Research Brief

Canada Inflation

August 2025

Interest Rate Clarity Stabilizing CRE Sales Amid Contained Inflation

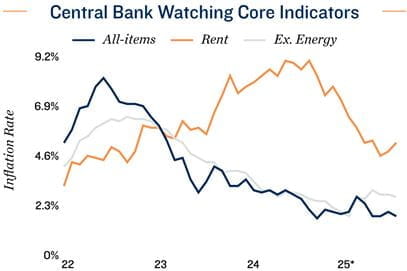

Inflation eases despite tariffs. Inflation dropped 20 basis points to 1.7 per cent in July. This can largely be attributed to a fall in gasoline prices following a ceasefire between Israel and Iran, as well as increased OPEC+ production. Excluding energy, inflation was higher at 2.5 per cent. While still showing some underlying price pressures, July’s softer core price data, along with revisions to previous months, has pulled down the three-month annualized rate of CPI-trim and CPI-median – a closely watched indicator by the Bank of Canada – to a more modest 2.4 per cent. Despite being above the monetary authority’s target, inflationary factors are likely temporary. For example, retaliatory tariffs on U.S. goods appear limited in scope, as sectors most exposed showed little signs of mounting price pressures. Protectionist U.S. trade policies do, however, sustain ongoing economic uncertainty for Canada, which may prompt the central bank to weigh the risks of slower growth over the inflationary impacts of tariffs.

Further room for additional monetary easing. While there is nearly a month until the BoC’s next interest rate decision, with a few key data releases in between, July’s soft inflation print brings a September move back into the fold. Money market odds for a rate reduction are inching closer to 50 per cent. If second-quarter GDP data comes in weak and further job losses materialize this month, a rate cut would be reasonable to assume. It is important to note, however, that the Bank’s summary of deliberation showed some hesitancy towards further monetary easing, given some economic resilience. Nevertheless, terminal rate forecasts range from 2.25 per cent to 2.50 per cent.

Commercial Real Estate Outlook

Rate stability aids gradual sales recovery. Canada’s commercial real estate investment market gained momentum over the second half of last year, as lower interest rates stimulated economic growth and helped stabilize lending markets. This momentum was curbed in the first quarter amid trade risks, but sales held up in the second quarter. Though investors remain cautious – as indicated by weaker dollar volume figures amid less higher-valued deals – interest rate clarity is aiding price discovery. Along with growing trade stability expected over the coming months, a recovery in CRE deal volumes could still materialize, albeit at a slower pace than originally expected.

Rents pulling inflation up. Shelter costs increased 10 basis points to 3.0 per cent in July, marking the first rise since early last year. This was mainly driven by rental inflation, which jumped 40 basis point to 5.1 per cent. While down from 8.9 per cent in 2024, annual rental costs have now increased for two consecutive months, which may be an early indication that purpose-built fundamentals are stabilizing. Despite this, Canada’s multifamily sector continues to face evolving supply and demand dynamics that are tempering underlying performance metrics, contrasting record highs in recent years. Amid tighter immigration and strained renters’ budgets, as well as robust supply growth, forecasts still suggest a further softening in apartment fundamentals. By year-end, the national vacancy rate is likely to approach 4.0 per cent – up from the 2023 low of 1.5 per cent. Meanwhile, annual rent growth is also set to slow to the 1.0 per cent to 2.0 per cent range – down from the record high of 8.4 per cent in 2023.

* Through July; ** Through 2Q

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Canada Mortgage and

Housing Corporation; Capital Economics; CoStar Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE