Shopping Strip

Eastland Plaza

2599 S Hamilton Rd, Columbus, OH 43232

Listing Price: $9,705,000

Investment Overview

Marcus & Millichap is pleased to present, Eastland Plaza, an 85,084 square-foot shopping center located in Columbus, Ohio. The subject property is one of the premier centers in the region, and is comprised of three separate strip centers, denoted as Eastland East, Eastland West, and Eastland Magnet. Original construction of Eastland Plaza dates back to 1979, 1974, and 1978 respectively, and has consistently catered to surrounding demographics + changing consumer behaviors. Ownership has been extremely diligent with Eastland Plaza via major upgrades and renovations over time, which has kept both the condition and tenant base on par with top-tier centers. The subject property is currently 90.18 percent occupied by a strong mixture of top-tier ecommerce-proof tenants, who are extremely befitting of the region. Tenant uses run a wide range across the 28 suites which includes – Medical, Government, Food, Dollar/Convenience, Cellular, Nail Salon, Hair Salon, Daycare, Karate, and Financial Services. Major tenants spread amongst Eastland Plaza include Nationwide Children’s Eastland Primary Care, AT&T, Papa John’s, United States Postal Service, Dollar General, United State Airforce, Sterling Cleaners, Dulce Vida, H&R Block, Lil Rascals Daycare, Five Star Nails, Proman Staffing, Maya Hair Braiding, and D&D Studio Salons. In its current state, there are two vacant units ranging from 3,615 - 4,852 square feet, and are spread across the 2 strips. Historical occupancy has been extremely high, 47 percent of the Gross Leasable Area (GLA) is leased to national or government tenants, while the rest of the existing tenant base is occupied by long-term successful local and regional brands. Despite being a top-tier center in the region, tenants are paying very reasonable/modest rent levels, with inline space averaging only $11.79 per square foot. The reasonable and modest rent levels – housed by arguably the top strip in the region – provides steady income, long-term upside, and hedges against relocation risk. Lionshare of tenants have base-term rental increases, and 45 percent of GLA currently lacks option terms. The combination of rental increases and lack of options provide significant NOI growth capabilities, while tenants with options all come with significant rent bumps. Majority of tenants encumbered by NNN Leases wherein lionshare of tax, CAM, insurance, as well as 3rd party management fees are reimbursed. Ownership benefits from an e-commerce proof tenant mix, favorable lease structures, modest rent levels, staggered lease expirations, and a prime location.

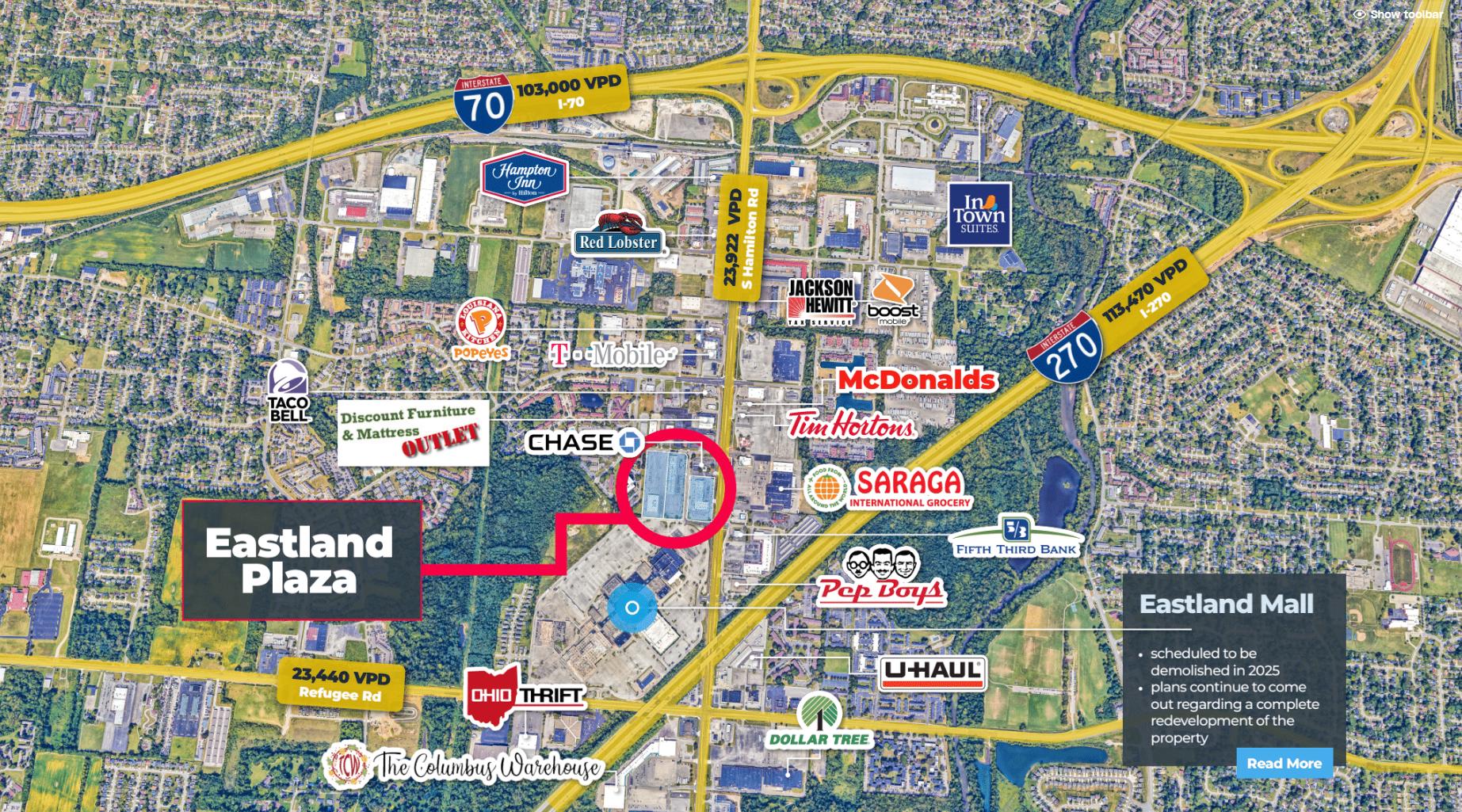

Eastland Plaza is located along South Hamilton Rd, one of Columbus’s main thoroughfares which sees over 23,922 vehicles per day. In addition to the high- traffic frontage, the subject property is situated less than a mile south of I-70, which sees over 103,000 vehicles per day. Eastland Plaza is strategically placed between two signalized intersections and has three points of ingress/egress. The prime location renders Eastland Plaza as the go-to center in the region, and the updated infrastructure positions it as the most modern strip for a good stretch – benefitting for both tenants and consumers. Adjacent to the subject property, and with shared access is the former Eastland Mall. In conjunction with the City of Columbus, the Eastland Mall is scheduled to be demolished in 2025 – and plans continue to come out regarding a complete redevelopment of the property. Unveiled in late 2024, the City of Columbus announced that a combination of development partners are in the planning stages for a over 78-acre major mixed-use development on the site – which will include public and private funding. Initial ideas include a combo of multi-family/ residential, civic use, senior housing, commercial uses, and public greenspace for the community (see page 26). Accompanying the hopeful development, the region currently houses a strong list of existing retailers/points of interest, but is overall underserved by retailers. Major tenants in the immediate area include McDonald’s, Tim Hortons, Chase Bank, Popeye’s, T-Mobile, DaVita, Taco Bell, Saraga Grocery, Giant Eagle, Raising Cane’s, Starbucks, Chipotle, Aldi, and many small shop tenants. Immediate demographics are dense and mature with population counts of 9,592 people within one-mile, 98,925 within three-miles and 236,919 within five-miles. The average household income spans $48,541 - $69,309 between one-three miles, which creates a wide consumer base.

The Columbus-MSA is the 32nd largest metro in the United States with over 2.2 million people, and is one of the fastest growing cities in the Midwest. Columbus is the state capitol of Ohio, and the county seat of Franklin County. Major employers within Columbus include JP Morgan/Chase, Nationwide, Amazon, Honda, Cardinal Health, Huntington, Victoria’s Secret, AEP, and is ranked Top 9 for logistics, 3rd best business climate, and arguably the top tech-talent market. Notable major in- process projects throughout Columbus include – Intel’s +$20b semiconductor plant (less than 30-min from Eastland), Amazon’s +$10b infrastructure investment, LinkUS $8b transit program, $4.4b Honda/LG battery plant, a +$2b renovation of John Glenn International Airport, and AMGEN’s new $365m biotechnology manufacturing plant.

Investment Highlights

- 90 Percent Occupied Shopping Center Located in Columbus, Ohio (Columbus-MSA Population Over 2.2B)

- Major Tenants Include: Nationwide Children's Eastland Primary Care, AT&T, Papa John's, United States Postal Service, Dollar General, United State Airforce, Sterling Cleaners, Dulce Vida, and H&R Block

- High Historical Occupancy | 47 Percent of Gross Leasable Area is Leased to National Tenants | Remainder of Rent Roll Consists of Long-Standing Local & Regional Tenants

- Modest Inline Rent Levels Averaging Only $11.79 per Square Foot | Hedge Against Relocation Risk + Upside Opportunity | Staggered Lease Expirations

- Numerous Upside Opportunities | Two Vacant Units - Ready to Lease | Tenants Have Contractual Base-Term Rent Bumps | Prominent Rental Bumps for Tenants with Options | Many Tenants Lack Option Terms and Are Paying Below Market Rent

- True Irreplaceable Real Estate Between Two Hard Corner/Signalized Intersections | Over 23,922 Vehicles Per Day | Less Than a Mile from I-70 | Over 103,000 Vehicles Per Day

- Dense and Mature Demographics | 9,592 Residents within One Mile | 98,925 within Three Miles | 236,919 within Five Miles | Wide Range of Household Incomes Averaging $48,541 - $69,309 within One-Three Miles | Wide Consumer Base

- Majority of Tenants Encumbered by Triple Net (NNN) Leases | Minimal Landlord Responsibilities | Strong Reimbursement of All Operating Expenses Including TAX/CAM/INS, as well as Admin/3rd Party Management

Listing Price: $9,705,000

Investment Highlights

- 90 Percent Occupied Shopping Center Located in Columbus, Ohio (Columbus-MSA Population Over 2.2B)

- Major Tenants Include: Nationwide Children's Eastland Primary Care, AT&T, Papa John's, United States Postal Service, Dollar General, United State Airforce, Sterling Cleaners, Dulce Vida, and H&R Block

- High Historical Occupancy | 47 Percent of Gross Leasable Area is Leased to National Tenants | Remainder of Rent Roll Consists of Long-Standing Local & Regional Tenants

- Modest Inline Rent Levels Averaging Only $11.79 per Square Foot | Hedge Against Relocation Risk + Upside Opportunity | Staggered Lease Expirations

- Numerous Upside Opportunities | Two Vacant Units - Ready to Lease | Tenants Have Contractual Base-Term Rent Bumps | Prominent Rental Bumps for Tenants with Options | Many Tenants Lack Option Terms and Are Paying Below Market Rent

- True Irreplaceable Real Estate Between Two Hard Corner/Signalized Intersections | Over 23,922 Vehicles Per Day | Less Than a Mile from I-70 | Over 103,000 Vehicles Per Day

- Dense and Mature Demographics | 9,592 Residents within One Mile | 98,925 within Three Miles | 236,919 within Five Miles | Wide Range of Household Incomes Averaging $48,541 - $69,309 within One-Three Miles | Wide Consumer Base

- Majority of Tenants Encumbered by Triple Net (NNN) Leases | Minimal Landlord Responsibilities | Strong Reimbursement of All Operating Expenses Including TAX/CAM/INS, as well as Admin/3rd Party Management

Investment Overview

Marcus & Millichap is pleased to present, Eastland Plaza, an 85,084 square-foot shopping center located in Columbus, Ohio. The subject property is one of the premier centers in the region, and is comprised of three separate strip centers, denoted as Eastland East, Eastland West, and Eastland Magnet. Original construction of Eastland Plaza dates back to 1979, 1974, and 1978 respectively, and has consistently catered to surrounding demographics + changing consumer behaviors. Ownership has been extremely diligent with Eastland Plaza via major upgrades and renovations over time, which has kept both the condition and tenant base on par with top-tier centers. The subject property is currently 90.18 percent occupied by a strong mixture of top-tier ecommerce-proof tenants, who are extremely befitting of the region. Tenant uses run a wide range across the 28 suites which includes – Medical, Government, Food, Dollar/Convenience, Cellular, Nail Salon, Hair Salon, Daycare, Karate, and Financial Services. Major tenants spread amongst Eastland Plaza include Nationwide Children’s Eastland Primary Care, AT&T, Papa John’s, United States Postal Service, Dollar General, United State Airforce, Sterling Cleaners, Dulce Vida, H&R Block, Lil Rascals Daycare, Five Star Nails, Proman Staffing, Maya Hair Braiding, and D&D Studio Salons. In its current state, there are two vacant units ranging from 3,615 - 4,852 square feet, and are spread across the 2 strips. Historical occupancy has been extremely high, 47 percent of the Gross Leasable Area (GLA) is leased to national or government tenants, while the rest of the existing tenant base is occupied by long-term successful local and regional brands. Despite being a top-tier center in the region, tenants are paying very reasonable/modest rent levels, with inline space averaging only $11.79 per square foot. The reasonable and modest rent levels – housed by arguably the top strip in the region – provides steady income, long-term upside, and hedges against relocation risk. Lionshare of tenants have base-term rental increases, and 45 percent of GLA currently lacks option terms. The combination of rental increases and lack of options provide significant NOI growth capabilities, while tenants with options all come with significant rent bumps. Majority of tenants encumbered by NNN Leases wherein lionshare of tax, CAM, insurance, as well as 3rd party management fees are reimbursed. Ownership benefits from an e-commerce proof tenant mix, favorable lease structures, modest rent levels, staggered lease expirations, and a prime location. Eastland Plaza is located along South Hamilton Rd, one of Columbus’s main thoroughfares which sees over 23,922 vehicles per day. In addition to the high- traffic frontage, the subject property is situated less than a mile south of I-70, which sees over 103,000 vehicles per day. Eastland Plaza is strategically placed between two signalized intersections and has three points of ingress/egress. The prime location renders Eastland Plaza as the go-to center in the region, and the updated infrastructure positions it as the most modern strip for a good stretch – benefitting for both tenants and consumers. Adjacent to the subject property, and with shared access is the former Eastland Mall. In conjunction with the City of Columbus, the Eastland Mall is scheduled to be demolished in 2025 – and plans continue to come out regarding a complete redevelopment of the property. Unveiled in late 2024, the City of Columbus announced that a combination of development partners are in the planning stages for a over 78-acre major mixed-use development on the site – which will include public and private funding. Initial ideas include a combo of multi-family/ residential, civic use, senior housing, commercial uses, and public greenspace for the community (see page 26). Accompanying the hopeful development, the region currently houses a strong list of existing retailers/points of interest, but is overall underserved by retailers. Major tenants in the immediate area include McDonald’s, Tim Hortons, Chase Bank, Popeye’s, T-Mobile, DaVita, Taco Bell, Saraga Grocery, Giant Eagle, Raising Cane’s, Starbucks, Chipotle, Aldi, and many small shop tenants. Immediate demographics are dense and mature with population counts of 9,592 people within one-mile, 98,925 within three-miles and 236,919 within five-miles. The average household income spans $48,541 - $69,309 between one-three miles, which creates a wide consumer base. The Columbus-MSA is the 32nd largest metro in the United States with over 2.2 million people, and is one of the fastest growing cities in the Midwest. Columbus is the state capitol of Ohio, and the county seat of Franklin County. Major employers within Columbus include JP Morgan/Chase, Nationwide, Amazon, Honda, Cardinal Health, Huntington, Victoria’s Secret, AEP, and is ranked Top 9 for logistics, 3rd best business climate, and arguably the top tech-talent market. Notable major in- process projects throughout Columbus include – Intel’s +$20b semiconductor plant (less than 30-min from Eastland), Amazon’s +$10b infrastructure investment, LinkUS $8b transit program, $4.4b Honda/LG battery plant, a +$2b renovation of John Glenn International Airport, and AMGEN’s new $365m biotechnology manufacturing plant.