Research Brief

Canada Housing

August 2025

Housing Market Momentum Continues Yet

Performance Differs Across Metros

Lower prices pulling some buyers off the sidelines. Following a challenging winter and spring, Canada’s housing market may be turning a corner. Existing home sales jumped 3.8 per cent in July, marking the fourth consecutive monthly rise. Given limited surprises surrounding interest rates and trade uncertainties continuing to loom, the uptick in home sales was likely attributed to lower prices bringing some buyers off the sidelines. Though the median price of a single-family home rose 0.2 per cent monthly in July, home values were still down 3.1 per cent year over year and 18 per cent from the early-2022 peak. Meanwhile, new listings only picked up 0.1 per cent monthly and inventory continued to shrink. This pushed the sales-to-new listings ratio up to 52 per cent, indicating a balanced housing market. While there is still excess supply that needs to clear, it appears the worst for Canada’s housing market is behind us. Lower prices, more favourable financing and growing trade clarity could even entice more potential buyers in the coming months.

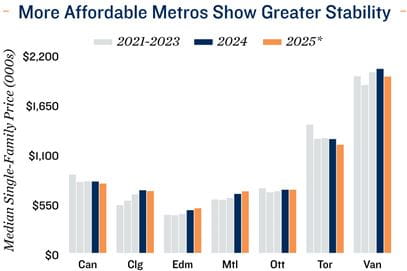

Housing market stability is hiding regional disparities. Lower-cost markets such as Calgary and Edmonton, as well as Montreal and Ottawa, have experienced more stable and in some cases rising home prices in recent years. In contrast, more costly markets like Toronto and Vancouver have seen greater downwards pressure on home prices. Ownership challenges persist in these higher-cost markets, but the sales-to-new listings ratios in these regions appear to be turning a corner, which may suggest a gradual recovery could be materializing for these less affordable metros as well.

Commercial Real Estate Outlook

Population tailwinds fading. Canada’s single-family market is gaining momentum amid lower interest rates and more favourable pricing; however, ownership is still a challenge for many Canadians. The affordability index – which measures the share of disposable income put towards housing-related expenses – remains elevated, now 25 per cent above the level seen in 2020. While these affordability hurdles keep more people in the rental market, tighter immigration policies are also impacting demand. After peaking at roughly 430,000 people in late-2023, quarterly population growth has since stalled to just 20,000 residence as of the first quarter of 2025. Though slower population growth will affect ownership demand and help alleviate some affordability challenges, it will more directly affect the purpose-built rental sector. Combined with historic apartment supply growth, multifamily vacancy is forecast to rise to just below 4.0 per cent by year-end, with annual rent growth slowing to roughly 1.0 per cent.

Supply-side dynamics could shift. Amid robust fundamentals, more favourable financing through the CMHC and incentives from various levels of government, apartment starts have surged over the past decade, reaching their highest reading on record in the second quarter of this year. Nevertheless, with immigration slowing notably, alongside rising vacancy and stagnating rents in new builds, this strength may soon fade. This is already being seen in higher-cost markets like Toronto and Vancouver, where significant supply growth, strained renters’ budgets and population outflows amid affordability hurdles are having a greater effect on property performance.

* As of July; ** Through 1Q

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Canada Mortgage and

Housing Corporation; Capital Economics; CoStar Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE