Research Brief

Canada Housing

February 2024

Canada’s Housing Market Correction is Nearing its

End as Sales Activity is Warming Up

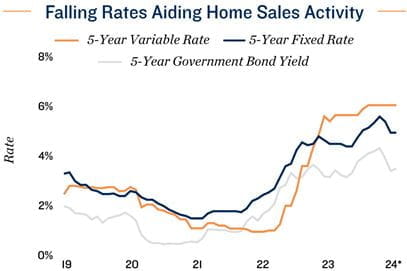

Housing market gaining some momentum. Canada’s housing market has experienced a significant correction over the past two years as the Central Bank undertook one of the most rapid tightening cycles in the nation’s history. When compared to the February 2022 peak, the median price of a single-family home has dropped roughly 16 per cent as of January of this year. However, with bond yields largely trending down since November 2023, fixed-rate mortgages have also shown modest drops. As a result, home sales over the last two months have begun to show signs of recovery. In January, national sales were up 3.7 per cent monthly, which followed the 8.7 per cent monthly surge in December. Despite this, the median price of a single-family home continued to trend down, falling 1.2 per cent month over month in January. Home prices, however, could stabilize in the coming months, with potential gains beginning to materialize over the second half of the year.

Home prices could be nearing inflection point. Despite the median price of a single-family home continuing to trend down on a monthly basis, early indicators suggest that these modest price corrections could be nearing an end. While new listings did edge up 1.5 per cent in January, the 3.7 per cent increase in home sales caused the sales-to-new-listings ratio to increase to 58.8 per cent. This is just slightly below a sellers’ market, which is indicated by a ratio above 60 per cent. Combined with limited housing supply and the expectation that the Bank of Canada will likely begin cutting its overnight rate by midyear, price growth could gain momentum over the latter half of 2024 as some potential buyers return from the sidelines.

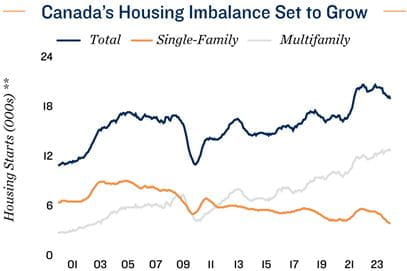

Commercial Real Estate Outlook

Further housing supply is needed. Rising interest rates over the past two years have caused new home starts to decline, which will likely continue in the short term as the value of building permits issued — an indicator of future development — has been trending down since mid-2023. Softening home prices, weaker new home sales and elevated construction costs are all contributing to this decline. Combined with Canada’s population growing at a record-setting pace of 3.2 per cent annually as of the start of the fourth quarter of last year, Canada’s housing supply-demand imbalance is set to grow. Consequently, additional supply is needed as this market imbalance is likely to create further affordability hurdles within Canada’s housing market. This is especially true for purpose-built rental apartments, as these properties offer a lower-cost housing option in the current environment of high homeownership barriers.

Multifamily performance remains robust. Canada’s apartment rental sector saw another year of healthy performance in 2023. The nation’s vacancy rate reached an all-time low of 1.5 per cent, which helped annual rent growth hit a record level of 8.4 per cent. Given these sound fundamentals in recent years, combined with historic population growth and government financing programs — which have improved the feasibility of new projects — development has increased significantly. However, despite supply growing at a healthy rate, vacancy is at an all-time low as demand continues to outpace supply. Consequently, further government initiatives are needed in order to alleviate supply-side pressures and restore housing affordability across the nation.

* Through January; ** Trailing-12-month average

Sources: Marcus & Millichap Research Services; Bank of Canada; Canada Mortgage and Housing Corporation;

Capital Economics; CoStar Group, Inc.; Ratehub; Statistics Canada

TO READ THE FULL ARTICLE