Research Brief

Canada Industrial

August 2025

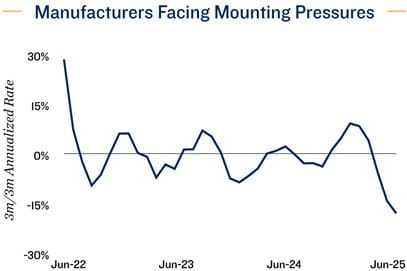

Rising U.S. Tariffs to Extend Strain on Manufacturing Sector

Headline improvement masks weakness beneath. Driven by a significant rise in sales of petroleum and coal products, as well as food products, total manufacturing sales edged up 0.3 per cent month over month in June, ending a string of declines since February. Yet this gain did little to improve the sequential weakness, as the three month-over-three-month annualized rate fell to 18 per cent. The latest manufacturing survey shows that producers continued to feel the negative impact of higher U.S. tariffs, which disproportionately hit sales of primary metals, machinery, fabricated metals and transportation equipment. As Canada’s manufacturing hub, Ontario saw the largest tariff-related sales decline relative to other provinces.

Higher tariffs keep the manufacturing sector under strain. As trade negotiations with the United States appear to have stalled, coupled with the U.S. increasing tariffs on non-USMCA-compliant Canadian exports to 35 per cent in early August, manufacturing sales are likely to remain subdued through the summer. In the second quarter, total sales recorded their steepest quarterly drop since mid-2020. If trade talks do not progress, this weakness could extend well into the third quarter, weighing on overall economic growth. Because inflation is expected to stay broadly within the Bank of Canada’s target range, weaker activity should keep the central bank in an accommodative stance in the near term. As such, the overnight rate is forecast to end 2025 in the 2.25 per cent to 2.50 per cent range.

Tariffs threaten to deepen industrial sector softness. The increase in tariffs since early August will undoubtedly add more pressure on Canada’s industrial sector. Higher input costs and weaker export demand are likely to further curb production in key industries such as machinery, fabricated metals and transportation equipment. This will continue to weigh on leasing activity in warehousing and logistics facilities, as slower trade flows reduce the need for additional capacity. Given the sector’s close integration with cross-border supply chains, prolonged trade frictions risk deepening the recent softness in manufacturing, delaying any meaningful recovery in space demand and pushing vacancy rates higher than initially expected.

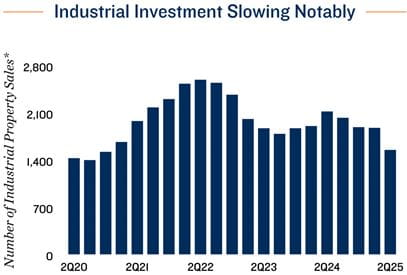

Investor caution limits transaction volumes. Because investor confidence was dampened by trade risks, investment activity in the industrial sector slowed notably in the second quarter. On a trailing 12-month basis, the total number of sales fell to its lowest level since the final quarter of 2020. Elevated uncertainty around trade policy, combined with weaker leasing momentum, has prompted many investors to adopt a wait-and-see approach. Financing conditions, while more supportive after the BoC’s rate reductions, have not been enough to offset the caution stemming from deteriorating demand fundamentals. Unless there is meaningful progress in trade negotiations or a clear stabilization in occupier demand, transaction volumes could remain muted through the second half of the year.

* Trailing 12-month total

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Statistics Canada

TO READ THE FULL ARTICLE