Research Brief

Canada Employment

October 2025

Canada’s Labour and CRE Markets Could be

Showing Early Signs of Recovery

September hiring rebounds. Canada’s labour market regained momentum in September, adding 60,400 jobs and partially reversing the cumulative loss of 106,300 positions over the prior two months. Employment gains were broad-based, with ten of 16 industries expanding, driven entirely by full-time positions. The six-month moving average improved to a more respectable 10,000 jobs, while the unemployment rate held steady at 7.1 per cent amid a 72,000-person increase in the labour force. September’s report points to genuine underlying strength, suggesting that the worst of recent trade-related uncertainty may be fading. Moreover, optimism is building around potential sector-specific trade agreements with the United States, which could help stabilize hiring into 2026. Even so, risks persist as the ongoing USMCA renegotiation continues to cloud the outlook and is likely to temper near-term growth expectations.

Renewed job gains complicate the Bank of Canada’s easing path. Canada’s strong September job print indicates the labour market is not as weak as it appeared in previous months – a key factor behind the Bank of Canada’s recent 25-basis-point rate cut to 2.5 per cent. Even so, the Bank’s Summary of Deliberations highlighted ongoing concern over upside inflation risks, suggesting policymakers may pause until December before easing further. Nevertheless, additional rate cuts remain likely, and with the removal of retaliatory tariffs, terminal rate expectations have been revised lower to the 1.75 per cent to 2.25 per cent range.

Commercial Real Estate Outlook

Industrial property sector may find firmer footing next year. After a brief rebound in late 2024 and early 2025, leasing momentum softened once again as renewed trade uncertainty and U.S. tariffs weighed on business expansion plans. Net absorption slipped back into negative territory in the second quarter and stayed muted in the third, pushing the national vacancy rate up to 3.7 per cent as of September. Still, early signs of stabilization are beginning to emerge. Manufacturing employment led September’s job gains, rising by 28,000 positions – a potential signal that tariff-related headwinds are easing. At the same time, Canada’s industrial construction pipeline – while still elevated compared with historic standards – is winding down, alleviating some supply-side pressures. Combined with growing trade clarity and a more accommodative monetary backdrop, fundamentals appear poised to gradually improve through the latter half of 2026.

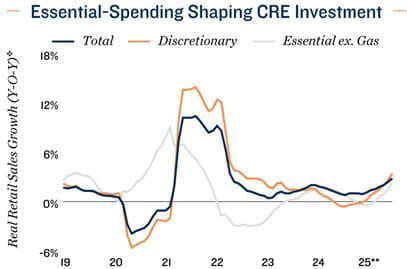

Retail fundamentals remain tight. The retail property sector is also exposed to U.S. tariffs, given their dampening effect on consumer confidence and reduced U.S. demand for smaller businesses due to higher prices. As a result, retail and wholesale employment posted the largest monthly decline in September – down 20,800 positions. That said, domestic spending has held firm, with second-quarter consumer expenditure rising 4.5 per cent annualized. This resilience, coupled with limited construction, has kept Canada’s retail property market exceptionally tight. Vacancy sat at just 2.0 per cent as of the third quarter. These dynamics continue to underpin investor preference for essential-based, grocery-anchored assets.

* Forecast provided by Capital Economics; ** Through 2Q; v Trailing 12-month sum

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Capital Economics; CoStar

Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE