Warehouse

149 Verona Ave

149 Verona Ave, Newark, NJ 07104

Listing Price: $1,800,000

Investment Overview

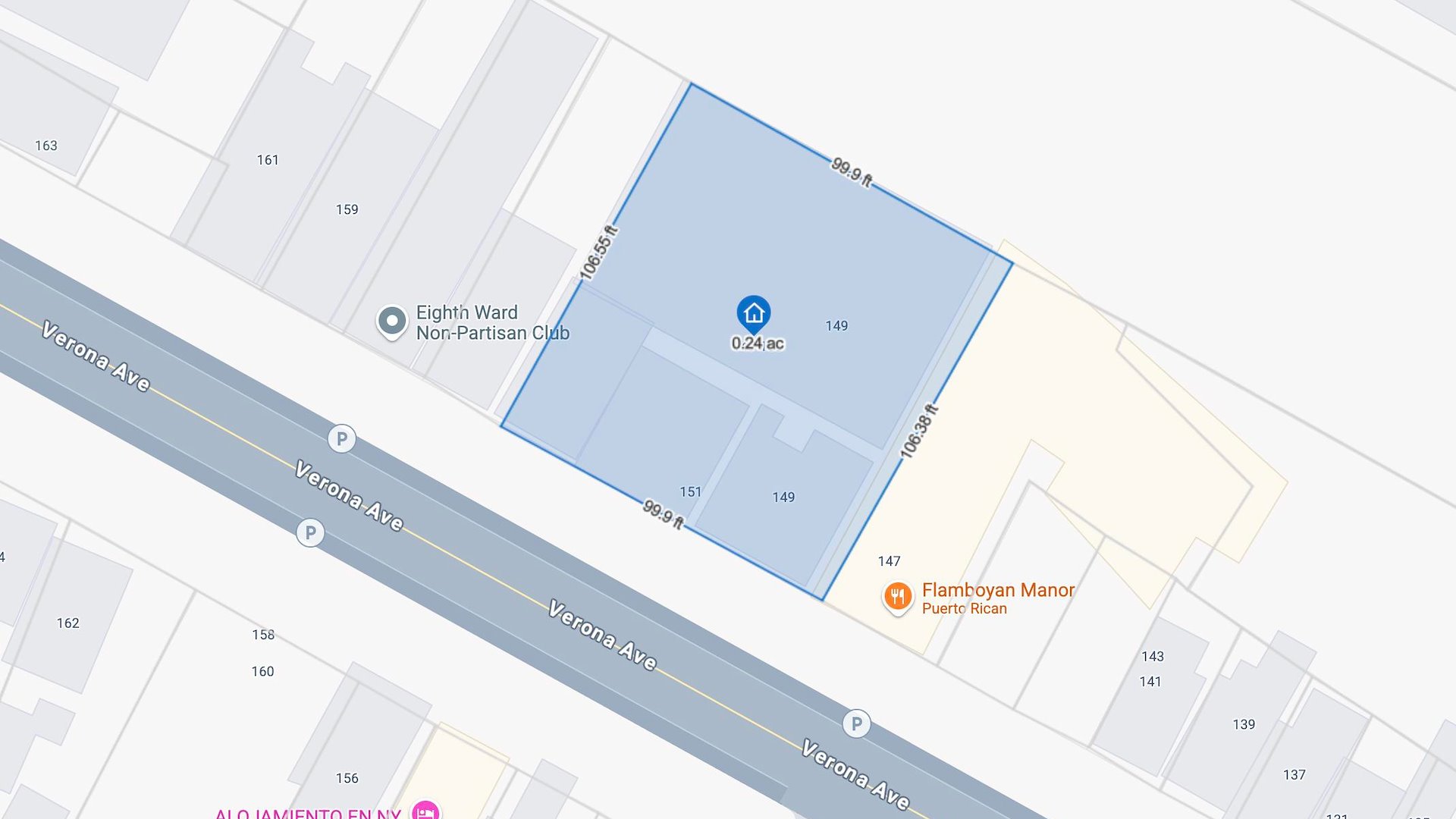

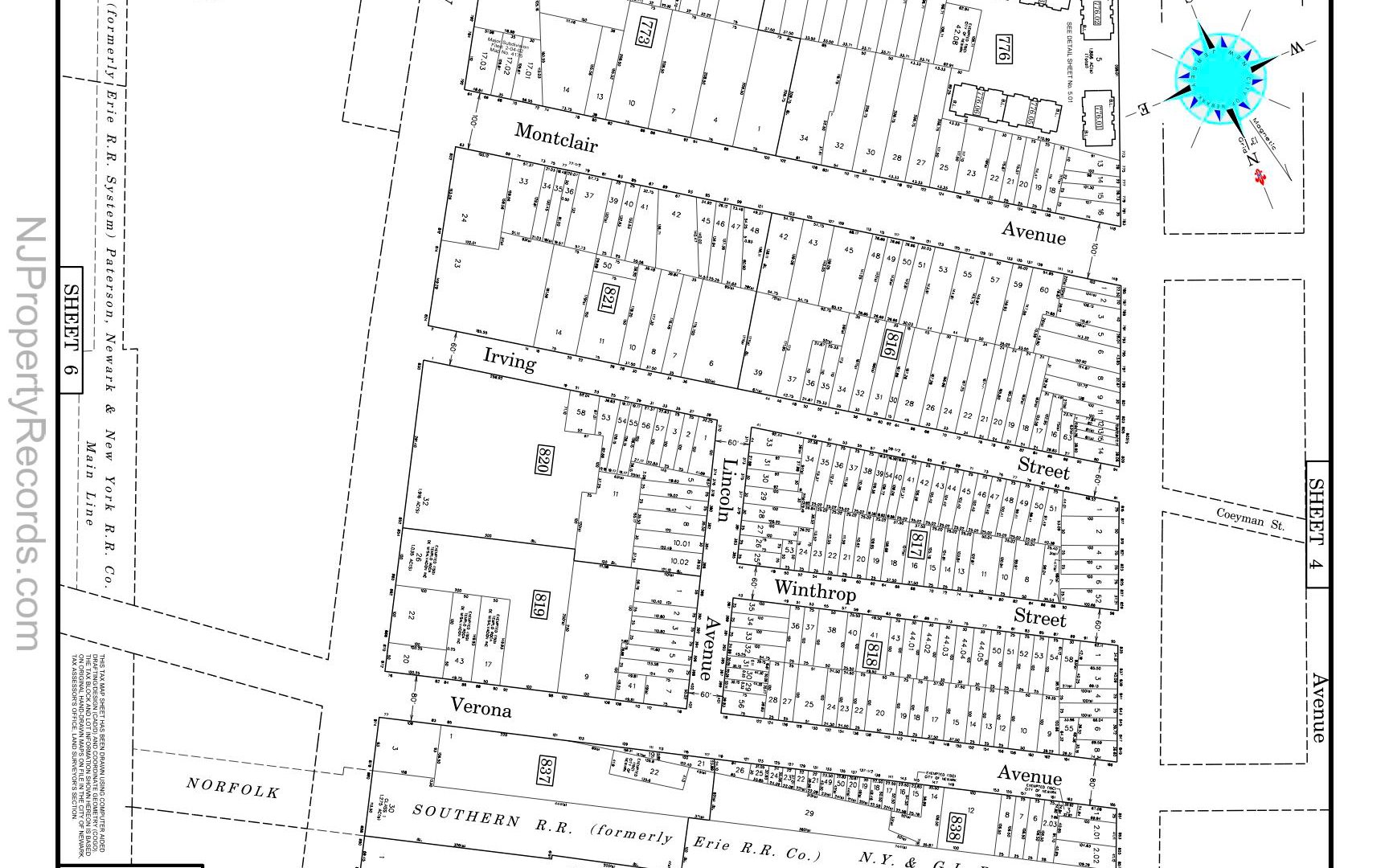

The Geller Group of Marcus & Millichap is pleased to present the exclusive offering of 149 Verona Avenue, a mixed-use asset located in the North Broadway submarket of Newark, New Jersey. The property encompasses approximately 9,500 square feet on a 10,660-square-foot (0.225-acre) lot and is currently 90% occupied, featuring one retail/industrial tenant and two residential apartments.

The retail tenant, US Wholesale Tobacco, occupies the warehouse structure situated along the northern boundary of the property, as well as the garage spaces on the western side. The warehouse features 15-foot clear heights and one drive-in door, and is leased through August 2027, providing stable, in-place income. The residential component consists of two 2-bedroom / 1-bath units located within a two-story, red-brick walk-up building positioned on the eastern portion of the site.

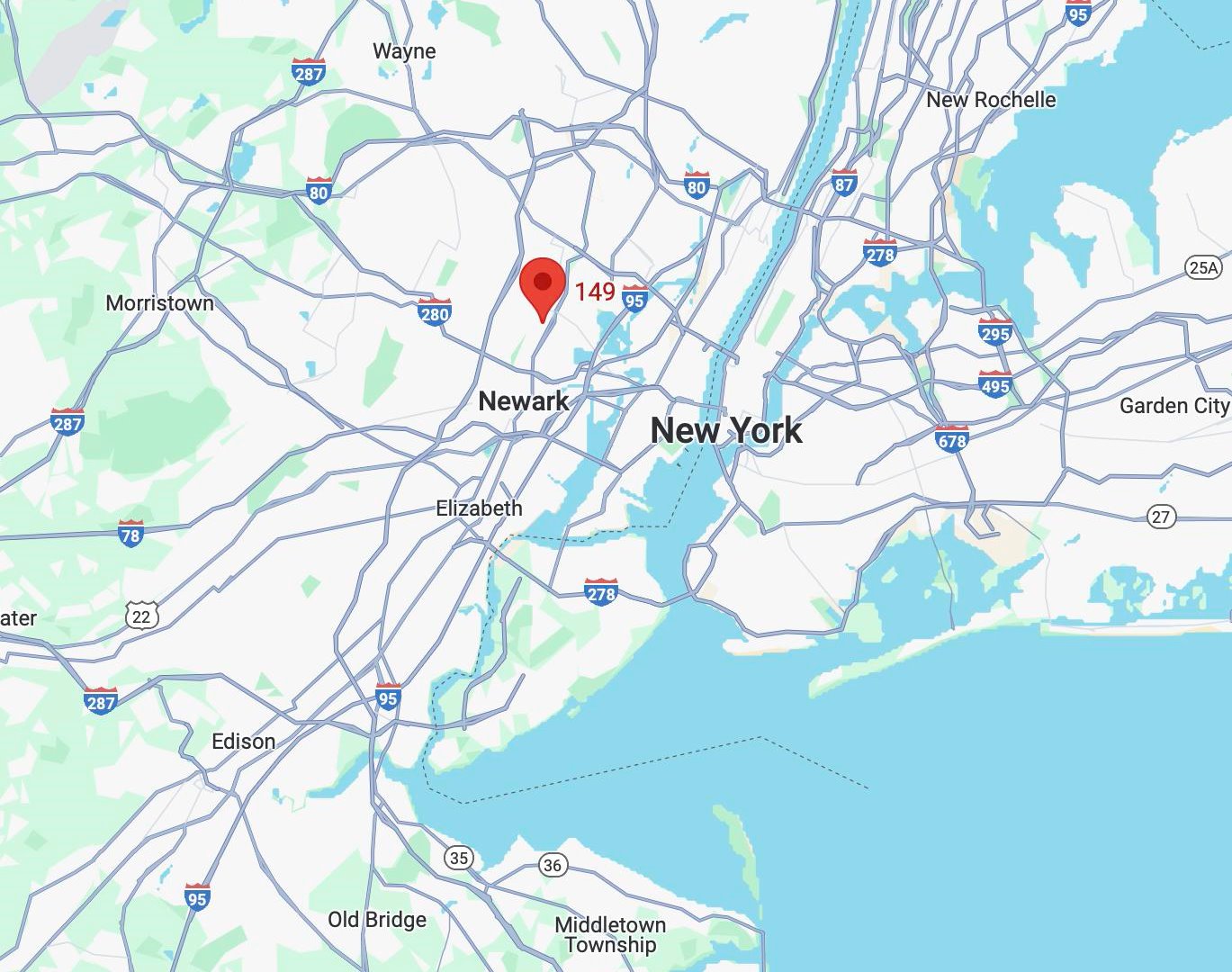

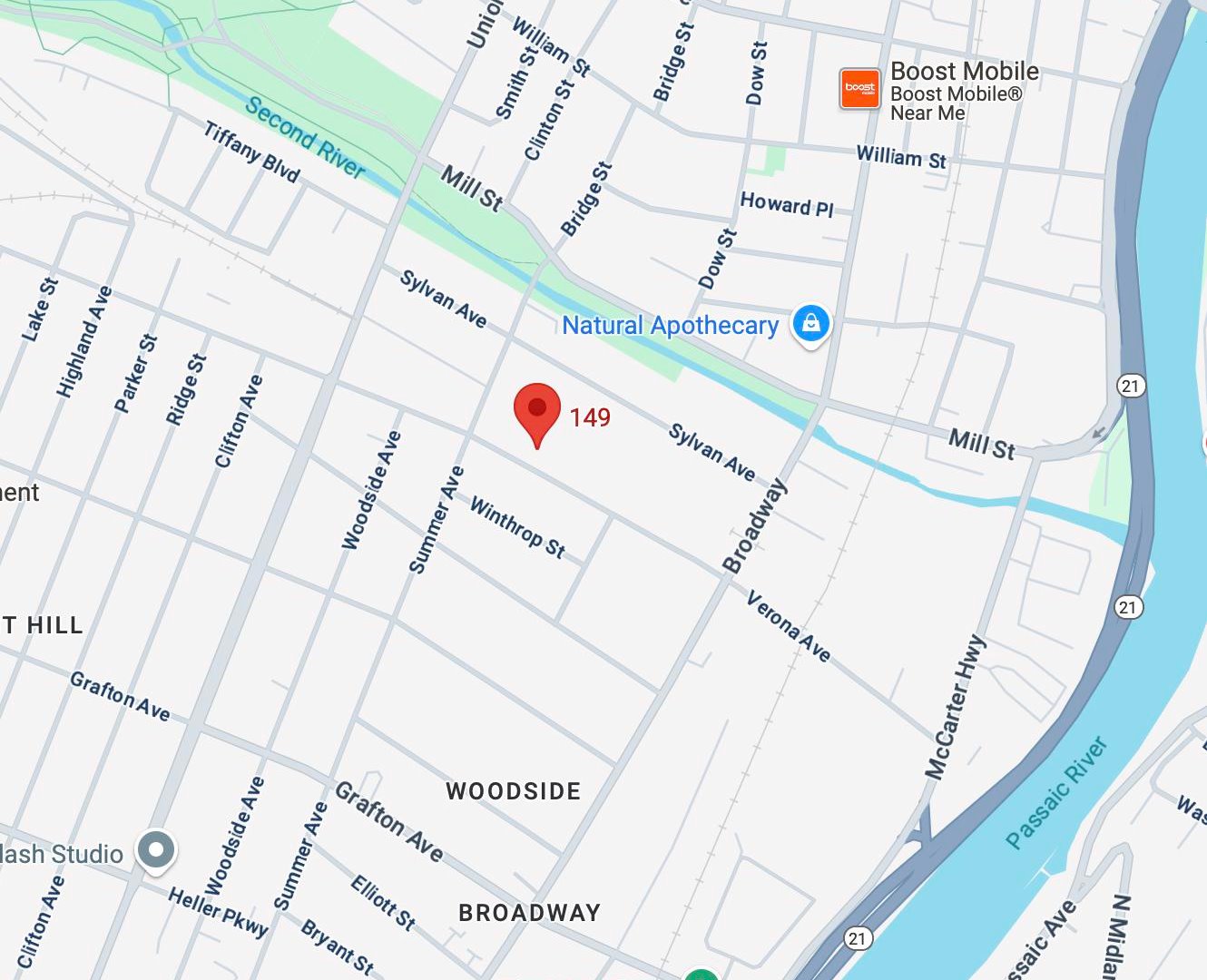

North Broadway is a densely populated, urban neighborhood characterized by a diverse mix of residential, commercial, and light industrial uses. Its rental-heavy housing stock, strong population density, and adjacency to Newark’s riverfront corridor support sustained retail and service demand as well as ongoing mixed-use redevelopment activity. The submarket has demonstrated steady residential rent growth and offers a more affordable alternative to Downtown Newark while benefiting from proximity to major employment centers.

The property boasts a Walk Score of 78 (“Very Walkable”) and a Transit Score of 56 (“Good Transit”), supported by multiple bus routes serving the Broadway & Verona Avenue corridor (including routes 13, 27, 74, 99, and 109). Regional connectivity is further enhanced by immediate access to Route 21, less than five blocks away and convenient proximity to Route 3, I-280, I-95, and the Garden State Parkway.

This investment presents a compelling opportunity to acquire a well-located mixed-use asset anchored by a strong retail tenant with term remaining, complemented by two residential units in a growing Northern Newark submarket. The property is offered at an attractive 7.86% cap rate, with additional upside potential.

Investment Highlights

- -7,500 SF Retail.

- -+/-2,000 SF Multifamily (2 Units).

- -Zoning MX-1 (Mixed-Use, Residnetial/Commercial).

Exclusively Listed By

Listing Price: $1,800,000

Investment Highlights

- -7,500 SF Retail.

- -+/-2,000 SF Multifamily (2 Units).

- -Zoning MX-1 (Mixed-Use, Residnetial/Commercial).

Investment Overview

The Geller Group of Marcus & Millichap is pleased to present the exclusive offering of 149 Verona Avenue, a mixed-use asset located in the North Broadway submarket of Newark, New Jersey. The property encompasses approximately 9,500 square feet on a 10,660-square-foot (0.225-acre) lot and is currently 90% occupied, featuring one retail/industrial tenant and two residential apartments. The retail tenant, US Wholesale Tobacco, occupies the warehouse structure situated along the northern boundary of the property, as well as the garage spaces on the western side. The warehouse features 15-foot clear heights and one drive-in door, and is leased through August 2027, providing stable, in-place income. The residential component consists of two 2-bedroom / 1-bath units located within a two-story, red-brick walk-up building positioned on the eastern portion of the site. North Broadway is a densely populated, urban neighborhood characterized by a diverse mix of residential, commercial, and light industrial uses. Its rental-heavy housing stock, strong population density, and adjacency to Newark’s riverfront corridor support sustained retail and service demand as well as ongoing mixed-use redevelopment activity. The submarket has demonstrated steady residential rent growth and offers a more affordable alternative to Downtown Newark while benefiting from proximity to major employment centers. The property boasts a Walk Score of 78 (“Very Walkable”) and a Transit Score of 56 (“Good Transit”), supported by multiple bus routes serving the Broadway & Verona Avenue corridor (including routes 13, 27, 74, 99, and 109). Regional connectivity is further enhanced by immediate access to Route 21, less than five blocks away and convenient proximity to Route 3, I-280, I-95, and the Garden State Parkway. This investment presents a compelling opportunity to acquire a well-located mixed-use asset anchored by a strong retail tenant with term remaining, complemented by two residential units in a growing Northern Newark submarket. The property is offered at an attractive 7.86% cap rate, with additional upside potential.

Exclusively Listed By