Single-Tenant Office

Chewy Inc. | National RX Script Validation & Training Center

3621 Fern Valley Rd, Louisville, KY 40219

Listing Price: $6,449,716

Investment Overview

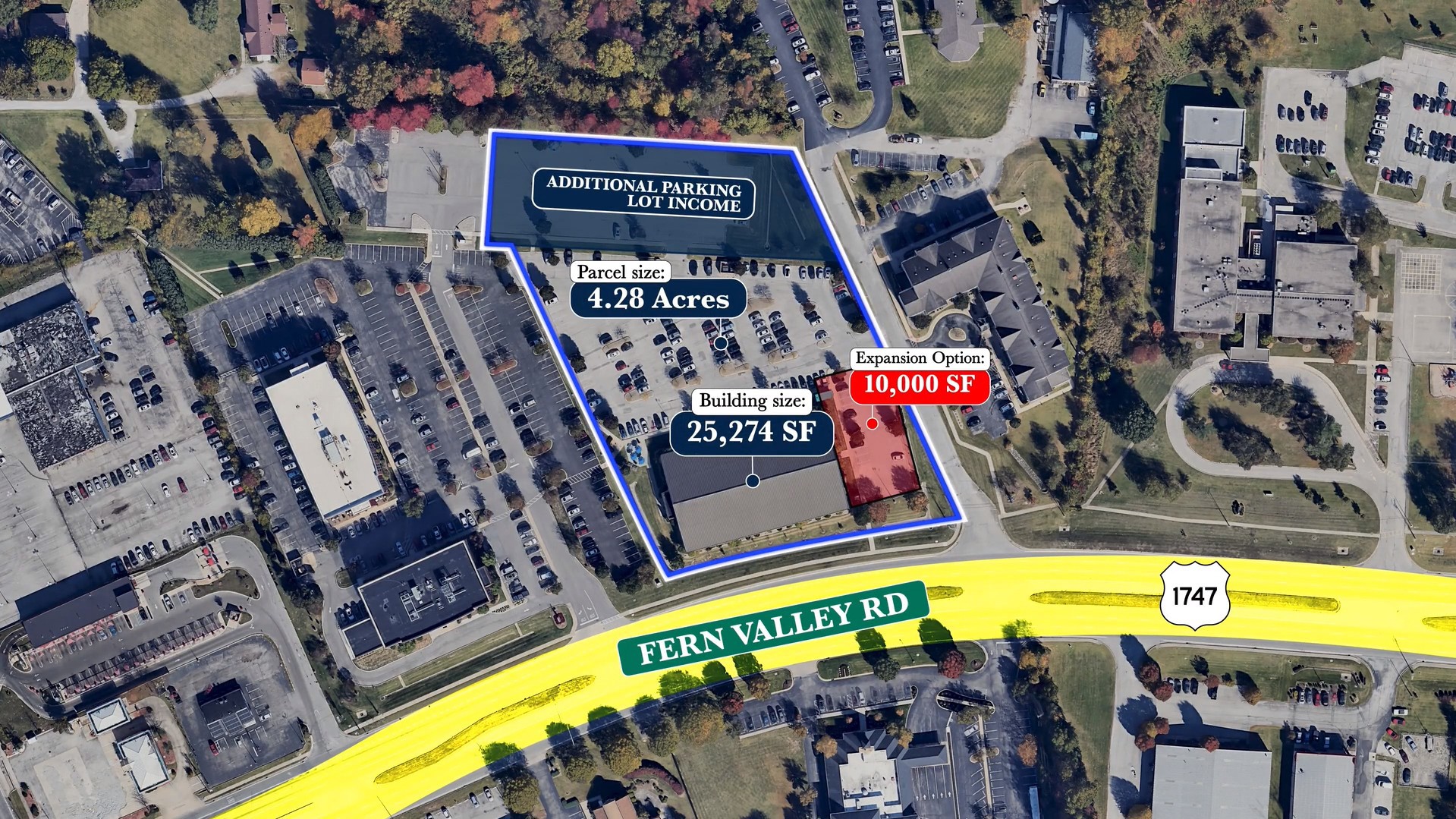

Marcus & Millichap is pleased to present a mission-critical pharmacy script validation, call center, and training facility leased to Chewy, Inc. (NYSE: CHWY) under a corporate-guaranteed lease with approximately 3.25 years remaining on the initial term and two five-year renewal options. The lease features 2.5 percent annual rent escalations and a modified gross structure with utility pass-throughs and expense reimbursements above the 2019 base year.

Located at 3621 Fern Valley Rd, Louisville, Kentucky, this facility serves as Chewy’s national intake and clinical validation hub. It processes almost all physical hard-copy prescriptions mailed by pet owners (excluding gabapentin), performing required clinical outreach and VCPR verification as the regulatory gatekeeper before orders proceed to fulfillment. This critical first step supports Chewy’s highest-margin compounded pharmaceuticals segment, a key driver of its projected $12.3 billion Fiscal Year2025 revenue.

Wall Street Analyst Outlook: Analysts remain overwhelmingly bullish on Chewy, frequently citing high-margin pharmaceuticals and healthcare services as the core driver of expected outperformance. Morgan Stanley named Chewy a “Top Pick” (Summer 2025), highlighting healthcare expansion as a “structural accelerant” with a bull-case target implying up to 70% upside. J.P. Morgan maintained an “Overweight” rating, noting the strategic shift toward higher-margin healthcare revenue. Bank of America reiterated its “Buy” rating, emphasizing the $40 billion pet healthcare market as a major long-term catalyst.

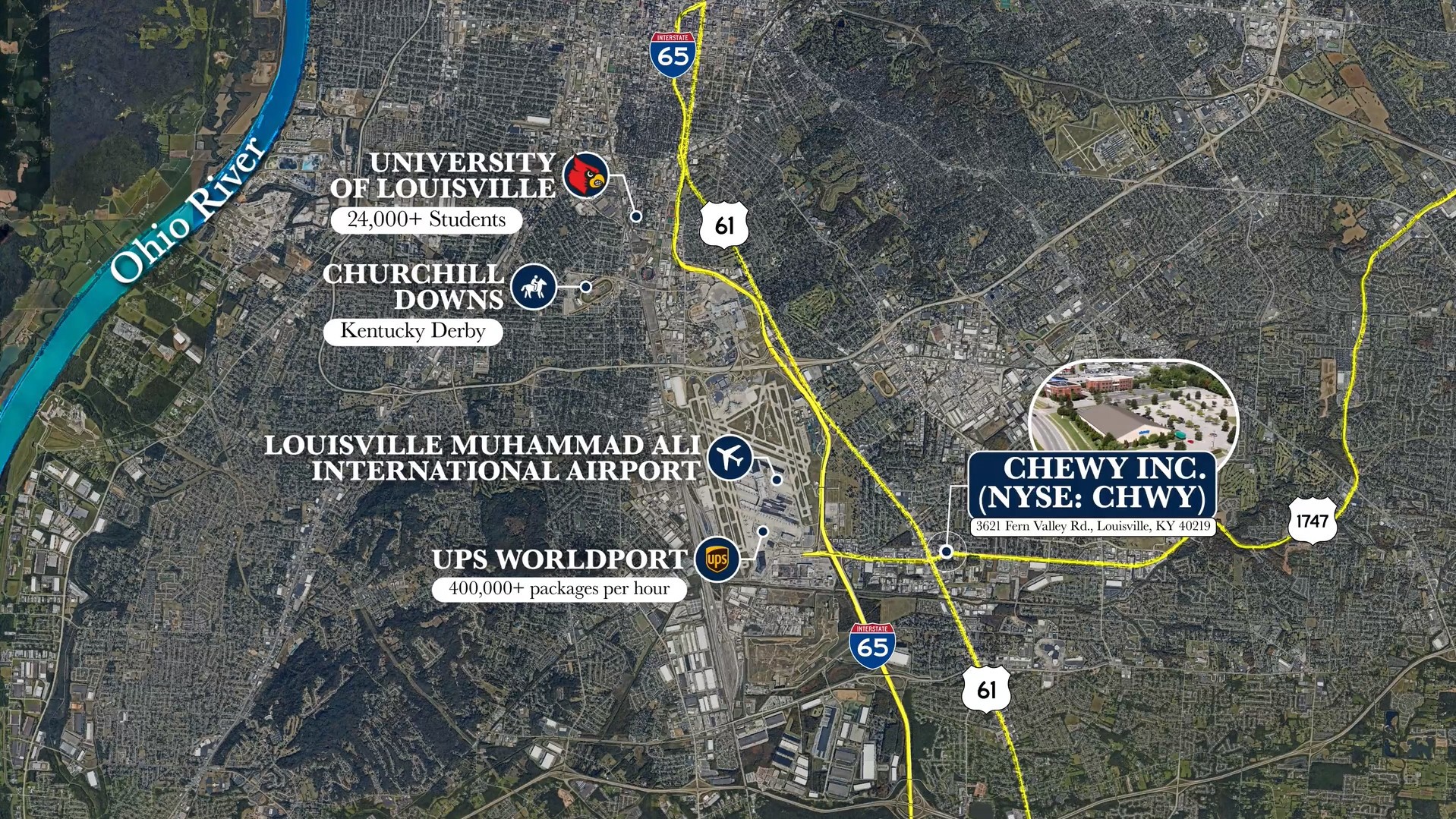

Located near Interstate 65 (200,000 vehicles daily) and a signalized intersection (52,000 vehicles daily) in a densely populated trade area, the property benefits from strong regional access and logistics fundamentals.

Investment Highlights

- Mission-Critical Single-Tenant Office Leased to Chewy, Inc. (NYSE: CHWY) – National Script Validation, Intake, and Training Hub for Pharmacy Operations

- Corporate-Guaranteed Lease with Approximately 3.25 Years Remaining on Initial Term, Two, Five-Year Renewal Options, and 2.5 Percent Annual Rent Escalations

- Modi?ed Gross Structure with Utilities Pass-Through and Expense Reimbursements Above 2019 Base Year, Providing Predictable Landlord Cash Flow

- Processes Nearly All Hard-Copy Mailed Prescriptions (Excluding Gabapentin) – Performs Clinical Outreach and VCPR Veri?cation as Regulatory Gatekeeper for Highest-Margin Compounded Pharmaceuticals

- Supports Chewy's High-Margin Healthcare Segment, Key Driver of $12.3B Fiscal Year 2025 Revenue; Wall Street Bullish (Morgan Stanley Top Pick 70 Percent Upside, J.P. Morgan Overweight, BofA Buy on $40B pet RX Catalyst)

- Strong Location Near I-65 (200,000 Vehicles per Day) and Signalized Intersection (52,000 Vehicles per Day) in Dense Trade Area with Excellent Regional Access and Logistics Fundamentals

Exclusively Listed By

Broker of Record

-

Grant Fitzgerald

Managing Director, Market Leader- Ohio

Single-Tenant Office

Chewy Inc. | National RX Script Validation & Training Center

Listing Price: $6,449,716

Investment Highlights

- Mission-Critical Single-Tenant Office Leased to Chewy, Inc. (NYSE: CHWY) – National Script Validation, Intake, and Training Hub for Pharmacy Operations

- Corporate-Guaranteed Lease with Approximately 3.25 Years Remaining on Initial Term, Two, Five-Year Renewal Options, and 2.5 Percent Annual Rent Escalations

- Modi?ed Gross Structure with Utilities Pass-Through and Expense Reimbursements Above 2019 Base Year, Providing Predictable Landlord Cash Flow

- Processes Nearly All Hard-Copy Mailed Prescriptions (Excluding Gabapentin) – Performs Clinical Outreach and VCPR Veri?cation as Regulatory Gatekeeper for Highest-Margin Compounded Pharmaceuticals

- Supports Chewy's High-Margin Healthcare Segment, Key Driver of $12.3B Fiscal Year 2025 Revenue; Wall Street Bullish (Morgan Stanley Top Pick 70 Percent Upside, J.P. Morgan Overweight, BofA Buy on $40B pet RX Catalyst)

- Strong Location Near I-65 (200,000 Vehicles per Day) and Signalized Intersection (52,000 Vehicles per Day) in Dense Trade Area with Excellent Regional Access and Logistics Fundamentals

Investment Overview

Marcus & Millichap is pleased to present a mission-critical pharmacy script validation, call center, and training facility leased to Chewy, Inc. (NYSE: CHWY) under a corporate-guaranteed lease with approximately 3.25 years remaining on the initial term and two five-year renewal options. The lease features 2.5 percent annual rent escalations and a modified gross structure with utility pass-throughs and expense reimbursements above the 2019 base year. Located at 3621 Fern Valley Rd, Louisville, Kentucky, this facility serves as Chewy’s national intake and clinical validation hub. It processes almost all physical hard-copy prescriptions mailed by pet owners (excluding gabapentin), performing required clinical outreach and VCPR verification as the regulatory gatekeeper before orders proceed to fulfillment. This critical first step supports Chewy’s highest-margin compounded pharmaceuticals segment, a key driver of its projected $12.3 billion Fiscal Year2025 revenue. Wall Street Analyst Outlook: Analysts remain overwhelmingly bullish on Chewy, frequently citing high-margin pharmaceuticals and healthcare services as the core driver of expected outperformance. Morgan Stanley named Chewy a “Top Pick” (Summer 2025), highlighting healthcare expansion as a “structural accelerant” with a bull-case target implying up to 70% upside. J.P. Morgan maintained an “Overweight” rating, noting the strategic shift toward higher-margin healthcare revenue. Bank of America reiterated its “Buy” rating, emphasizing the $40 billion pet healthcare market as a major long-term catalyst. Located near Interstate 65 (200,000 vehicles daily) and a signalized intersection (52,000 vehicles daily) in a densely populated trade area, the property benefits from strong regional access and logistics fundamentals.

Exclusively Listed By

Broker of Record

-

Grant Fitzgerald

Managing Director, Market Leader- Ohio