Research Brief

Canada Monetary Policy

July 2025

More Stable Lending Environment May Drive a

Gradual Recovery in CRE Sales

Central bank holds for third consecutive meeting. In a widely expected move, the Bank of Canada maintained its key policy interest rate at 2.75 per cent, marking the third straight hold. This comes after the monetary authority began lowering its overnight rate from 5.0 per cent just over a year ago. One of the main reasons for this pause was lingering uncertainties stemming from protectionist U.S. trade, as well as the corresponding impacts from supply chain disruptions and retaliatory tariffs on inflation. Additionally, Canada’s economy has shown some resilience. First-quarter GDP growth was stronger than expected, the labour market has not collapsed and household spending is holding up, despite falling consumer confidence. Combined, mounting inflationary pressures have formed, which on top of tariff uncertainties, reinforced the Bank’s decision to hold.

Bank signals more rate cuts could happen. Given some resilience in Canada’s economy and ongoing trade negotiations, a pause was widely priced in by investors. Even so, money markets are still expecting one more rate cut by year-end. The Bank of Canada seems to be growing more concerned about slower economic growth and is now penciling in a 1.5 per cent GDP contraction in the second quarter. Meanwhile, the monetary authority cited that if a weakening economy puts further downwards pressure on inflation and the upwards pressure on prices from trade disruptions are also contained, a further rate reduction may be needed. As such, major banks and forecasters still call for more cuts. Terminal rates range from 2.25 per cent to 2.50 per cent.

Commercial Real Estate Outlook

More stability in lending market. There is a growing consensus forming that the Bank of Canada is nearing the end of its easing cycle, due to economic resilience and lingering inflation pressures. As this occurs, longer-term bond yields may begin to feel more upwards pressure, as greater planned government deficits will be financed through debt. As commercial mortgages are mainly priced around longer-term money, the current environment may present a favourable time for opportunistic investors to re-enter the market. Debt capital is available for better-performing property types such as apartment rentals and essential-based retail, as well as some industrial build-types. With bond yields currently showing some stabilization and bid-ask spreads narrowing, a recovery in commercial real estate investment could materialize, albeit at a more gradual pace than expected at the start of the year amid ongoing trade uncertainties.

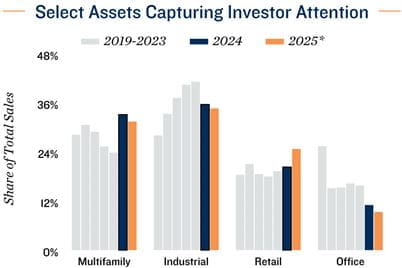

Sales holding up. Commercial real estate transactions bottomed in the third quarter of 2024. Bond yields then began to stabilize and in some cases come down, while Canada’s economy also gained momentum. Combined with prices recalibrating, sales activity has been picking up. Tariff uncertainties stalled this recovery in the early parts of 2025, yet with the total number of sales ticking up slightly in the second quarter, it appears a more gradual rebound could still materialize. With commercial real estate generally offering stability, along with a less restrictive lending environment and more favourable pricing, some confidence may be returning to the sector. Essential-retail, apartments and industrial continue to generate positive sentiment.

* Through 2Q; ** Sales valued above $1 million for multifamily, office, industrial, retail and hotels

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Capital Economics; CoStar

Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE