Research Brief

Canada Retail Sales

May 2025

Retail Sales Hold Despite Dwindling Confidence,

Implications for Industrial and Retail Sectors

Consumers could be front-loading. There was a 0.8 per cent monthly rebound in retail sales in March. As tariffs were set to take effect in April, some consumers may have been looking to get ahead of potential levies. Highlighting this was the 5.2 per cent jump in new motor vehicle sales – a sector highly exposed to trade uncertainties – rising despite the recent plunge in consumer confidence. Sales would have been much stronger were it not for the 6.5 per cent drop in gasoline sales, which was mainly due to lower prices. That said, spending held up, even amid uncertainties, and was also broad-based. Retail sales rose in six of the nine sub-sectors, and core retail sales jumped 0.2 per cent in March – the second consecutive monthly rise.

Bank of Canada has a lot to consider. Strong retail sales in March – up 5.5 per cent year over year – have led to estimates now pointing to 1.6 per cent annualized growth in first quarter GDP. Additionally, preliminary estimates suggest a 0.5 per cent increase in April retail sales. This lends support to the idea that Canada’s economy will slow sharply rather than contract in the second quarter, as strength in domestic demand may offset external weakness from trade uncertainties. While positive news for the nation, this makes the Bank of Canada’s job harder and could prevent them from resuming their monetary easing cycle in June. Nevertheless, economic risks remain amid slowing population growth, mortgage renewals at higher rates and weakening labour market conditions. As such, a June rate cut remains possible.

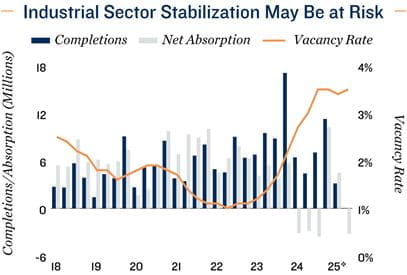

Industrial a sector to monitor. After 2.5 years of softening fundamentals, Canada’s industrial sector began to stabilize late last year. In the first quarter of 2025, the nation’s vacancy rate actually fell 10 basis points to 3.4 per cent, marking the first quarterly drop since mid2022. Declining interest rates caused Canada’s economy to gain momentum, which in turn drove healthy absorption levels over the past two quarters. Yet despite growing momentum, Canada’s industrial sector is still the most exposed to ongoing tariff uncertainties. Preliminary estimates for the second quarter indicate negative net absorption and vacancy returning to a rising trajectory, as both business and consumer confidence has plunged. Manufacturing activity showed weakness to start the year due to this same reason, while e-commerce sales have also fallen for three consecutive months as of March. All of this points to softening space demand, suggesting further rebalancing in Canada’s industrial sector amid ongoing trade risks. Consequently, vacancy is forecast to rise to the 4.0 per cent range

March retail sales a boon for property sector. Canada’s retail property sector has shown resilience in recent years. The nation’s vacancy rate sits around 2.0 per cent. Investors have heavily favoured grocery-anchored neighbourhood centres, as the format largely hosts tenants that offer essential-based goods and services, which fair better in times of uncertainty. With retail sales increasing across most subsectors in March, however, it also indicates that there could be ongoing space demand for other retail formats, including single-tenant, strip and, in some cases, well-located malls.

* Through 1Q; ** Forecast provided by Capital Economics; v Preliminary estimates through 2Q

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Capital Economics; CoStar

Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE