Research Brief

Canada Inflation

February 2024

Investor Confidence to Grow as Canada

Inflation Beats Expectations

Inflation returns to target range. Canada’s annual inflation hit 2.9 per cent in January, down from a 3.4 per cent measure in December and below market expectations of a 3.3 per cent reading. This deceleration was largely due to lower energy prices, which fell 2.7 per cent. With the most volatile components of CPI stripped out, the Bank of Canada’s preferred measure of core inflation — CPI-trim and CPI-median — also slowed, as clothing and recreation prices dropped. CPI-trim decelerated to 3.4 per cent from 3.7 per cent, while CPI-median eased to 3.3 per cent from 3.5 per cent. Overall, January’s inflation print was a positive shift in the right direction for commercial real estate investors, but the Bank of Canada will need to see this trend continue as a healthy labour market and still-elevated core measures provide further inflationary risks. Despite this, the BoC is still expected to lower the overnight rate by mid-2024.

Mid-year rate cut still the likely outcome. January’s better-than-expected inflation reading caused financial markets to pull forward their expectations on the first rate cut. With inflation now back in the BoC’s target range, along with further downward pressure on core inflation, markets now estimate a roughly 50 per cent chance of the first cut in April and a 70 per cent chance it happens in June. This comes after January’s strong jobs report earlier this month, which saw the unemployment rate post its first decline since December 2022. Money markets then pushed back their view and estimated June or July to be the most likely timing. Nonetheless, it is becoming increasingly likely that rates will trend down over the latter half of 2024, providing optimism for CRE investors.

Commercial Real Estate Outlook

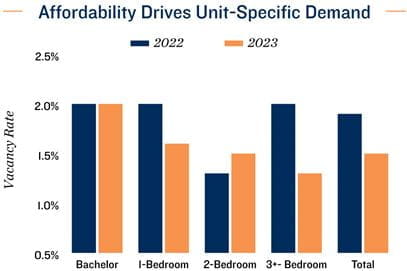

Multifamily sector seeing healthy demand. With inflation peaking at 8.1 per cent in June 2022, the Bank of Canada was forced to undertake one of its most rapid tightening cycles in the nation’s history. Over the past two years, the central bank increased its overnight rate 475 basis points, bringing it to 5.0 per cent. Due to this, homeownership has become out of reach for many Canadians, which has redirected demand toward the apartment rental sector. Coupled with historic population growth, the nation’s vacancy rate hit an all-time low of 1.5 per cent in 2023, helping annual rent growth reach a record level of 8.4 per cent. This combination of homeownership barriers and record multifamily performance has created affordability hurdles across the nation. As a result, smaller units with lower rents, along with larger units that can accommodate families priced out of the ownership market, saw the largest vacancy drops in 2023.

Investment activity to gain momentum. Given the central bank’s rapid tightening cycle, total dollar volume transacted across Canada’s major commercial property types fell roughly 25 per cent annually in 2023. Not only did financing capital become limited, but price expectation gaps between many buyers and sellers emerged. However, with the policy rate holding stable since July 2023 and underlying inflationary pressures continuing to ease, bond yields have been trending down. Consequently, CRE transaction activity has gained momentum. On a quarterly basis, total dollar volume edged up 5.0 per cent in the final three months of last year, which translated into a year-over-year gain of 10 per cent. As borrowing costs are set to fall over the second half of the year, this trend is likely to continue.

Sources: Marcus & Millichap Research Services; Altus Data Solutions; Bank of Canada; Canada Mortgage and Housing Corporation;

Capital Economics; CoStar Group, Inc.; Statistics Canada

TO READ THE FULL ARTICLE