Research Brief

Canada Housing

October 2025

Canada’s Housing Market Is Slowly Turning the

Corner Amid Pent-Up Demand

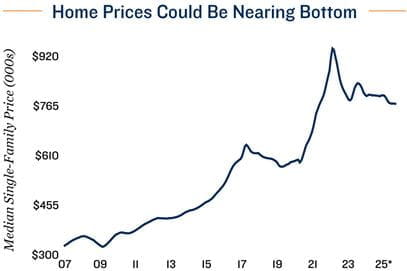

Underlying momentum is building. After five consecutive monthly increases, national home sales edged down 1.7 per cent in September. Even so, it was the strongest September reading since 2021, extending the market’s gradual recovery seen through the summer months. New listings also dipped, falling 0.8 per cent, which nudged the sales-to new-listings ratio slightly lower to 50.7 per cent – a level consistent with balanced housing market conditions. With supply and demand now better aligned, prices appear to be stabilizing, with the median price of a single family home slipping by just 0.1 per cent month over month and 3.2 per cent year over year in September. After three years of pent-up demand, lower prices and less restrictive borrowing costs are beginning to unlock some sidelined buyers, setting the stage for firmer sales and pricing through late 2025 and into 2026.

Regional dynamics still diverse. While several large markets – including Greater Vancouver, Montreal, Ottawa and Calgary – posted month-over-month declines in sales, gains in the Greater Toronto Area helped cushion the modest slowdown in September. In Alberta, conditions remain resilient, though price trends have softened in Calgary in recent months. Meanwhile, British Columbia continues to be constrained by affordability pressures, though some stabilization is starting to form. Overall, the widening gap between high- and mid-priced regions highlights how affordability, migration and local supply dynamics still drive Canada’s housing market performance.

Commercial Real Estate Outlook

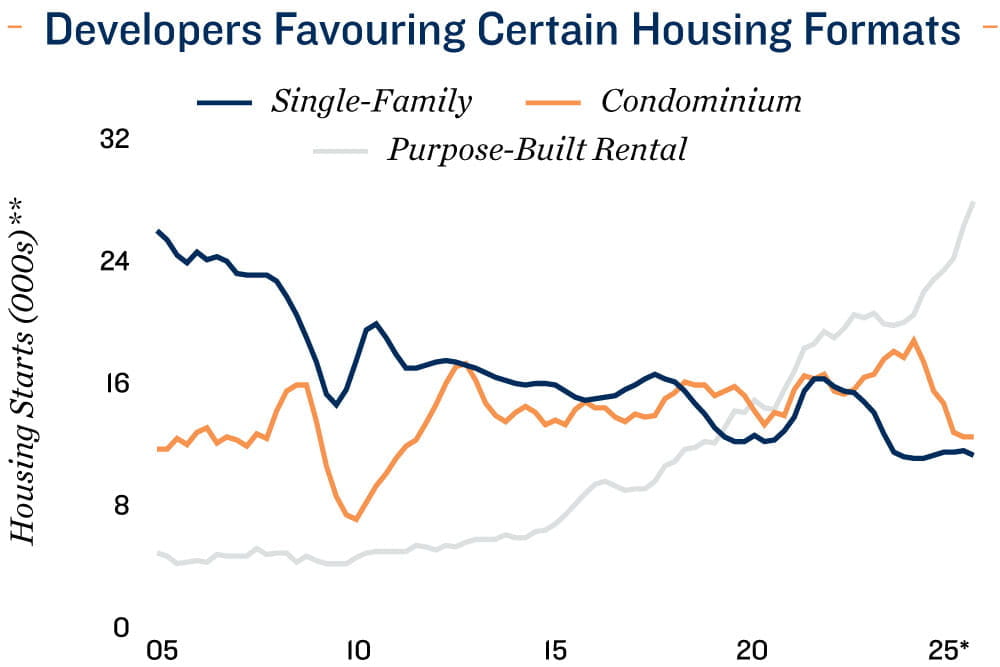

Construction and investment activity are recalibrating. Canada’s housing construction pipeline is adjusting to shifting conditions. Single-family homebuilding has slowed in recent years, reflecting weaker builder sentiment and tighter project financing. Condominium starts have also dropped sharply as rising costs, higher rates and soft presales delay or cancel projects – especially in Toronto and Vancouver, where developers are facing the greatest affordability and absorption challenges. By contrast, purpose-built rentals remain the most active segment. Strong rent growth in recent years and past population gains continue to draw institutional and private capital here. Nevertheless, total housing completions are projected to lag household formation well into 2026, underscoring persistent supply shortfalls and reinforcing the case for investment in high-quality rentals.

Conditions point to a gradual rebalancing through 2026. Market sentiment stays cautious, but several tailwinds are aligning to support a moderate recovery. Although slowing population growth will temper growth prospects, easing inflation and lower borrowing costs should gradually restore confidence among buyers and developers. Still, elevated construction costs, labour shortages and tighter financing will constrain new supply, especially in ownership-oriented segments. For investors, this backdrop reinforces a structural shift towards income-producing residential assets, where supply constraints and resilient demand underpin long-term value creation.

* Through September; ** Trailing 12-month average

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Canada Mortgage and

Housing Corporation; Capital Economics; CoStar Group, Inc.; CREA; Statistics Canada

TO READ THE FULL ARTICLE