Research Brief

Third Quarter Fundamentals

October 2025

CRE Fundamentals Meet Expectations in the Third Quarter,

Outlook Could Considerably Strengthen if Uncertainty Abates

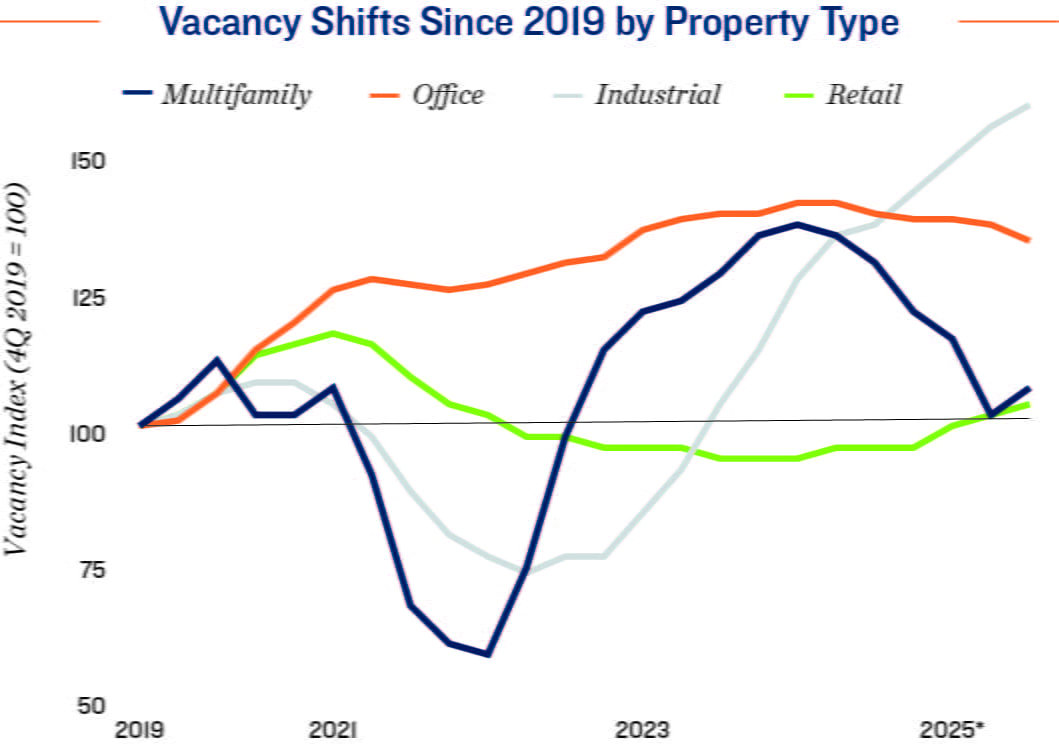

Multifamily sector's main hurdle starting to abate. Third quarter performance metrics offer some key insights for each major commercial property type. For the multifamily market, demand growth is moderating, but so is new supply, allowing for potential balance.

- While still down 100 basis points year-over-year, the U.S. multifamily vacancy rate ticked up to 4.6 percent in the third quarter as demand stepped back from recent high marks.

- Construction activity has been a major challenge for the sector. Markets like Austin, Dallas-Fort Worth, Charlotte, Denver, Nashville and Phoenix are experiencing lease up pressure amid high numbers of recent openings.

- The development wave may be starting to abate, however, which will help stabilize markets, specifically those with strong economic drivers.

- Metros with limited development like Chicago, Cincinnati, Cleveland, Detroit, Minneapolis-St. Paul and San Francisco have outperformed, with rent growth north of 5 percent

Office properties gaining. The office market continued to post positive performance in the third quarter, signaling modest recovery in some metros for this property type.

- Nearly 38 million square feet of office space was absorbed on net in the third quarter, the sixth consecutive positive period.

- This helped pull the national vacancy rate down 30 basis points to 16.4 percent in September.

- San Jose noted one of the more significant vacancy improvements over the past year, with the metrowide rate down 230 basis points to 17.7 percent at the end of the third quarter.

- Vacancy fell 210 basis points in New York City, 170 basis points in Milwaukee and 160 basis points in Orange County.

- Cleveland, Indianapolis, Miami-Dade, the Inland Empire and Tampa-St. Petersburg are the least vacant major office metros

Industrial tenants still digesting recent development. Years of heavy supply pressure are still influencing the industrial sector.

- Nearly 20 million square feet was absorbed from July to September after a negative second quarter. Increased construction, however, still pushed vacancy to a 12-year high of 7.8 percent.

- About 3.5 billion square feet has been completed over the past decade, a significant volume of space that is still being absorbed, especially in major port and trans-shipping hubs.

- On the other hand, many other markets have welcomed minimal development for several years, aiding vacancy.

Retail properties holding up. While development is minor in most markets, a slowdown in leasing amid economic uncertainty has affected vacancy.

- Net absorption was positive in the third quarter, but vacancy still edged up to a below-average 4.9 percent

- Vacancy was below 3.5 percent in Northern New Jersey, Boston, Indianapolis, Miami-Dade and Minneapolis-St. Paul.

- While most markets noted slight vacancy upticks, well-located space, especially in centers with a higher concentration of necessity retailers, remains in demand by investors.

* As of 3Q

Sources: Marcus & Millichap Research Services; CoStar Group, Inc.; RealPage, Inc

TO READ THE FULL ARTICLE