Research Brief

Canada Employment

September 2025

Weakening Job Market Poses Risks but

Signals Friendly Lending Environment

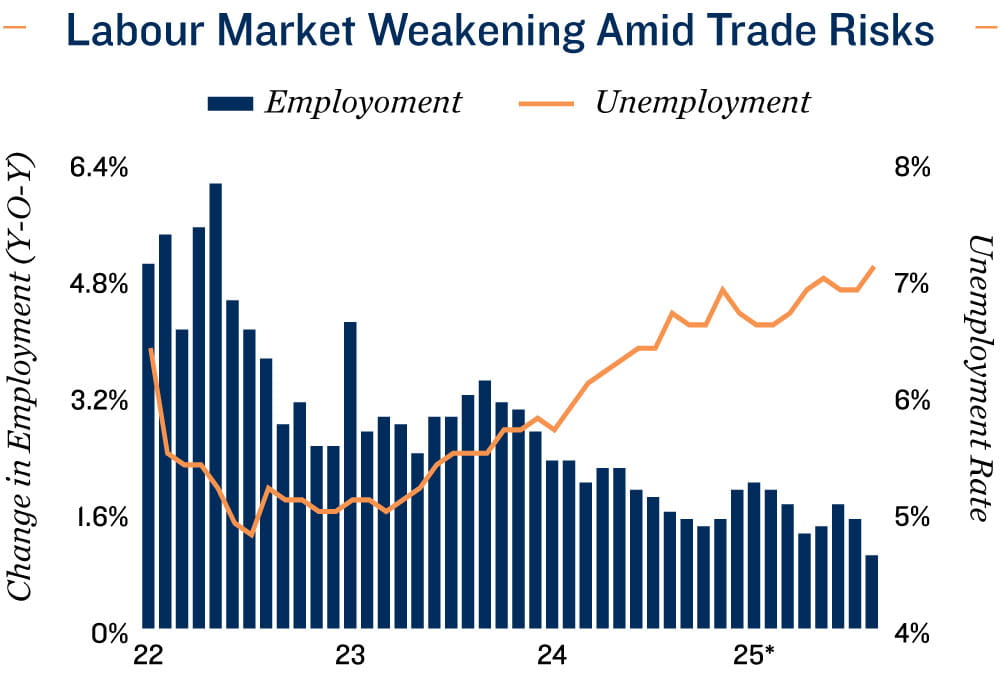

Labour market under pressure. Canada’s job market is showing clear signs of strain as tariff uncertainty weighs on the economy. In August, employment fell by 66,500 jobs following July’s decline of 40,800 – the steepest monthly drops since early 2022. Year-to-date job gains have been pared back to just 36,500, while the six-month average has slipped into negative territory at -6,000. Losses were widespread, spanning the private, public and self-employed sectors, underscoring how trade frictions are dragging on activity. Even with the labour force shrinking by 31,200 job seekers, the jobless rate still edged up 20 basis points to 7.1 per cent – the highest since August 2021. The only sliver of good news was a 0.1 per cent uptick in hours worked, though the modest increase merely reinforces the picture of an economy struggling to generate momentum in the third quarter.

Further rate cuts increasingly likely. Canada’s economic backdrop continues to weaken. Second-quarter GDP contracted at a 1.6 per cent annualized pace on the back of falling exports and subdued business investment. August’s labour report reinforced the slowdown, showing broad-based job losses were tied to protectionist U.S. trade measures. On the inflation front, the federal government’s removal of most retaliatory tariffs on American imports will ease upwards price pressures. Meanwhile, the U.S. Federal Reserve has signaled a renewed shift towards easing in response to softer conditions south of the border. Against this backdrop, money markets are now assigning a roughly 90 per cent probability of a September rate cut. Terminal rate expectations also moved lower to the 2.0 per cent to 2.25 per cent range.

Commercial Real Estate Outlook

More supportive lending conditions could bolster CRE sales. Signs of additional easing from the Bank of Canada – along with the United States’ weaker-than-expected August jobs report that all but ensures further Federal Reserve cuts – are setting the stage for downwards pressure on bond yields. For Canada, the combination of easing inflation risks, following the removal of retaliatory tariffs, and close alignment with U.S. markets suggests lending benchmarks may also soften. This shift would provide a tailwind for CRE investment sales,

which have already demonstrated resilience through the first half of 2025. That said, sector-specific tariffs still pose inflationary risks, while trade-related bailouts and higher defense spending could push government deficits wider, limiting the extent of yield compression in Canada. Nevertheless, the nation’s capital markets are still relatively stable – a backdrop that should support price discovery and possibly drive an uptick in CRE transactions over the coming quarters.

Labour data underscores industrial risks. Trade-exposed industries remain under pressure. Manufacturing, as well as transportation and warehousing, shed a combined 42,000 jobs in August. Industrial fundamentals – which had shown signs of stabilizing late last year as lower interest rates spurred momentum – have since softened again, reflected in rising vacancy through the second and third quarters. Vacancy is expected to edge up to around 4.0 per cent by year-end, though a tapering construction pipeline offers potential for stabilization in 2026, particularly if trade conditions become clearer.

* Through August ** Through 2Q

v Sales $1 million or greater for multifamily, retail, office, industrial, and hotels

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Capital Economics; CoStar

Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE