Research Brief

Canada Retail Sales

April 2025

Sharp Drop in Consumer Confidence Not Yet

Pulling Through Into Household Spending

Retail sales take anticipated step back after recent events. February was marked by U.S. tariff announcements and retaliatory measures, their subsequent pauses, and the resulting drop in consumer confidence. As such, the 0.4 per cent monthly fall in retail sales values and volumes should not come as a surprise; that said, severe weather – rather than a slump in confidence – appears to be the main contributor to February’s decline. Preliminary estimates for March suggest retail sales rose 0.7 per cent, which would translate into a more than 1.0 per cent jump in total sales volumes. The Bank of Canada’s first quarter business outlook survey also suggests that firms’ future sales expectations are holding up. Meanwhile, households have yet to significantly increase precautionary savings, indicating that other factors were influencing the February drop in consumer spending.

Recession could be avoided. With future sales expectations holding and the latest flash estimate for March implying that retail sales volumes saw a healthy rebound, the strong handover to the second quarter suggests GDP growth could slow rather than collapse in the face of U.S. tariffs. On aggregate, this can be taken as a positive for Canada’s economy. There were a wide range of possible outcomes that could have materialized, such as a 25 per cent blanket tariff on all goods. Some risks do remain, however. Consumer and business confidence has nosedived in recent months, likely resulting in a weakening labour market and only marginal economic growth throughout 2025.

Commercial Real Estate Outlook

February sales support ongoing retail property trend. The 0.4 per cent monthly fall in retail sales was mainly fuelled by a pullback in discretionary sectors. Motor vehicle and parts sales fell 2.6 per cent monthly. Furniture, electronics and appliance receipts saw a 2.9 per cent drop, clothing sales fell by 2.7 per cent, and spending on building material and garden equipment declined by 2.8 per cent. In contrast, more essential-based categories, such as food and beverage store sales, jumped 2.8 per cent. Health and personal care also saw a 0.6 per cent increase. This greater focus on essentials has been playing out over the past year. Elevated interest rates, heightened costs and more recent labour market risks continued to redirect consumer spending towards non-discretionary goods and services. As a result, retail spaces, especially grocery-anchored centers, have maintained their status as a preferred investment option. Not only do these property types offer higher cap rates and stable in-place cash flow, but they also provide future redevelopment and/or intensification potential.

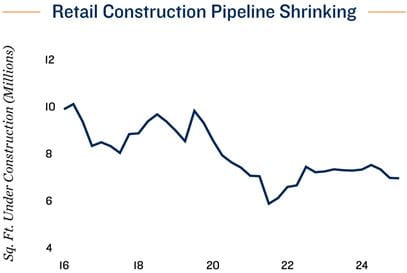

Limited supply pressures also aid retail sector. Historic population growth over the past two years has in part driven consumer spending and retail property performance. Retail sales were up 5.0 per cent as of February when compared with the start of 2023. At the same time, retail property supply growth has been minimal. The threat of e-commerce, the global health crisis and elevated construction costs hindering project feasibility have caused the retail construction pipeline to trend down over the past decade. These limited supply pressures are helping maintain a sub-2.0 per cent vacancy rate.

* BOS future sales indicator through 1Q

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Canada Mortgage and

Housing Corporation; Capital Economics; CoStar Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE