Research Brief

Retail Sales

April 2024

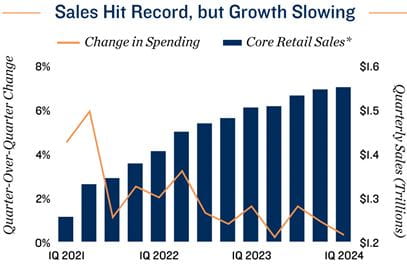

Retail Sector Boosted by Broad-Based Retail Sales Gains

Most store types report encouraging start to 2024. Consumers set a new benchmark for quarterly retail sales volume in the first three months of 2024 — roughly $1.55 trillion. Spending during the January-March span was up 3 percent when compared to the same period last year, despite slackening consumer confidence. This recent rise in spending occurred alongside consumers spreading their purchases across more types of retail, with seven of 10 major categories notching gains. While still prioritizing necessities, households reserved more of their incomes for eating out, general merchandise and items available online in the first quarter. This trend was most apparent in March, when spending across each of these categories reached a record tally, supporting a 1.1 percent year-over-year rise in inflation-adjusted core retail sales. Should these conditions continue, it should reinforce positive leasing activity.

Grocery sector in a position of strength. Spending at supermarkets reached a record mark in March, with the segment again accounting for 24 percent of all store-based retail sales, which exclude purchases made online and at restaurants and bars. This consistency is supporting standout property metrics, including low-2 percent vacancy. Moving forward, continued spending gains are likely if grocery prices remain unchanged as they did the past two months.

Grocery sector in a position of strength. Spending at supermarkets reached a record mark in March, with the segment again accounting for 24 percent of all store-based retail sales, which exclude purchases made online and at restaurants and bars. This consistency is supporting standout property metrics, including low-2 percent vacancy. Moving forward, continued spending gains are likely if grocery prices remain unchanged as they did the past two months.

Tax season may provide a cushion. Households with tighter discretionary budgets may receive a near-term boost from their upcoming tax refunds. Last year, nearly 65 percent of tax returns resulted in a reimbursement, with the average tax refund at $2,753. Prior to this April's filing deadline, the average payment received was $3,011. Many individuals are expected to pay off debt or build their savings with these funds, which has positive implications for long-term spending.

Online purchases account for record share of core retail sales. Spending at nonstore retailers highlighted the first quarter's retail sales data. During the January-March period, online sales rose 8.7 percent when compared to the same period last year, an indication that households enduring a period of budget tightening are scouring online venues for deals. While this has the potential to adversely impact some brick and mortar retailers, with electronics and appliance stores most likely to face challenges, it should also preserve demand for warehouse and distribution space.

Fed may delay rate cuts. The combination of projection-exceeding first quarter retail sales, surprising strong job growth and bumpier CPI inflation has pushed back Wall Street expectations for when the Federal Reserve will begin cutting interest rates. Probabilities now favor September over June. The Fed, however, tracks core PCE more closely, an indicator that has been on a cooling trend of late. If core PCE continues to come down, March’s elevated CPI measure may be less impactful on the Fed’s future decision-making process.

4.9% |

3.8% |

|

March Year-Over-Year Rise in Core Retail Sales |

March Year-Over-Year |

* Core retail sales exclude auto and gasoline purchases

Sources: Marcus & Millichap Research Services; Bureau of Labor Statistics; CoStar Group, Inc.;

Internal Revenue Service; U.S. Census Bureau

TO READ THE FULL ARTICLE