Research Brief

Canada Industrial

September 2025

Strong Rebound Signals Early Turnaround Amid Lingering Challenges

Green shoots emerge for manufacturing sector. Total manufacturing sales rose 2.5 per cent month over month in July, driven by higher sales of transportation equipment, petroleum and coal products, as well as primary metals. This marked the second consecutive gain this year after the United States imposed higher tariffs on Canadian exports. Although sales were still weak on a year-over-year basis, the monthly increase may be an early sign of recovery. More encouragingly, manufacturing inventories rose 0.8 per cent, led by gains in intermediate goods and raw materials, while finished product inventories declined 0.5 per cent. This pattern suggests manufacturers were likely replenishing inputs and ramping up production to meet future demand, while at the same time selling through existing stock faster than they could replace it.

A gradual recovery may take shape. Amid stalled trade negotiations between Canada and the U.S., the risk of prolonged tariffs remains a major headwind for the manufacturing sector. At the same time, with the Bank of Canada expected to resume interest rate cuts in September, manufacturers could see some support from stronger domestic demand, particularly in interest-sensitive industries such as autos, machinery and construction-related sectors. Even so, developments on the trade front will likely carry major weight in shaping the sector’s outlook. If trade disruptions persist, any recovery driven by lower interest rates may be slow and gradual. Growth could also be uneven across subsectors, depending on their exposure to the U.S. and tariff-affected supply chains.

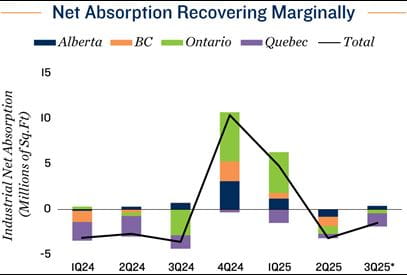

Industrial fundamentals started improving in select regions. Space demand in the industrial sector has closely mirrored developments in the manufacturing sector. In the third quarter, preliminary data indicates that total net absorption stayed in negative territory at the national level, though the shortfall appears to be narrowing. The metric improved from -3.2 million square feet to -1.5 million square feet. This weakness is concentrated in Ontario and Quebec, while Alberta has already begun to record positive absorption. Looking ahead, a potential pick up in manufacturing activity, helped by lower interest rates, could pave the way for a recovery in space demand. Still, with higher tariffs continuing to weigh on trade volumes, any rebound is likely to be modest and uneven across regions.

Promising signs in latest transaction trends. The spike in trade policy uncertainty in the second quarter led to a significant decline in total dollar volume; however, deal count held up, even registering a quarter-over-quarter increase. This suggests that investors shifted their focus towards small- to medium-sized properties, where fundamentals have remained more resilient thanks to stronger demand and limited supply pressure. In the third quarter, initial sales data indicate that confidence may be returning. There was a notable pickup in average dollar volume, likely due to rising transactions for larger properties. Some buyers seem willing to look beyond current headwinds, positioning themselves for long-term opportunities.

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Statistics Canada

* Preliminary estimates

TO READ THE FULL ARTICLE