercial Real Estate Outlook

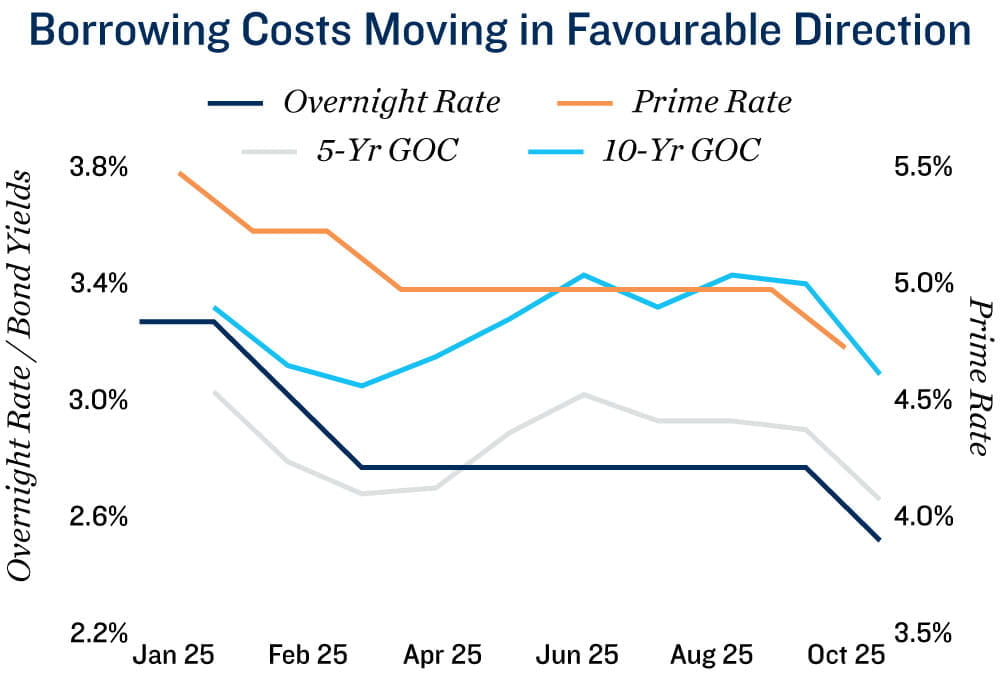

Global rate cuts drive momentum in Canada’s bond market. Canadian bond yields have retreated in recent months as investors price in slower domestic growth, easing inflation and rate cuts by the U.S. Federal Reserve. These factors have boosted demand for government debt and lowered benchmark borrowing costs. The five-year Government of Canada yield has fallen to roughly 2.6 per cent, while the 10-year sits near 3.0 per cent, both down meaningfully from summer highs. While larger government deficits and tariff-related inflation risks remain, this repricing is flowing through to real estate financing. Spreads remain selective, but debt costs have decreased, showing confidence that inflation is steadily falling and paving the way for better credit conditions by year-end.

Falling yields could support investment. Although caution remains, lower bond yields have reduced the overall debt cost, supporting renewed underwriting activity. This is particularly true in multifamily, industrial, and grocery-anchored retail where vacancy rates remain sub-4.0 per cent and rental rate growth has been robust in recent years. While lenders continue to favour high-quality sponsors and stable income profiles, lower capital costs should help narrow bid-ask spreads and lift transaction volumes into 2026. Office and secondary retail are unlikely to see the same benefit, as underwriting discipline and higher risk premiums persist despite the better rate environment.

* Through October

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Canada Mortgage and

Housing Corporation; Capital Economics; CoStar Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE