Office Warehouse

Capital Centre | Flex Office Warehouse | South Bend , IN

3371 Cleveland Rd, South Bend, IN 46628

Listing Price: $2,500,000

Investment Overview

Marcus & Millichap is pleased to exclusively represent for sale the Capital Centre, a 2-building flex office warehouse portfolio totaling 44,837 SF, located on W Cleveland Rd (19,800 VPD) in South Bend’s Toll Road Industrial Park, a well-established industrial hub on city’s northwest side.

Built in 1988/1990, the metal and block construction features 16 units, 1 dock, 13 drive-ins, 18’ clear height, partial sprinkler coverage, and zoned for industrial use. The site includes 180 parking spaces and monument signage for strong visibility and is located within a designated TIF District.

The property is 80% occupied with NNN leases and minimal landlord responsibilities. Current rents average $6.71 SF, 29% below market average, presenting significant upside potential through future lease-up and mark-to-market opportunities. The tenant mix is diverse and internet-resistant, including professional services (40%), medical (19%), industrial (12%), and media/entertainment (12%).

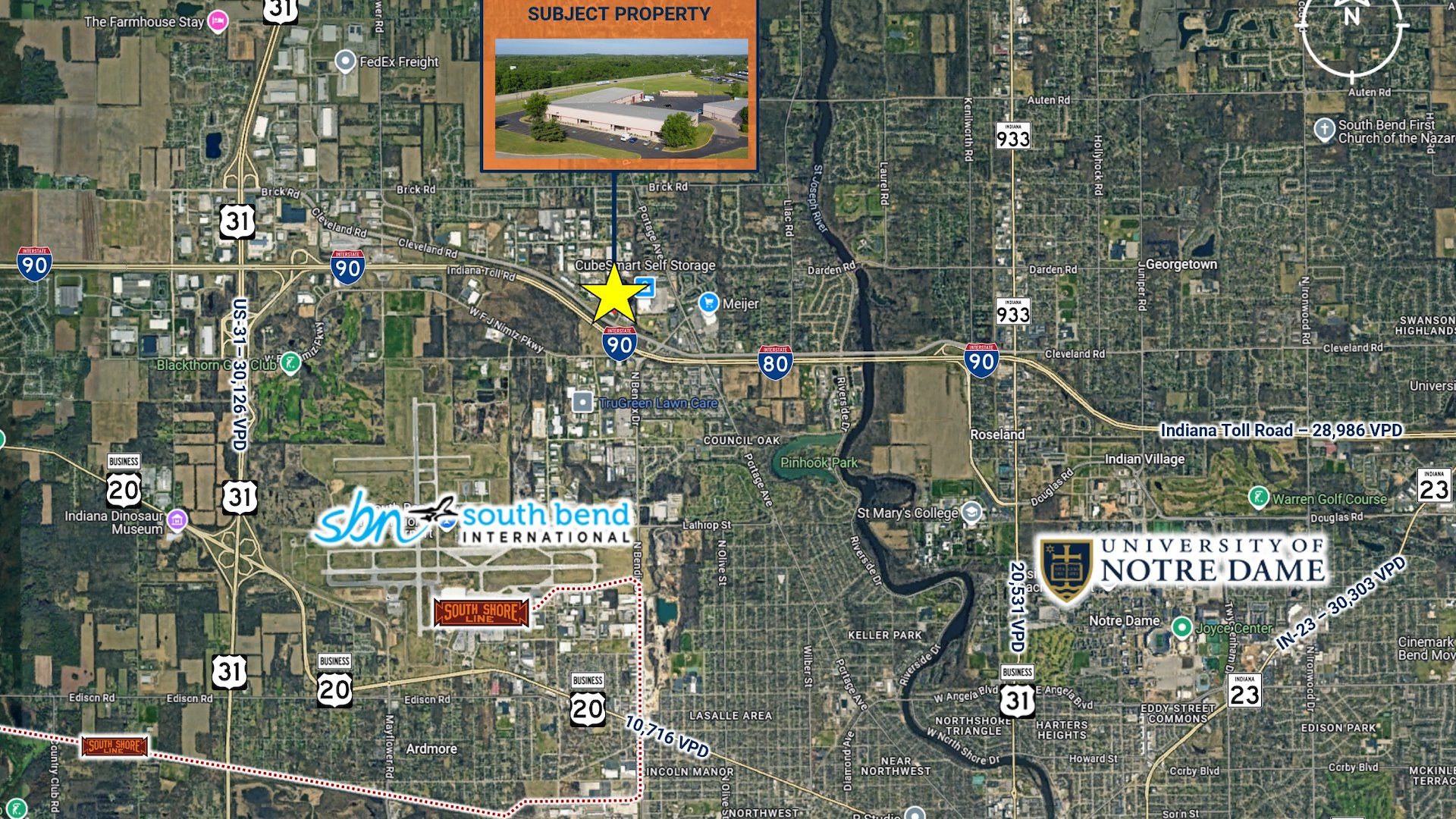

The property offers exceptional regional and national connectivity, located 5 minutes from the I-90 (28,986 VPD) and US-31 (30,126 VPD) interchanges, and 7 minutes from South Bend International Airport. South Bend also benefits from easy access to 14 major interstates, reaching 75% of the U.S. and Canada population within a day’s drive.

South Bend’s industrial market remains tight, with a 2.2% vacancy rate and an average asking rent of $9.38/SF (CoStar, November 2025). The market continues to experience strong economic momentum driven by transformative developments, including the $11 billion AWS data center and the $3.5 billion GM-Samsung EV battery plant. Additional developments include downtown revitalization, expanded healthcare facilities, and mixed-use projects.

The population exceeds 262,000 (10-mile radius) with an average household income of $79,596 and a 3% daytime population increase. The region is supported by an educated workforce from the University of Notre Dame (Total Enrollment: 13,129) and multiple regional colleges and technical schools.

This 2-building flex office warehouse portfolio offers a compelling investment opportunity with immediate value-add potential through lease-up and rent growth, within a growing, high-demand industrial submarket.

Investment Highlights

- Value-Add Opportunity with Mark-to-Market Upside | Current Rents at $6.71/SF are 29% Below Market Average ($9.38/SF)

- 80% Occupied | NNN Leases | Diverse, Internet-Resistant Tenant Mix Across Professional Services, Medical, Industrial & Media/Entertainment

- Anchor Tenants Include NuCO2 (Linde plc - NASDAQ: LIN; $33B Annual Revenue) & Numotion ($777M Annual Revenue)

- Recent CapEx: ~$100,000 Invested in Improvements | New Furnaces, 11 Lennox AC Units, Electrical Enhancements & Exhaust System

- 2-Building Flex Office Warehouse Portfolio Totaling 44,837 SF with 16 Units, 13 Drive-ins, 1 Dock & 18' Clear Height

- Located on W Cleveland Rd (19,800 VPD) in Toll Road Industrial Park (TIF District), 5 Minutes from I-90 (28,986 VPD) & US-31 (30,126 VPD) Interchanges | Reach 75% of U.S. & Canada in 1 Day's Drive

- South Bend Economy: Low 2.2% Industrial Vacancy (CoStar, November 2025) | $18B+ Economic Development (AWS Data Center & GM-Samsung EV Battery Plant) | Indiana Ranked #1 for Cost of Doing Business

- Strong Demographics & Workforce: 262,285 Population | $79,596 AHHI (10 Miles) | Access to 533,000+ Regional Labor Force Supported by University of Notre Dame & Regional Colleges

Exclusively Listed By

Financing By

Office Warehouse

Capital Centre | Flex Office Warehouse | South Bend , IN

Listing Price: $2,500,000

Investment Highlights

- Value-Add Opportunity with Mark-to-Market Upside | Current Rents at $6.71/SF are 29% Below Market Average ($9.38/SF)

- 80% Occupied | NNN Leases | Diverse, Internet-Resistant Tenant Mix Across Professional Services, Medical, Industrial & Media/Entertainment

- Anchor Tenants Include NuCO2 (Linde plc - NASDAQ: LIN; $33B Annual Revenue) & Numotion ($777M Annual Revenue)

- Recent CapEx: ~$100,000 Invested in Improvements | New Furnaces, 11 Lennox AC Units, Electrical Enhancements & Exhaust System

- 2-Building Flex Office Warehouse Portfolio Totaling 44,837 SF with 16 Units, 13 Drive-ins, 1 Dock & 18' Clear Height

- Located on W Cleveland Rd (19,800 VPD) in Toll Road Industrial Park (TIF District), 5 Minutes from I-90 (28,986 VPD) & US-31 (30,126 VPD) Interchanges | Reach 75% of U.S. & Canada in 1 Day's Drive

- South Bend Economy: Low 2.2% Industrial Vacancy (CoStar, November 2025) | $18B+ Economic Development (AWS Data Center & GM-Samsung EV Battery Plant) | Indiana Ranked #1 for Cost of Doing Business

- Strong Demographics & Workforce: 262,285 Population | $79,596 AHHI (10 Miles) | Access to 533,000+ Regional Labor Force Supported by University of Notre Dame & Regional Colleges

Investment Overview

Marcus & Millichap is pleased to exclusively represent for sale the Capital Centre, a 2-building flex office warehouse portfolio totaling 44,837 SF, located on W Cleveland Rd (19,800 VPD) in South Bend’s Toll Road Industrial Park, a well-established industrial hub on city’s northwest side. Built in 1988/1990, the metal and block construction features 16 units, 1 dock, 13 drive-ins, 18’ clear height, partial sprinkler coverage, and zoned for industrial use. The site includes 180 parking spaces and monument signage for strong visibility and is located within a designated TIF District. The property is 80% occupied with NNN leases and minimal landlord responsibilities. Current rents average $6.71 SF, 29% below market average, presenting significant upside potential through future lease-up and mark-to-market opportunities. The tenant mix is diverse and internet-resistant, including professional services (40%), medical (19%), industrial (12%), and media/entertainment (12%). The property offers exceptional regional and national connectivity, located 5 minutes from the I-90 (28,986 VPD) and US-31 (30,126 VPD) interchanges, and 7 minutes from South Bend International Airport. South Bend also benefits from easy access to 14 major interstates, reaching 75% of the U.S. and Canada population within a day’s drive. South Bend’s industrial market remains tight, with a 2.2% vacancy rate and an average asking rent of $9.38/SF (CoStar, November 2025). The market continues to experience strong economic momentum driven by transformative developments, including the $11 billion AWS data center and the $3.5 billion GM-Samsung EV battery plant. Additional developments include downtown revitalization, expanded healthcare facilities, and mixed-use projects. The population exceeds 262,000 (10-mile radius) with an average household income of $79,596 and a 3% daytime population increase. The region is supported by an educated workforce from the University of Notre Dame (Total Enrollment: 13,129) and multiple regional colleges and technical schools. This 2-building flex office warehouse portfolio offers a compelling investment opportunity with immediate value-add potential through lease-up and rent growth, within a growing, high-demand industrial submarket.

Exclusively Listed By

Financing By