Multifamily

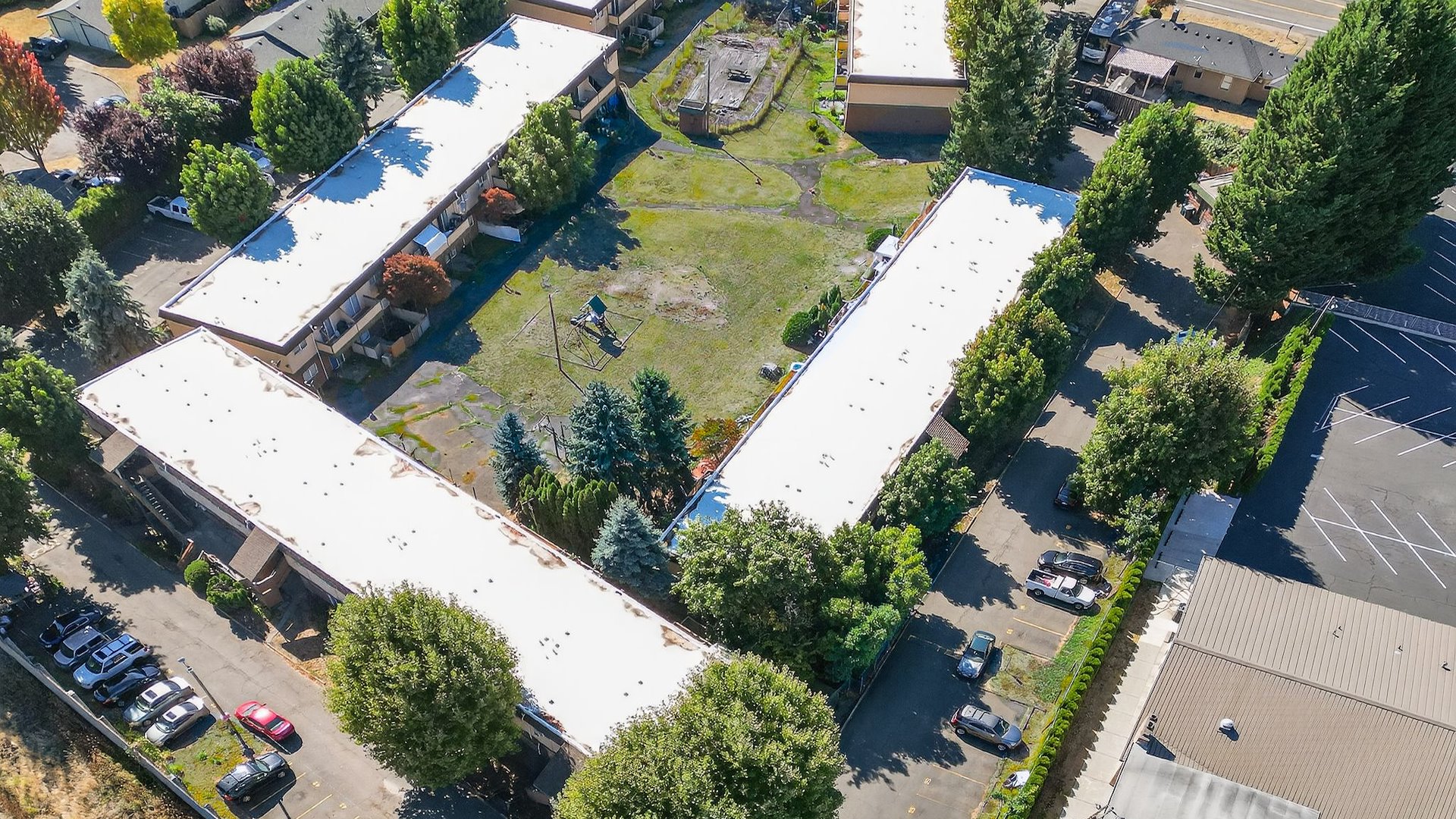

Greentree Apartments

6405 NE Hazel Dell Ave, Vancouver, WA 98665

Listing Price: Request For Offer

Investment Overview

Greentree Apartments is a classic value-add in a submarket with durable demand drivers, limited

near-term supply, and clear rent displacement relative to like-kind vintage. With an average unit size of ~800 SF, versatile floor plans from studios through 4-bedrooms, and a large, underutilized common area, the asset is primed for an interior/amenity reposition that captures meaningful rent premiums while remaining competitively priced against nearby pre-1989 properties. Year-built vintage (1968) and recent exterior work (new roof membranes; repaired/replaced decks) de-risk major systems and allow capital to be focused on rent-producing upgrades.

Market context—Clark County strength, Hazel Dell stability. Clark County continues to benefit from steady in-migration and cross-river employment access, with West Hazel Dell offering neighborhood conveniences and immediate I-5 connectivity to Downtown Vancouver and the Portland CBD.

Submarket vacancy is tracking in the ~7% range—supportive of absorption and rent growth without over-building pressures seen in urban cores. Notably, only one project (˜198 units) is under construction locally with delivery targeted for late 2026, underscoring a constrained near-term pipeline.

Operations & rent positioning—material upside to peers. In-place rents at Greentree average $892/month ($0.86/SF)—well below proximate, pre-1989 comps. Nearby older assets are achieving ~$1,250–$1,500+ per month depending on plan type (e.g., The Groove ’71, Rolling Creek ’73, Hazel Dell Ridge ’86, Rosewood ’87), with two- and three-bedroom premiums extending higher. This sustained delta validates a straightforward path to lift revenue via unit renovations, professional management, and modernized amenities while staying inside an attainable workforce band.

Favorable unit mix & livability. Greentree’s mix (studios, 1BR, 2BR, 3BR, and select 4BR layouts)

addresses a broad renter profile—from singles to larger households—while the average 800 SF

provides livable space that is increasingly scarce in newer, smaller-format stock. Historical accounts indicate washer/dryer hook-ups may exist in 2BR homes (to be verified), offering a low-friction avenue

to introduce in-unit laundry—one of the highest-ROI, resident-valued upgrades in suburban product.

Connectivity & demand drivers. Immediate access to Interstate 5 provides short commutes to

Downtown Vancouver and the Portland CBD, expanding the renter draw while preserving suburban convenience. Proximity to daily-needs retail, services, and schools further supports retention and

reduces frictional vacancy.

Physical plant & recent capital. Built in 1968, the community benefits from recent exterior work:

tear-off roof replacements with new membranes and deck repairs/replacements (per ownership).

With major surfaces addressed, investors can prioritize interiors and amenities to monetize the rent gap rather than backfilling deferred items.

Investment Highlights

- Interior Renovations Tied to Measurable Rent Deltas

- In-Unit Laundry Where Feasible (2BR focus)

- Activate the Common Area

- Professional Management & Marketing

- Expense Discipline & CapEx Sequencing

Exclusively Listed By

Broker of Record

Investment Highlights

- Interior Renovations Tied to Measurable Rent Deltas

- In-Unit Laundry Where Feasible (2BR focus)

- Activate the Common Area

- Professional Management & Marketing

- Expense Discipline & CapEx Sequencing

Investment Overview

Greentree Apartments is a classic value-add in a submarket with durable demand drivers, limited near-term supply, and clear rent displacement relative to like-kind vintage. With an average unit size of ~800 SF, versatile floor plans from studios through 4-bedrooms, and a large, underutilized common area, the asset is primed for an interior/amenity reposition that captures meaningful rent premiums while remaining competitively priced against nearby pre-1989 properties. Year-built vintage (1968) and recent exterior work (new roof membranes; repaired/replaced decks) de-risk major systems and allow capital to be focused on rent-producing upgrades. Market context—Clark County strength, Hazel Dell stability. Clark County continues to benefit from steady in-migration and cross-river employment access, with West Hazel Dell offering neighborhood conveniences and immediate I-5 connectivity to Downtown Vancouver and the Portland CBD. Submarket vacancy is tracking in the ~7% range—supportive of absorption and rent growth without over-building pressures seen in urban cores. Notably, only one project (˜198 units) is under construction locally with delivery targeted for late 2026, underscoring a constrained near-term pipeline. Operations & rent positioning—material upside to peers. In-place rents at Greentree average $892/month ($0.86/SF)—well below proximate, pre-1989 comps. Nearby older assets are achieving ~$1,250–$1,500+ per month depending on plan type (e.g., The Groove ’71, Rolling Creek ’73, Hazel Dell Ridge ’86, Rosewood ’87), with two- and three-bedroom premiums extending higher. This sustained delta validates a straightforward path to lift revenue via unit renovations, professional management, and modernized amenities while staying inside an attainable workforce band. Favorable unit mix & livability. Greentree’s mix (studios, 1BR, 2BR, 3BR, and select 4BR layouts) addresses a broad renter profile—from singles to larger households—while the average 800 SF provides livable space that is increasingly scarce in newer, smaller-format stock. Historical accounts indicate washer/dryer hook-ups may exist in 2BR homes (to be verified), offering a low-friction avenue to introduce in-unit laundry—one of the highest-ROI, resident-valued upgrades in suburban product. Connectivity & demand drivers. Immediate access to Interstate 5 provides short commutes to Downtown Vancouver and the Portland CBD, expanding the renter draw while preserving suburban convenience. Proximity to daily-needs retail, services, and schools further supports retention and reduces frictional vacancy. Physical plant & recent capital. Built in 1968, the community benefits from recent exterior work: tear-off roof replacements with new membranes and deck repairs/replacements (per ownership). With major surfaces addressed, investors can prioritize interiors and amenities to monetize the rent gap rather than backfilling deferred items.

Exclusively Listed By

Broker of Record