Ontario, California

Commercial Real Estate in Inland Empire

Contact Our Office

3281 East Guasti Road, Suite 800

Ontario, CA 91761

Get Directions

Connect With Our Team

In 1971, Marcus & Millichap was founded on a unique set of principles to maximize value for real estate investors and, in the process, revolutionized the brokerage industry.

The Inland Empire Office

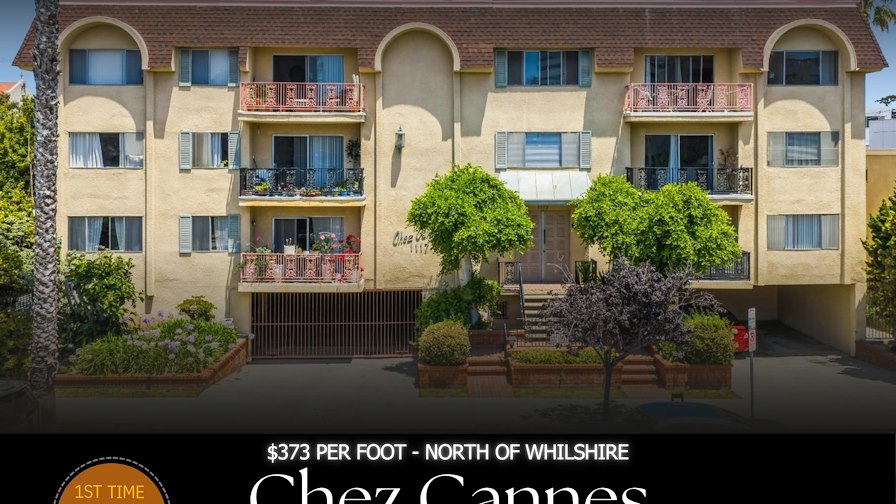

The Ontario office of Marcus & Millichap serves commercial real estate investors throughout the Inland Empire and broader Western U.S. with investment sales and financing services. Ontario commercial real estate agents assist in the acquisition and disposition of a wide range of assets, including healthcare, hospitality, multifamily, office, and industrial properties. Backed by the firm’s national reach and market research, the team offers strategic support and visibility for real estate properties for sale. Marcus & Millichap Capital Corporation loan originators are available for commercial real estate financing.

Press Releases

Marcus & Millichap Establishes Hawaii Market Presence with Honolulu Office and Veteran Investment Sales and Leasing Team

Marcus & Millichap has established its Honolulu office, the firm’s first location in Hawaii, staffed by two veteran commercial real estate investment advisors, Trent Thoms and Alexander Kidani.

February 23, 2026

Press Releases

Marcus & Millichap Announces New Regional Leadership Titles Across the U.S. and Canada

Marcus & Millichap announced that effective Jan. 1, 2026, the firm transitioned its regional management position titles to market leader titles of Director, Managing Director and Senior Managing Director based on tenure and level of accomplishment.