Single-Tenant Office Medical

Wichita Endodontics (S1P: 220 Units) NNN Medical Office Portfolio

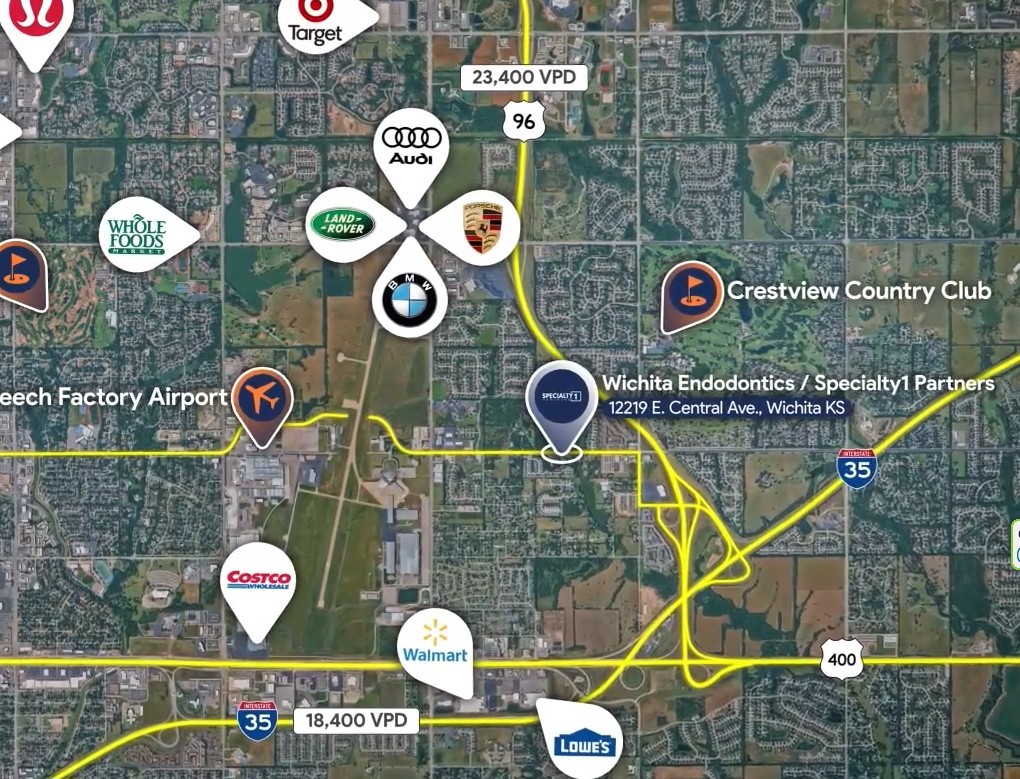

12219 E Central Ave, Wichita, KS 67206

Listing Price: $4,650,000

Investment Overview

Marcus & Millichap is pleased to offer a fully stabilized medical office portfolio located in two of Wichita’s most affluent neighborhoods. The portfolio is exclusively occupied by Wichita Endodontics, the region’s leading endodontic practice with a dominant market position, exceptional patient retention, and a long-standing reputation for advanced specialty care. The practice generates approximately $1.92 million in revenue per doctor and has demonstrated consistent five percent annual EBITDA growth.

The lease is corporately guaranteed by Specialty1 Partners, a top-tier dental support organization with over 220 affiliated practices nationwide. A recent expansion by Specialty1 Partners has consolidated tenancy, resulting in both buildings now structured as single-tenant, triple-net assets, offering investors a streamlined, passive ownership profile. The leases feature full expense reimbursement, three percent annual rent increases, and 10 years of remaining term, providing predictable cash flow and long-term stability.

Located in Wichita—widely recognized as the “Aerospace Capital of the World”—the properties benefit from strong regional employment drivers, highly educated workforces, and affluent surrounding demographics, making this an attractive opportunity for investors seeking secure income with minimal operational complexity.

Investment Highlights

- Wichita Endodontics is the Largest Endodontic Practice in the Wichita Metro | Six Board Certified Endodontists | High Patient Retention, Advanced Clinical Care, and Long-Term Community Presence

- Specialty1 Partners (Guarantor): One of the Nation's Leading Dental Support Organizations (DSOs), Specializing in Surgical Dental Care | Over 220 Practices Across 28 States

- Triple Net Lease Structure: Minimal Landlord Responsibilities | Three Percent Annual Rent Increases Provide Consistent, Built-in Income Growth and a Hedge Against Inflation

- 2021 Capital Improvements: $600,000 Invested per Building | State-of-the-art Endodontic Equipment, Surgical Operating Microscopes, and Modernized Interiors | Medical-grade

- One-Mile Average Household Income of $146,876 (East) and $118,281 (West) | Located in Wichita's Most Desirable Medical and Professional Corridors

Exclusively Listed By

Single-Tenant Office Medical

Wichita Endodontics (S1P: 220 Units) NNN Medical Office Portfolio

Listing Price: $4,650,000

Investment Highlights

- Wichita Endodontics is the Largest Endodontic Practice in the Wichita Metro | Six Board Certified Endodontists | High Patient Retention, Advanced Clinical Care, and Long-Term Community Presence

- Specialty1 Partners (Guarantor): One of the Nation's Leading Dental Support Organizations (DSOs), Specializing in Surgical Dental Care | Over 220 Practices Across 28 States

- Triple Net Lease Structure: Minimal Landlord Responsibilities | Three Percent Annual Rent Increases Provide Consistent, Built-in Income Growth and a Hedge Against Inflation

- 2021 Capital Improvements: $600,000 Invested per Building | State-of-the-art Endodontic Equipment, Surgical Operating Microscopes, and Modernized Interiors | Medical-grade

- One-Mile Average Household Income of $146,876 (East) and $118,281 (West) | Located in Wichita's Most Desirable Medical and Professional Corridors

Investment Overview

Marcus & Millichap is pleased to offer a fully stabilized medical office portfolio located in two of Wichita’s most affluent neighborhoods. The portfolio is exclusively occupied by Wichita Endodontics, the region’s leading endodontic practice with a dominant market position, exceptional patient retention, and a long-standing reputation for advanced specialty care. The practice generates approximately $1.92 million in revenue per doctor and has demonstrated consistent five percent annual EBITDA growth. The lease is corporately guaranteed by Specialty1 Partners, a top-tier dental support organization with over 220 affiliated practices nationwide. A recent expansion by Specialty1 Partners has consolidated tenancy, resulting in both buildings now structured as single-tenant, triple-net assets, offering investors a streamlined, passive ownership profile. The leases feature full expense reimbursement, three percent annual rent increases, and 10 years of remaining term, providing predictable cash flow and long-term stability. Located in Wichita—widely recognized as the “Aerospace Capital of the World”—the properties benefit from strong regional employment drivers, highly educated workforces, and affluent surrounding demographics, making this an attractive opportunity for investors seeking secure income with minimal operational complexity.

Exclusively Listed By