Research Brief

Gross Domestic Product

April 2024

Consumer Resilience Offers Benefits and

Drawbacks for Commercial Real Estate

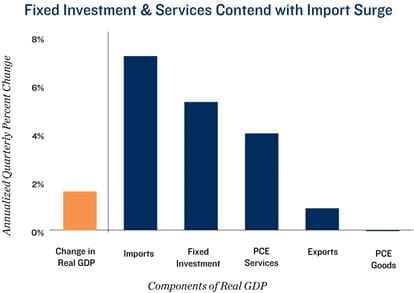

Key GDP growth contributors post positive results. Real gross domestic product increased at an annual rate of 1.6 percent during the first quarter of 2024. While this is a deceleration from the 3.4 percent rate from the final quarter of last year, the economy still grew in several areas. U.S. residents continued to spend robustly, with final sales to private domestic purchasers up 6.1 percent annualized, the best mark in a year. Residential and non-residential fixed investment also climbed, largely driven by single-family home construction and new intellectual property. A 7.2 percent surge in imports countered some of these figures, contributing to the smaller gain in the overall GDP measure.

Higher incomes benefit multifamily, retail properties. Despite slower real GDP growth, the first quarter was the best opening period for job creation, outside of the pandemic rebound, since 2012. More employment opportunities are supporting greater real disposable income, up by an annualized 1.1 percent in the first quarter, enabling household formation and retail spending. Apartment net absorption achieved a nine-quarter high in the first quarter, a feat that would have lowered vacancy had a record-high 135,700 new units not opened at the same time. While deliveries will remain elevated for the near term, inhibiting rent growth, underlying demand is expected to improve further. Supply pressure, meanwhile, is largely absent from the retail sector, where vacancy has held at a multi-decade low of 4.5 percent for nine straight months.

Entrepreneurial efforts speak to future office space needs. The creation of new intellectual property and businesses bodes well for the challenged office sector. A record 5.5 million new business applications were filed last year. While not all of these endeavors will pan out, others will find success, likely leading to future office leasing. This demand will help offset remote work-related attrition. Pre-pandemic leases are still working their way through the system, contributing to choppy office performance. Operations continue to be the most challenged in downtown areas, with newer, smaller suburban properties tending to draw the most demand at present.

Inflation and Monetary Policy Implications

Inflation pressures holding up. The core personal consumption expenditures index increased by 2.8 percent year-over-year in March, matching the annual gain noted in February. Prices rose the most for services at 4.0 percent year-over-year, up slightly from the measure taken last month but below marks from 2023. These metrics, in conjunction with the step up in core CPI, reflect that while inflation has come down significantly from its peak in the summer of 2022, costs are still climbing faster than normal in several areas of the economy.

Recent economic data paints complex picture for Fed. While decelerating GDP growth aligns with the Federal Reserve’s soft landing goal, stubborn inflation and robust hiring add complications. These factors speak to the strength of the economy, but also push back when the Fed will likely feel it necessary to cut the overnight lending rate. High interest rates have been a challenge to commercial real estate investment sales, but recent cap rate and sale price trends indicate buyers and sellers are coming into closer alignment.

1.6% |

6.1% |

|

Annual Rate of Change in Real GDP in 1Q 2024 |

Annual Rate of Change in Final Sales to Private Domestic Purchasers in 1Q 2023 |

Sources: Marcus & Millichap Research Services; Bureau of Economic Analysis;

CoStar Group, Inc.; CME Group; RealPage, Inc.

TO READ THE FULL ARTICLE